Samsung 2011 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2011 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

69

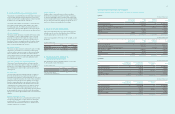

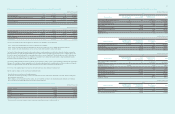

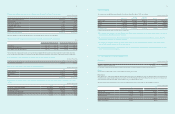

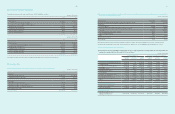

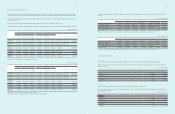

B) Goodwill

Goodwill is allocated to Cash-Generating Units at the end of the reporting period, and consists of the following :

(In millions of Korean Won)

2011 2010

Samsung Digital Imaging ₩287,199 ₩470,344

Samsung Mobile Display 80,299 80,299

Samsung Medison 74,347 -

Grandis 39,883 -

Others 41,681 20,769

Total ₩523,409 ₩571,412

Goodwill impairment reviews are undertaken annually. Impairment test suggests that, except for Samsung Digital Imaging, the carrying value of cash

generating units does not exceed the recoverable amount. The recoverable amounts of cash-generating units have been determined based on value-in-use

calculations. These calculations use pre-tax cash flow projections based on financial budgets approved by management covering a five-year period. Cash

flows beyond the five-year period are extrapolated using the estimated growth rates stated below. The growth rate does not exceed the long-term average

growth rate for the business in which Samsung Digital Imaging operates. In addition, a constant growth rate assumption is used for perpetual cash flow

calculation. The key assumptions used for value-in-use calculations in 2011 and 2010, are as follows :

Samsung Digital Imaging

2011 2010

Growth rate¹ 2.1 2.5

Pre-tax discount rate² 13.6 15.2

¹ Growth rate is consistent with the projected growth rate over five years in the industry reports.

² Pre-tax discount rate applied to the cash flow projections.

The carrying value of Samsung Digital Imaging exceeded the value in use by ₩ 183,145 million in 2011 and ₩ 153,940 million in 2010 and the amount

exceeded carrying value is recognized as the other gains / losses- net in the consolidated income statements.

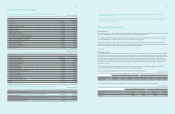

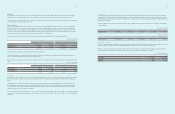

C) Details of amortization of intangible assets as of December 31, 2011 and 2010, consist of the following :

(In millions of Korean Won)

