Samsung 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

75

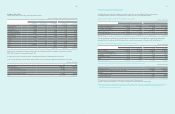

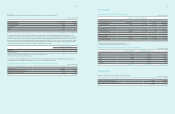

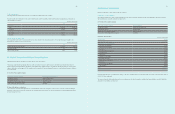

C) Litigation

(1) Civil class actions with respect to fixed pricing on the sales of TFT-LCD were filed against the Company and its subsidiaries in the United States.

As of balance sheet date, the outcome of the investigation and civil actions cannot be reasonably determined.

(2) Based on the agreement entered on August 24, 1999 with respect to Samsung Motor Inc.’s (“SMI”) bankruptcy proceedings, Samsung Motor

Inc.’s creditors (“the Creditors”) filed a civil action against Mr. Kun Hee Lee, former chairman of the Company, and 28 Samsung Group affiliates

including the Company under joint and several liability for failing to comply with such agreement. Under the suit, the Creditors have sought

₩ 2,450 billion (approximately $1.95 billion) for loss of principal on loans extended to SMI, a separate amount for breach of the agreement, and

an amount for default interest.

SLI completed its Initial Public Offering (“IPO”) on May 7, 2010. After disposing 2,277,787 shares and paying the principal balance owed to the

Creditors, ₩ 878 billion (approximately $ 0.80 billion) was deposited in to an escrow account. That remaining balance was to be used to pay the

Creditors interest due to the delay in the SLI IPO. On January 11, 2011, the Seoul High Court ordered Samsung Group affiliates to pay

₩ 600 billion (approximately $ 0.53 billion) to the Creditors and pay 5% annual interest for the period between May 8, 2010 and January 11,

2011, and pay 20% annual interest for the period after January 11, 2011 until the amounts owed to the Creditors are paid. In accordance with

the Seoul High Court order, ₩ 620.4 billion (which includes penalties and interest owed) was paid to the Creditors from the funds held in escrow

during January 2011. On February 7, 2011, the Samsung Group affiliates and the Creditors appealed the Seoul High Court’ ruling to the Korean

Supreme Court and the appeal is currently in progress. The amount of loss related to this matter cannot be reasonably determined. Accordingly,

the Company has concluded that no provision for loss should be reflected in the Company’s consolidated financial statements at December 31,

2011.

(3) As of December 31, 2011, in addition to the cases mentioned above, the Company’s domestic and foreign subsidiaries have been involved in

various claims and proceedings with Apple and other companies during the normal course of business, the amount and timing of these matters

cannot be reasonably determined. The Company’s management believes that, although the amount and timing of these matters cannot be

reasonably determined, the conclusion of these matters will not have a material adverse effect on the financial position of the Company.

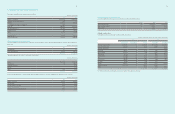

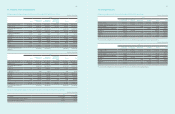

(4) As of December 31, 2011, the company has trade financing agreement, trade notes receivable discounting facilities, loan facilities with

accounts receivable pledged as collaterals with Woori Bank and 5 other financial institutions with a combined limit of up to ₩ 7,414,400 million.

In addition, the company has trade financing agreement with Korea Development Bank and 18 other financial institutions for up to USD 4,410

million. SEC and Living Plaza, one of SEC’s domestic subsidiaries, have trade notes receivable discounting facilities with financial institutions,

including Standard Chartered, for up to ₩ 90,000 million, and the Company and SEC’s Subsidiaries have loan facilities with accounts receivable

pledged as collaterals with financial institutions, including Industrial Bank, for up to ₩ 415,100 million and USD 22 million.

SEA and other overseas subsidiary have agreements with financial institutions to sell certain eligible trade accounts receivable under which, on

an ongoing basis, a maximum of US$ 1.348 billion can be sold.

Samsung Mobile Display, one of domestic subsidiary has trade financing agreement with Woori Bank for up to ₩ 9,000 million, trade note

receivable loan facility with Korea Exchange Bank for up to ₩ 10,000 million, and export bill negotiation agreement with Woori Bank and 7 other

financial institutions for up to US$ 720 million as of December 31, 2011.

