Samsung 2011 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2011 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

47

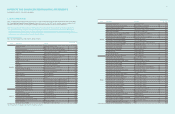

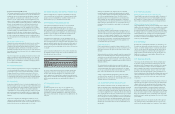

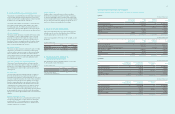

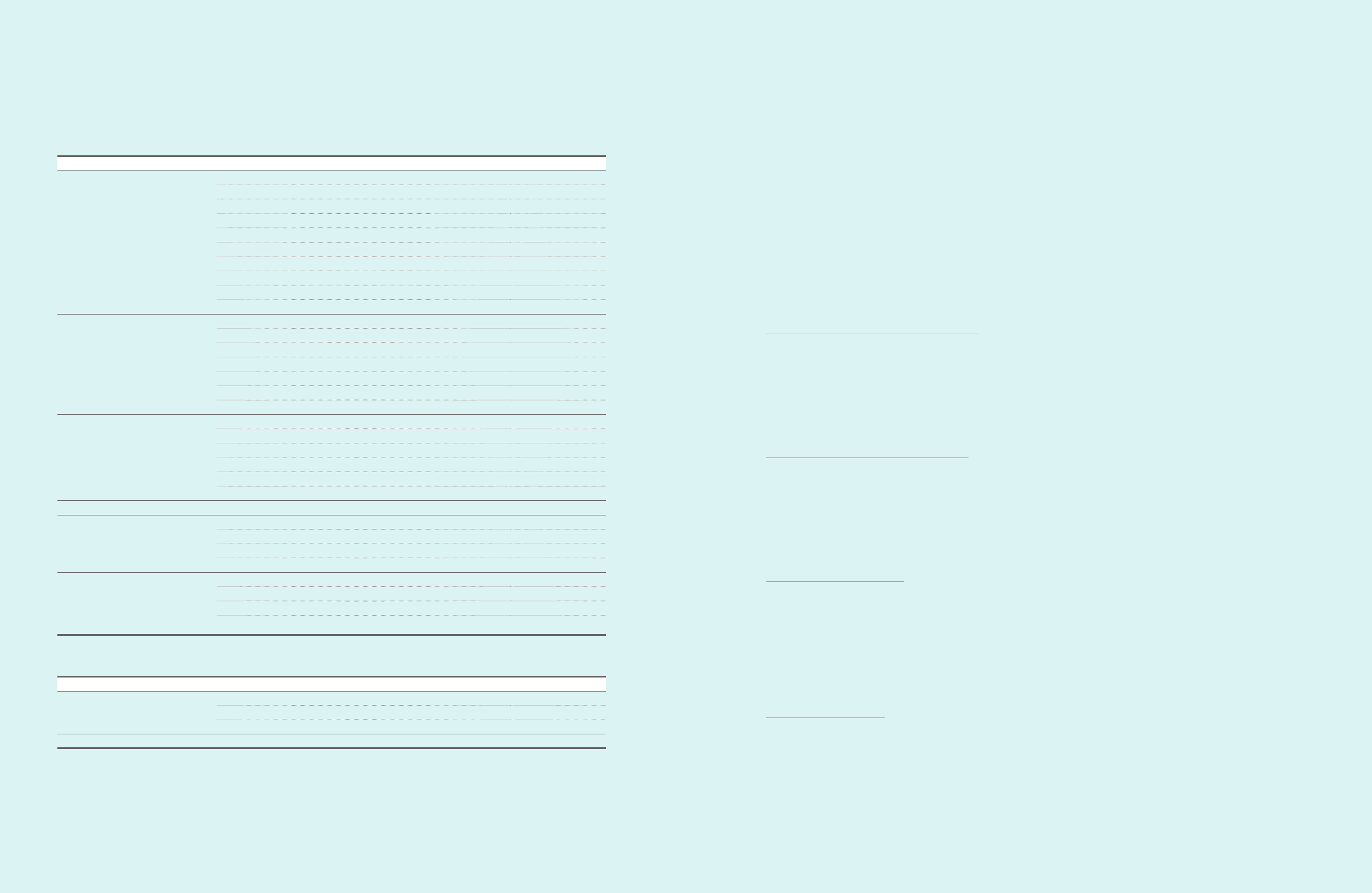

D) Changes in scope of consolidation

(1) Subsidiaries newly included in consolidation for the year ended December 31, 2011 are as follows :

