Samsung 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

91

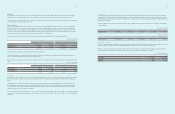

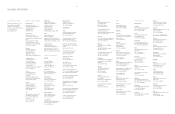

C) Other related parties

Samsung Everland and Samsung Petrochemical, etc. are defined as related parties for the company.

Transactions with other related parties for the years ended December 31, 2011 and 2010, and the related receivables and payables as of December 31,

2011 and 2010, are as follows :

(In millions of Korean Won)

2011 2010

Transactions

Sales ₩ 85,907 ₩ 598,795

Purchases 655,062 478,122

Receivables and Payables

Receivables 244,411 233,649

Payables 172,872 109,875

D) Key management compensation

Key management includes directors (executive and non-executive), members of the Executive Committee. The compensation paid or payable to key

management for employee services is shown below :

(In millions of Korean Won)

2011 2010

Salaries and other short-term benefits ₩ 15,808 ₩ 18,222

Termination benefits 696 2,633

Other long-term benefits 5,096 7,634

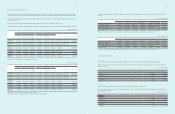

33. Capital Transactions Without Controlling Loss

Capital transactions without controlling loss as of December 31, 2011 are as follows :

The Company acquired Samsung Gwangju Electronics with a closing date of January 1, 2011 to improve shareholder value through enhancement of

business efficiency and manufacturing competitiveness in the digital media (appliance) business. The approval of the Board of Directors of the Company

replaces shareholders’ meeting approval of the acquisition, as the acquisition of Samsung Gwangju Electronics is a small and simple merger as defined in

the commercial law.

(1) Overview of the acquired company

Name of the acquired company Samsung Gwangju Electronics

Headquarters location Gwangju, Gwangsan-gu

Representative director Chang-wan Hong

Classification of the acquired company Unlisted company

Former relationship with the Company Subsidiary

(2) Terms of the business combination

The shareholders of Samsung Gwangju Electronics. received 0.0252536 shares of the Company’s common stock for each share of Samsung Gwangju

Electronics common stock owned on the closing date. The Company transferred its treasury stocks to the shareholders of Samsung Gwangju Electronics,

instead of issuing new stocks.

