SkyWest Airlines 2008 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Certain Federal Income Tax Consequences

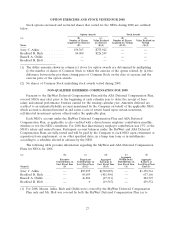

The following is a brief summary of certain United States federal income tax consequences relating

to the Stock Purchase Plan. This summary is not intended to be complete and does not describe state,

local, foreign, or other tax consequences. The tax information summarized is not tax advice.

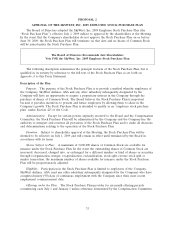

Grant of Options: The Stock Purchase Plan is intended to qualify as an ‘‘employee stock purchase

plan’’ within the meaning of Section 423 of the Code. As such, a participant under the Stock Purchase

Plan incurs no income tax liability, and the Company obtains no deduction, from the grant of the

options. The payroll deductions and other contributions by a participant to his or her account under

the Plan, however, are made on an after-tax basis. Participants will not be entitled to deduct or exclude

from income or employment taxes any part of their payroll deductions.

Exercise of Options: A participant will not be subject to federal income tax upon the exercise of

an option granted under the Stock Purchase Plan, nor will the Company be entitled to a tax deduction

by reason of such exercise. The participant will have a cost basis in the shares of Common Stock

acquired upon such exercise equal to the option exercise price.

Disposition of Shares Acquired Under the Plan: In order to defer taxation on the difference

between the fair market value and exercise price of shares acquired upon exercise of an option, the

employee must hold the shares of Common Stock acquired under the Stock Purchase Plan for a

holding period which runs through the later of one year after the option exercise date or two years

after the date the option was granted. The only exceptions are for dispositions of shares upon death, as

part of a tax-free exchange of shares in a corporate reorganization, into joint tenancy with right of

survivorship with a another person, or the mere pledge or hypothecation of shares.

If a participant disposes of stock acquired under the Stock Purchase Plan before expiration of the

holding period in a manner not described above, such as by gift or ordinary sale of such shares, the

employee must recognize as ordinary compensation income in the year of disposition the difference

between the exercise price for the shares and the stock’s fair market value on the date of exercise. In

such an event, the Company will be entitled to a corresponding compensation expense deduction.

Disposition of shares after expiration of the required holding period (including disposition upon

death) will result in the recognition of gain or loss in the amount of the difference between the amount

realized on the sale of the shares and the exercise price for such shares. Any loss on such a sale will be

a long-term capital loss. Any gain on such a sale will be taxed as ordinary compensation income up to

an amount equal to the product of the stock’s fair market value as of the date of grant of the purchase

right multiplied by the applicable purchase price discount percentage (i.e., 5%), with any additional

gain taxed as a long-term capital gain.

Value of Benefits

The Company is unable to determine the amount of benefits that may be received by participants,

including the NEOs, under the Stock Purchase Plan if adopted, as participation is discretionary with

each employee.

35