Location Name of Subsidiaries Remark

Domestic

Prosonic Newly acquired

Samsung Venture Capital Union #20 Newly acquired

Samsung Medison Newly acquired

Medison Healthcare Newly acquired

CSL Newly acquired

Medison Xray Newly acquired

SU Materials Newly acquired

High Pioneer Private Investment Trust #1 Newly incorporated

Samsung Venture Capital Union #21 Newly acquired

Samsung Venture Capital Union #22 Newly acquired

America

Samsung Medison America (SMUS) Newly acquired

Samsung Medison Brasil (SMBR) Newly acquired

Grandis (GRANDIS) Newly acquired

NexusDX (Nexus) Newly acquired

HX Diagnostics (HX) Newly acquired

HX Reagents (HX Reagent) Newly acquired

Deltapoint Cardiac Diagnostics (Deltapoint) Newly acquired

Europe

SonoAce Deutschland (SMDE) Newly acquired

Samsung Medison Italia (SMIT) Newly acquired

Samsung Medison France (SMFR) Newly acquired

Samsung Medison Europe (SMNL) Newly acquired

Samsung Moscow Research Centre (SMRC) Newly incorporated

Nanogen Recognomics (Nanogen) Newly acquired

Middle East and Africa Samsung Electronics East Africa (SEEA) Newly incorporated

China

Samsung Medison Shanghai Medical Instrument (SMS1) Newly acquired

Medison (Shanghai) (SMS2) Newly acquired

Medison Medical Equipment (Shanghai) (MMS) Newly acquired

Samsung Suzhou LCD (SSL) Newly incorporated

Rest of Asia

Samsung Medison Japan (SMJP) Newly acquired

Samsung Medison India (SMIN) Newly acquired

Medison Medical Systems (India) (MI) Newly acquired

TNP Small / Medium Size & Venture Enterprises Growth

Promotion Investment Limited partnership (TSUNAMI) Newly acquired

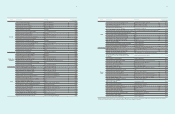

(2) Details of subsidiaries deconsolidated for the year ended December 31, 2011, are as follows :

Location Name of Subsidiaries Remark

Domestic

Samsung Gwangju Electronics Merged

CSL Disposed

Medison Xray Disposed

China Samsung Electronics Shenzhen (SESZ) Liquidated

2.1 Basis of Presentation

The Company first adopted the International Financial Reporting

Standards as adopted by the Republic of Korea (“Korean IFRS”) from

January 1, 2010. International Financial Reporting Standards (IFRS) have

been adopted by the Korean Accounting Standards Board as Korean

IFRS based on standards, amendments and interpretations published

by the International Accounting Standards Board.

The principal accounting policies applied in the preparation of these

consolidated financial statements are set out below. These policies have

been consistently applied to all the years presented, unless otherwise

stated.

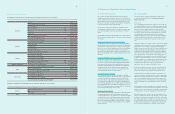

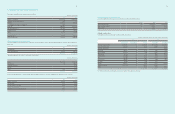

New standards, amendments and interpretations issued but not effective

for the financial year beginning January 1, 2011 and not early adopted are

set out below :

K-IFRS 1012, ‘Deferred Tax : Recovery of Underlying Assets’

The amendment addresses the measurement of deferred tax liabilities

and deferred tax assets to reflect the tax consequences that would follow

from the manner in which the entity expects, at the end of the reporting

period, to recover or settle the carrying amount of its assets and liabilities.

The amendments to the standard are mandatory for the first time for

the financial year beginning January 1, 2012. The Company expects the

impact of this amendment on the consolidated financial statements to be

immaterial.