Account 2011 2010

Production costs ₩266,101 ₩236,275

Selling general and administrative expenses 300,497 227,195

Research and development expenses 91,192 83,052

Total ₩657,79 0 ₩546,522

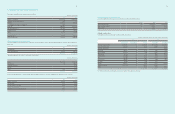

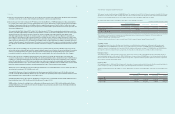

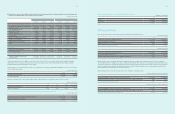

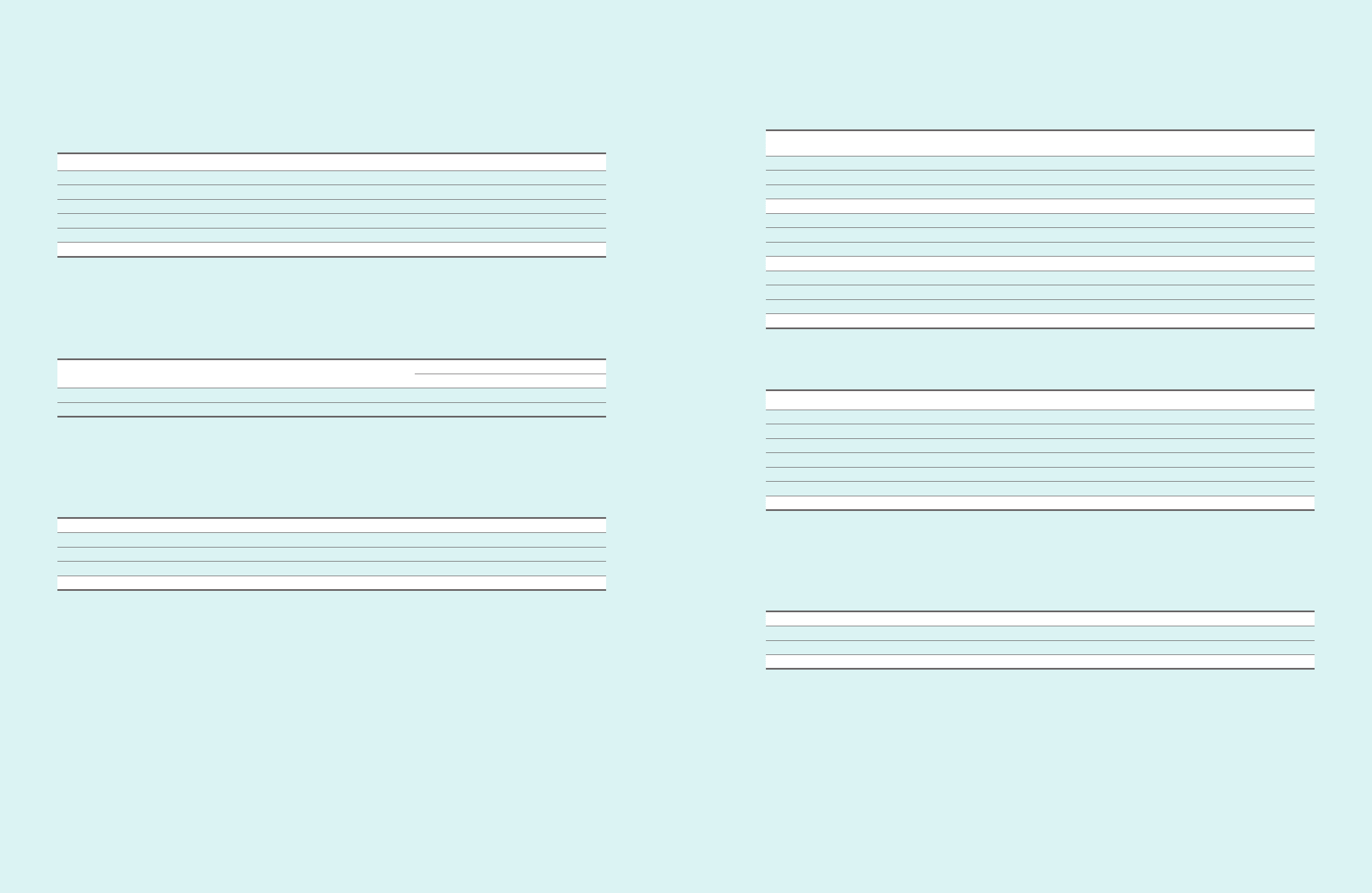

13. Borrowings

A) Borrowings as of December 31, 2011 and 2010, are as follows :

(In millions of Korean Won)

Financial

Institutions

Annual Interest Rates (%)

as of December 31, 2011 2011 2010

Short-term borrowings

Collateralized borrowings¹ Woori Bank etc 0.9 ~ 7.1 ₩4,878,383 ₩5,090,433

Without collateralized CITI etc 0.4 ~ 10.8 4,775,339 3,339,288

Total ₩ 9,653,722 ₩ 8,429,721

Current Portion of long-term borrowings

Bank borrowings DBJ etc 2.8 ~ 4.5 ₩10,820 ₩1,008,884

Financial lease liabilities² APCI etc 2.2 ~ 15.6 13,936 9,591

Total ₩ 24,756 ₩ 1,018,475

Long-term borrowings

Bank borrowings SMBC etc 1.1 ~ 5.8 ₩3,559,554 ₩536,871

Financial lease liabilities² APCI etc 2.2 ~ 15.6 122,918 97,510

Total ₩ 3,682,472 ₩ 634,381

¹ Collateralized borrowings are secured by trade receivables (note 8).

² Leased property, plant and equipment were pledged as collateral (note 17).

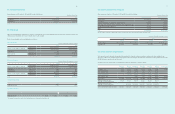

B) Maturities of long-term borrowings, outstanding as of December 31, 2011, are as follows :

(In millions of Korean Won)

Long-term borrowings

in local currency

Long-term borrowings

in foreign currency Total

For the Years Ending December 31

2012 ₩6,899 ₩17,8 57 ₩24,756

2013 73,326 434,612 507,9 38

2014 944,064 1, 527, 319 2,471,383

2015 - 6,955 6,955

Thereafter 1,650 694,546 696,196

Total ₩1,025,939 ₩2,681,289 ₩3,707,228

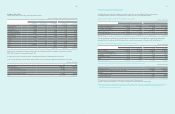

14. Debentures

Debentures as of December 31, 2011 and 2010, consist of the following :

(In millions of Korean Won)

2011 2010

Korean Won denominated debenture (A) ₩1,197,079 ₩500,000

Foreign currency denominated debenture (B) 83,045 87,338

Total ₩1,280,124 ₩587,338