Samsung 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

57

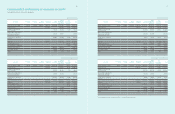

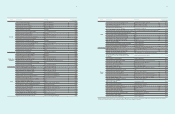

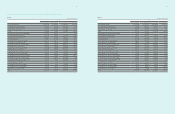

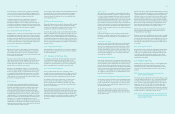

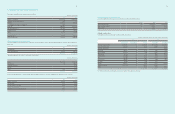

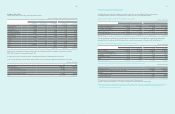

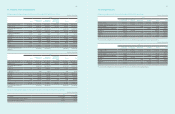

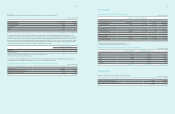

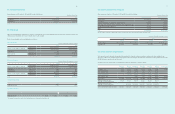

D) Income and loss of financial instruments by category for the years ended December 31, 2011 and 2010, are as follows :

(In millions of Korean won)

2011

Financial Assets

Assets at fair value

through the profit

and loss

Loans

and receivables

Available-for-sale

financial assets Total

Loss on valuation (Other comprehensive loss) ₩-₩-₩ (559,831) ₩ (559,831)

Loss on valuation / disposal 113,401 -102,351 215,752

Gain on disposal (Reclassification) - - 134,202 134,202

Interest income - 702,198 3,455 705,653

Gain on foreign currency translation - 27,768 -27,76 8

Loss on foreign currency transaction - (483,980) (2,924) (486,904)

Dividend income - - 34,423 34,423

Impairment / Reversal - - (39) (39)

(In millions of Korean won)

2011

Financial Liabilities

Liabilities at fair

value through the

profit and loss

Financial liabilities

measured at

amortized cost

Other Financial

Liabilities Total

Loss on valuation / disposal (Profit or loss) ₩ (1,865) ₩-₩-₩ (1,865)

Interest expense - 555,581 85,073 640,654

Gain (Loss) on foreign currency translation - (69,049) 26,559 (42,490)

Loss on foreign currency transaction - (163,191) - (163,191)

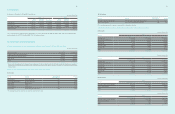

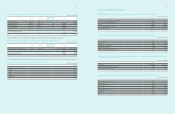

(In millions of Korean won)

2010

Financial Assets

Assets at fair value

through the profit

and loss

Loans

and receivables

Available-for-sale

financial assets Total

Gain on valuation (Other comprehensive

income or loss) ₩-₩-₩1,193,297 ₩1,193,297

Gain (Loss) on valuation / disposal

(Profit or loss) (32,341) - 27, 319 (5,022)

Gain on disposal (Reclassification) - - 4,420 4,420

Interest income - 556,624 1,489 558,113

Loss on foreign currency translation - (103,896) - (103,896)

Loss on foreign currency transaction - (239,877) - (239,877)

Dividend income - - 32,829 32,829

Impairment / Reversal - - (10,719) (10,719)

(In millions of Korean won)

2010

Financial Liabilities

Liabilities at fair

value through the

profit and loss

Financial liabilities

measured at

amortized cost

Other Financial

Liabilities Total

Interest expense ₩-₩579,588 ₩-₩579,588

Gain (Loss) on foreign currency translation - 193,259 (6,897) 186,362

Loss on foreign currency transaction - (22,289) - (22,289)