Samsung Mobile Display and one other domestic subsidiary have entered into a letter of credit facility agreement with Woori Bank and 2 other

financial institutions for up to US$ 13.2 million and ₩ 45,000 million as of December 31, 2011.

SEMES and three other domestic subsidiaries have credit purchase facility agreements of up to ₩ 140,000 million with financial institutions,

including Shinhan Bank, and S-LCD and two other domestic subsidiaries have general term loan facilities of up to ₩ 325 million with Kookmin

Bank and 2 other financial institutions.

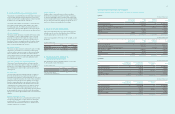

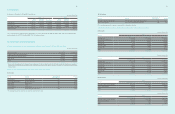

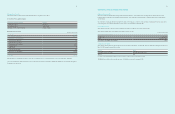

18. Share Capital and Premium

The Company’s number of authorized shares is 500,000,000 shares. The company has issued 147,299,337 shares of common stock and 22,833,427 shares

of preferred stock as of December 31, 2011, excluding retired shares. Due to retirement of shares, the total par value of the shares issued is 850,664 million

(common stock 736,497 million, preferred stock 114,167 million), which does not agree with paid-in captital of 897,514 million.

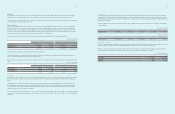

The changes in the number of shares outstanding as of December 31, 2011 and 2010, are as follows :

(In millions of Korean Won and number of shares)

Number of shares of Share capital Share premium Total

Preferred stock¹Common stock²

Balance at December 31, 2010 19,853,734 129,843,077 ₩ 897,514 ₩ 4,403,893 ₩ 5,301,407

Shares issued - 485,650 - - -

Disposal of treasury stock³ - 57,996 - - -

Balance at December 31, 2011 19,853,734 130,386,723 ₩ 897,514 ₩ 4,403,893 ₩ 5,301,407

¹ Non-cumulative, non-voting preferred stock with par value of ₩ 5,000 per share that were all issued on or before February 28, 1997, and are entitled to an

additionalcash dividend of 1% of par value over common stock.

² Common stock with par value of ₩ 5,000 per share.

³ Treasury stocks were issued with respect to options exercised during 2011 and the merger of Samsung Gwangju Electronics during 2011.

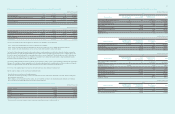

Convertible securities

SEC is authorized to issue to investors, other than current shareholders, convertible debentures and debentures with warrants with face values up to

₩4,000,000 million and ₩ 2,000,000 million, respectively. The convertible debentures amounting to ₩ 3,000,000 million and ₩ 1,000,000 million are

assigned to common stock and preferred stock, respectively. While the debentures with warrants amounting to ₩ 1,500,000 million and ₩ 500,000 million

are assigned to common stock and preferred stock, respectively. As of December 31, 2010, there are no convertible securities currently in issue.

Redemption of shares

SEC is authorized, subject to the Board of Directors’ approval, to retire treasury stock in accordance with applicable laws up to the maximum amount of

certain undistributed earnings. As of December 31, 2010, 8,310,000 shares of common stock and 1,060,000 shares of non-voting preferred stock had been

retired over three tranches, with the Board of Directors’ approval. The par value of capital stock differs from paid-in capital as the retirement of capital stock

was recorded as a deduction from retained earnings.

Issuance of shares

SEC is authorized, subject to the Board of Directors’ approval, to issue shares of common or preferred stock to investors other than current shareholders for

issuance of depository receipts, general public subscription, urgent financing with financial institutions, and strategic alliance.

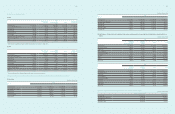

SEC has issued global depositary receipts (“GDR”) to overseas capital markets. The number of outstanding GDR as of December 31, 2011 and 2010, are as

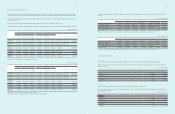

follows :

2011 2010

Non-voting

Preferred Stock

Common

Stock

Non-voting

Preferred Stock

Common

Stock

Outstanding GDR

- Share of Stock 3,092,581 7,316,976 3,253,577 9,049,098

- Share of GDR 6,185,162 14,633,952 6,5 07,154 18,486,976