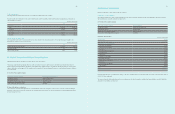

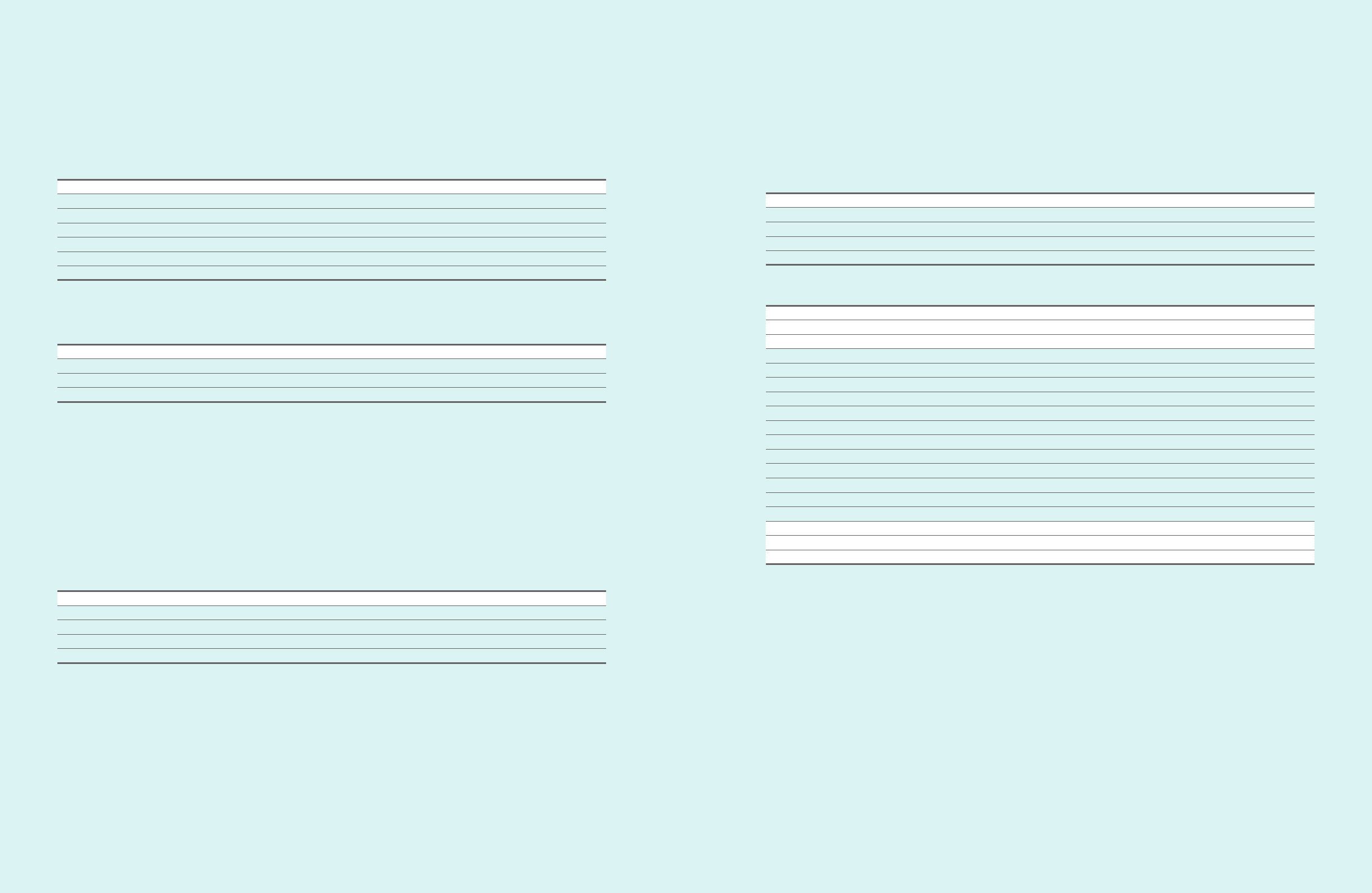

34. Business Combination

Business combinations as of December 31, 2011 are as follows :

A) Acquisition of Samsung Medison

The Company acquired 43.5% shares of Samsung Medison Co.,Ltd. with a closing date of February 16, 2011, and additionally acquired 22.3% shares of

Samsung Medison Co.,Ltd. with closing date of April 29, 2011.

(1) Overview of the acquired company

Name of the acquired company Samsung Medison

Headquarters location Gangwon-do, Hongchen-gun

Representative director Sang-won Bang

Classification of the acquired company Unlisted company

After acquision relationship with the Company Subsidiary

(2) Purchase price allocation

(In millions of Korean Won)

Classification Amount

I. Considerations transferred ₩ 436,965

II. Identifiable assets and liabilities

Cash and cash equivalents 42,287

Trade and other receivables 66,471

Inventories 57,880

Property, plant, and equipment 112,102

Intangible assets 331,433

Other assets 42,708

Trade and other payables (39,161)

Borrowings and loans (88,236)

Retirement benefit obligation (3,306)

Provisions (8,506)

Deferred income tax liabilities (71,157)

Other liabilities (22,450)

Total ₩ 420,065

III. Non-controlling interests ₩ (57,447)

IV. Goodwill ₩ 74,347

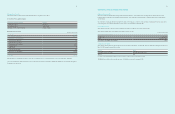

Had Samsung Medison been consolidated from January 1, 2011, the consolidated for the one-year period would show revenue of ₩57,023 million and loss

of ₩ 12,219 million, additionally.

The revenue included in the financial statement of income statement since the date of acquisition contributed by Samsung Medison was ₩ 83,304 million

and profit of ₩1,491 million over the period.