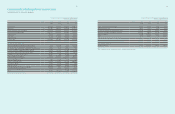

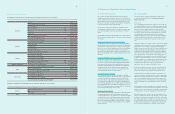

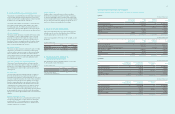

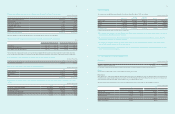

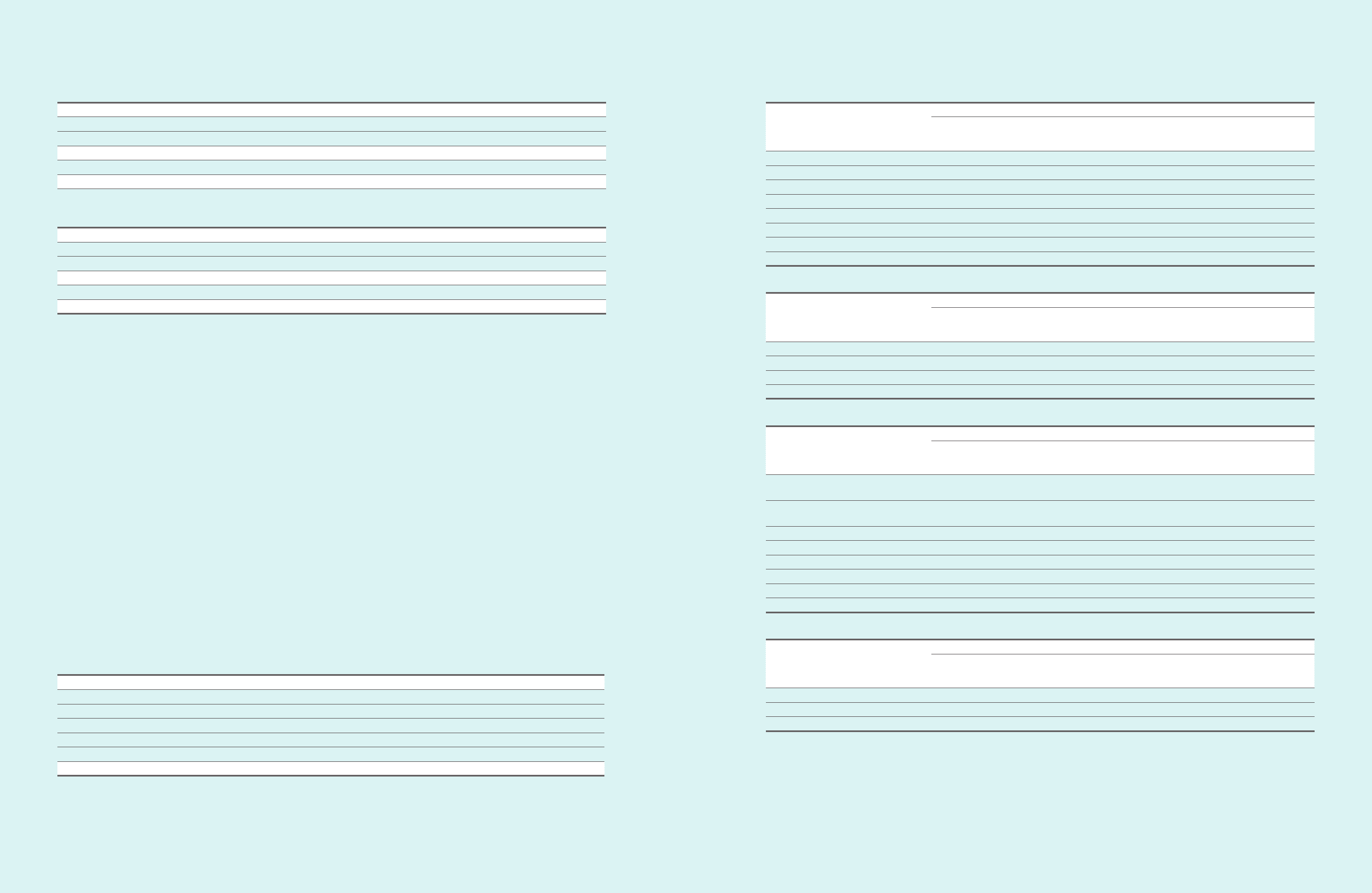

B) The following table presents the assets and liabilities that are measured at fair value at 31 December 2011.

(In millions of Korean won)

Level 1 Level 2 Level 3 Total balance

Short-term derivatives ₩-₩130,057 ₩-₩130,057

Long and short-term Available-for-sale financial assets 3,182,157 73,672 623,738 3,879,567

Total assets ₩ 3,182 ,157 ₩ 203,729 ₩ 623,738 ₩ 4,009,624

Short-term derivatives - 40,932 -40,932

Total liabilities ₩-₩ 40,932 ₩ - ₩ 40,932

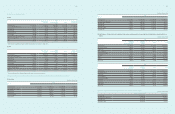

The following table presents the assets and liabilities that are measured at fair value at 31 December 2010.

(In millions of Korean won)

Level 1 Level 2 Level 3 Total balance

Short-term derivatives ₩-₩34,458 ₩-₩34,458

Long and short-term Available-for-sale financial assets 3,823,234 49,765 326,359 4,199,358

Total assets ₩ 3,823,234 ₩ 84,223 ₩ 326,359 ₩ 4,233,816

Short-term derivatives -24,638 -24,638

Total liabilities ₩ -₩ 24,638 ₩ -₩ 24,638

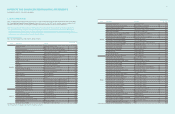

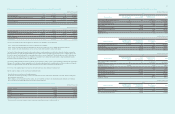

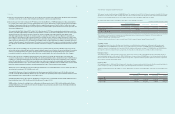

The levels of the fair value hierarchy and its application to financial assets and liabilities are described below

∙ Level 1 : Quoted prices (unadjusted) in active markets for identical assets or liabilities

∙ Level 2 : Inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly or indirectly

∙ Level 3 : Inputs for the asset or liability that are not based on observable market data (that is, unobservable inputs)

The fair value of financial instruments traded in active markets is based on quoted market prices at the balance sheet date. A market is regarded as

active if quoted prices are readily and regularly available from an exchange, dealer, broker, industry group, pricing service, or regulatory agency, and

those prices represent actual and regularly occurring market transactions on an arm’s length basis. The quoted market price used for financial assets

held by the group is the current bid price. These instruments are included in level 1. Instruments included in level 1 comprise primarily listed equity

investments classified as trading securities or available-for-sale.

The fair value of financial instruments that are not traded in an active market (for example, over-the-counter derivatives) is determined by using valuation

techniques. These valuation techniques maximize the use of observable market data where it is available and rely as little as possible on entity specific

estimates. If all significant inputs required to fair value an instrument are observable, the instrument is included in level 2.

If one or more of the significant inputs is not based on observable market data, the instrument is included in level 3.

Specific valuation techniques used to value financial instruments include :

∙ Quoted market prices or dealer quotes for similar instruments.

∙ The fair value of forward foreign exchange contracts is determined using forward exchange rates at the balance sheet date, with the resulting value

discounted back to present value.

∙ Other techniques, such as discounted cash flow analysis, are used to determine fair value for the remaining financial instruments. As for trade and

other receivables, the book value approximates a reasonable estimate of fair value.

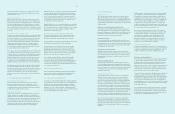

C) The changes of the financial instruments on level 3, December 31, 2011 and 2010, are as follows :

(In millions of Korean won)

2011 2010

Balance at January 1 ₩326,359 ₩228,973

Purchase 397,86 5 136,216

Disposal (97,390) (23,714)

Comprehensive income / expense 69,004 86,683

Others¹ (72,100) (101,799)

Balance at December 31 ₩ 623,738 ₩ 326,359

¹ Others consist of the effects from changes in currency exchange rate, acquisitions from business combination and etc.