SkyWest Airlines 2008 Annual Report Download - page 124

Download and view the complete annual report

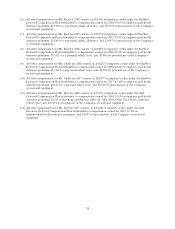

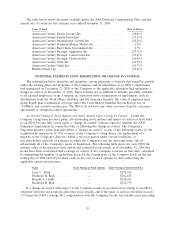

Please find page 124 of the 2008 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(6) All other compensation for Mr. Rich for 2008 consists of: $63,390 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2008; $4,074 in employer-paid health

insurance premiums; $13,920 for a personal vehicle allowance; and, $2,930 for personal use of the Company’s

recreational equipment.

(7) All other compensation for Mr. Rich for 2007 consists of: $70,152 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2007; $3,703 in employer-paid health

insurance premiums; $10,634 for a personal vehicle allowance; and, $3,097 for personal use of the Company’s

recreational equipment.

(8) All other compensation for Mr. Rich for 2006 consists of: $66,885 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2006; $3,703 in employer-paid health

insurance premiums; $11,021 for a personal vehicle lease; and, $3,806 for personal use of the Company’s

recreational equipment.

(9) All other compensation for Mr. Childs for 2008 consists of: $56,220 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2008; $3,466 in employer-paid health

insurance premiums; $13,966 for a personal vehicle lease; and, $2,930 for personal use of the Company’s

recreational equipment.

(10) All other compensation for Mr. Childs for 2007 consists of: $46,877 of employer credits under the SkyWest

Deferred Compensation Plan attributable to compensation earned for 2007, $3,104 in employer-paid health

insurance premiums; $8,147 for a personal vehicle lease; and, $3,097 for personal use of the Company’s

recreational equipment.

(11) All other compensation for Mr. Holt for 2008 consists of: $47,175 of employer credits under the ASA

Deferred Compensation Plan attributable to compensation earned for 2008; $3,170 in employer-paid health

insurance premiums; $2,625 in matching contributions under the ASA 401(k) Plan; $12,444 for a personal

vehicle lease, and, $2,930 for personal use of the Company’s recreational equipment.

(12) All other compensation for Mr. Holt for 2007 consists of: $40,688 of employer credits under the ASA

Executive Deferred Compensation Plan attributable to compensation earned for 2007; $3,703 in

employer-paid health insurance premiums; and, $3,097 for personal use of the Company’s recreational

equipment.

24