K-IFRS 1107, ‘Disclosures—Transfers of Financial Assets’

The amendments will help users of financial statements evaluate the

risk exposures relating to transfers of financial assets and the effect of

those risks on an entity’s financial position and will promote transparency

in the reporting of transfer transactions, particularly those that involve

securitization of financial assets. The amendments to the standard are

mandatory for the first time for the financial year beginning January

1, 2012. The Company expects the impact of this amendment on the

consolidated financial statements to be immaterial.

K-IFRS 1113, ‘Fair value measurement’

The standard aims to improve consistency and reduce complexity by

providing a precise definition of fair value and a single source of fair value

measurement and disclosure requirements for use across IFRSs. The

requirements, which are largely aligned between IFRSs and US GAAP,

do not extend the use of fair value accounting but provide guidance on

how it should be applied where its use is already required or permitted by

other standards within IFRSs or US GAAP. The Company is yet to assess

K-IFRS 1113’s full impact and intends to adopt K-IFRS 1113 no later than

the accounting period beginning January 1, 2013.

K-IFRS 1019, ‘Employee benefits’

The main impacts on the Company will be that the corridor approach will

no longer be applied and instead all actuarial gains and losses will be

recognized in OCI as they occur; all past service costs will be immediately

recognized, and interest cost and expected return on plan assets will be

replaced with a net interest amount calculated by applying the discount

rate to the net defined benefit liability (asset). The Company is still in the

process of assessing the impact of the amendment on the consolidated

financial statements.

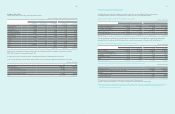

2. Summary of Significant Accounting Policies

2.2 Consolidation

The Company prepares annual consolidated financial statements in

accordance with Korean IFRS 1027, Consolidated and Separate

Financial Statements.

A) Subsidiaries

The consolidated financial statements include the accounts of SEC and

its controlled subsidiaries. Control over a subsidiary is presumed to exist

when the Company has the power to govern the financial and operating

policies of an entity to obtain benefits from its activities generally

accompanying a shareholding of more than one half of the voting rights.

The existence and effects of potential voting rights that are exercisable

or convertible at the end of the reporting period are considered in

determining whether the Company controls another entity. Subsidiaries

are fully consolidated from the date when control is transferred to the

Company and de-consolidated from the date which control ceases to

exist.

The purchase method of accounting is used to account for the acquisition

of subsidiaries by the Company. The cost of an acquisition is measured

at the fair value of the assets given, equity instruments issued and

liabilities incurred or assumed at the date of exchange. Identifiable assets

acquired and liabilities and contingent liabilities assumed in a business

combination are measured initially at their fair values at the acquisition

date, irrespective of the extent of any non-controlling interest. The excess

of the cost of acquisition over the fair value of the Company’s share of

the identifiable net assets acquired is recorded as goodwill. If the cost of

acquisition is less than the fair value of the net assets of the subsidiary

acquired, the difference is recognized directly in the statement of income.

For each business combination, the Company shall measure any non-

controlling interest in the acquiree at the non-controlling interest’s

proportionate share of the acquiree’s identifiable net assets.

In a business combination achieved in stages, the acquisition date fair

value of the acquirer’s previously held equity interest in the acquiree is

remeasured to fair value at the acquisition date through profit or loss.

Transactions with non-controlling interests that do not result in loss of

control are accounted for as equity transactions – that is, as transactions

with the owners in their capacity as owners. The difference between fair

value of any consideration paid and the relevant share acquired of the

carrying value of net assets of the subsidiary is recorded in equity. Gains

or losses on disposals to non-controlling interests are also recorded in

equity.

All inter-company transactions and balances are eliminated as part of the

consolidation process. Inter-company transactions, balances, income and

expenses on inter-company transactions are eliminated. Unrealized losses

are eliminated upon assessing the impairment of the transferred assets.

When the Company ceases to have control any retained interest in the

entity is re-measured to its fair value at the date when control is lost, with

the change in carrying amount recognized in profit or loss. The fair value

is the initial carrying amount for the purposes of subsequently accounting

for the retained interest as an associate, joint venture or financial asset.

In addition, any amounts previously recognized in other comprehensive

income in respect of that entity are accounted for as if the company