Samsung 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

93

B) Acquisition of Grandis

Samsung Information Systems America acquired Grandis with a closing date of July 22, 2011.

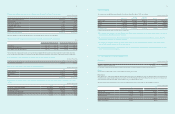

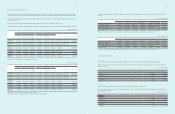

(1) Overview of the acquired company

Name of the acquired company Grandis

Headquarters location Milpitas, CA

Representative director Farhad Tabrizi

Classification of the acquired company Unlisted company

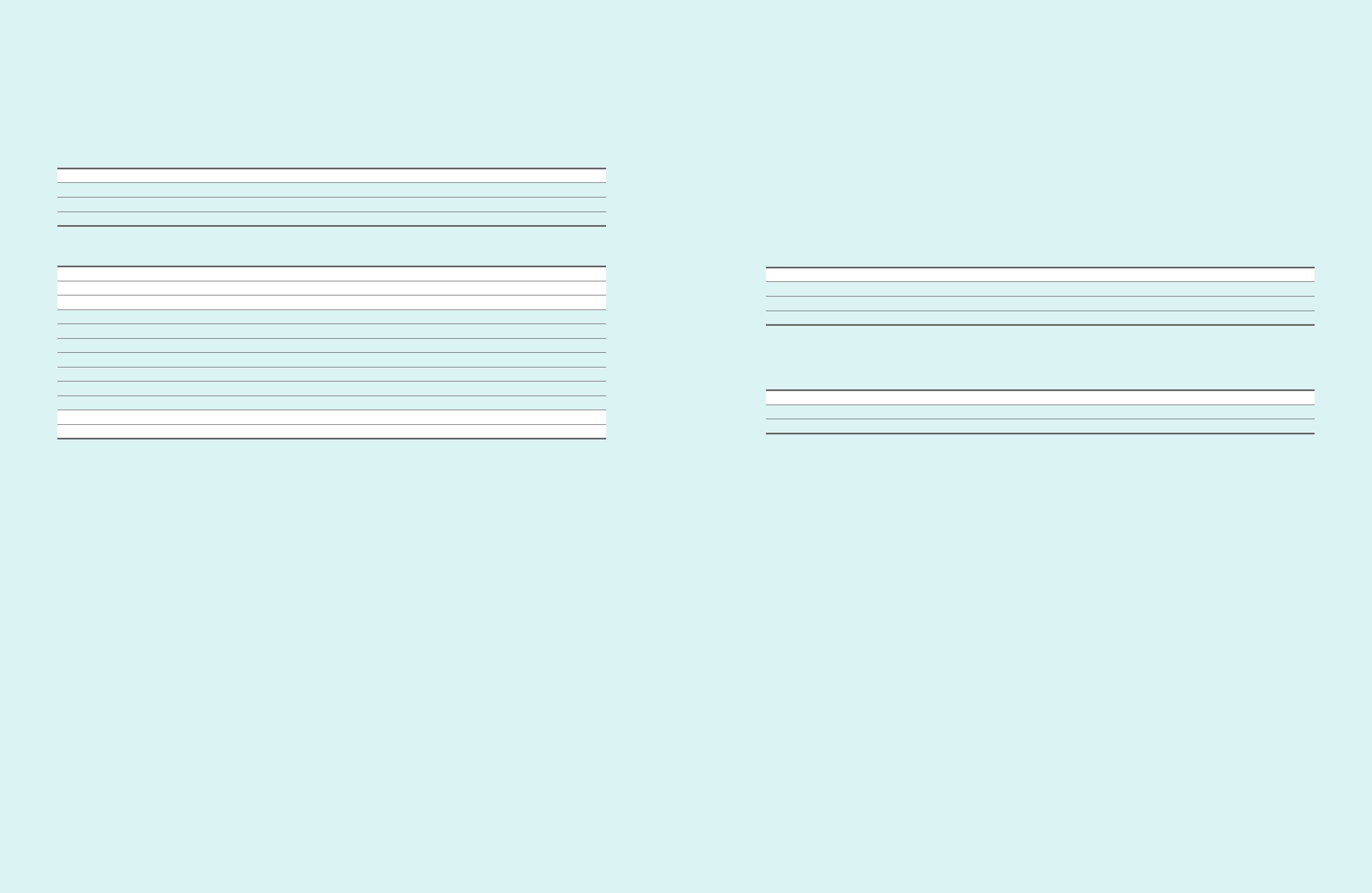

(2) Purchase price allocation

(In millions of Korean Won)

Classification Amount

I. Considerations transferred ₩ 81,050

II. Identifiable assets and liabilities

Cash and cash equivalents 269

Trade and other receivables 367

Property, plant, and equipment 2,129

Intangible assets 57,682

Other assets 83

Trade and other payables (527)

Deferred income tax liabilities (18,836)

Total ₩ 41,167

III. Goodwill ₩ 39,883

Had Grandis been consolidated from January 1, 2011, the consolidated for the one-year period would show loss of ₩1,600 million, additionally.

The revenue included in the financial statement of income statement since the date of acquisition contributed by Grandis was ₩ 2,668 million and profit of

₩600 million over the period.

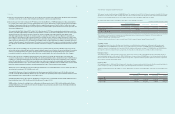

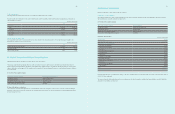

35. Events After the Reporting Period

A) Merger of Samsung LED

The merger of Samsung LED with SEC was approved by the Board of Directors on December 26, 2011. The approval of the Board of Directors of the

Company replaces shareholders’ meeting approval of the acquisition, as the acquisition of Samsung LED is a small and simple merger as defined in the

commercial law.

The shareholders of Samsung LED will receive 0.0134934 shares of the Company’s common stock for each share of Samsung LED common stock owned

on the closing date. The Company transferred its treasury stocks to the shareholders of Samsung LED.

B) Acquisition of S-LCD

The Company entered into contracts to acquire remaining issued shares of S-LCD from Sony on December 26, 2011.

The Company acquired shares of S-LCD with a closing date of January 19, 2011.

(In millions of Korean Won)

Name of the acquired company S-LCD

Purchase price ₩ 1,067,082

Shares 329,999,999 shares

Percentage of shareholding after acquisition 100 %

C) Spin-Off of LCD division

The Company’s Board of Directors approved the spin-off of the Company’s LCD division on February 20, 2012. The shareholders will approve the spin-off on

March 16, 2012, during the shareholders’ meeting

Category Details

Companies subject to stock split Samsung Display Corporation¹

Business LCD

¹ The name of the newly established company is subject to change according to decision of shareholder’s meeting.

150,000,000 shares will be newly issued with par value of ₩5,000 per shares and be assigned to SEC.