Samsung 2011 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2011 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

61

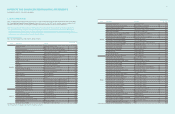

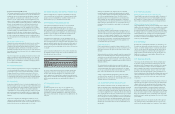

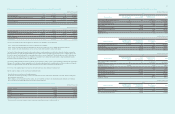

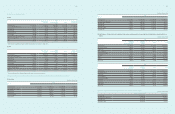

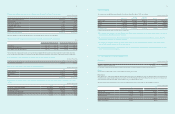

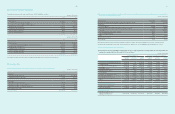

8. Trade and Other Receivables

Substantially all current trade and other receivables are due within 1 year from the end of the reporting period. The carrying amount is a

reasonableapproximation of fair value for current trade and other receivables, with effect of discount being insignificant.

A) Trade and other receivables of December 31, 2011 and 2010, are as follows :

(In millions of Korean Won)

2011 2010

Trade Non-Trade Trade Non-Trade

Receivables from external customers ₩22,026,734 ₩2,215,002 ₩ 19,277,300 ₩2,171,115

Receivables from related parties 107,007 96,994 61,587 8,638

Less : Allowances for impairment (214,597) (37,833) (185,758) (19,585)

Trade receivables, net ₩ 21,919,144 ₩ 2,274,163 ₩ 19,153,129 ₩ 2,160,168

Less : Non-current portion (37,017) (3,262) (15) (4,448)

Current portion ₩ 21,882,127 ₩ 2,270,901 ₩ 19,153,114 ₩2,155,720

The Company transferred receivable balances to financial institutions in exchange for cash. The outstanding balance of transferred receivable balances

amounting to ₩ 4,878,383 million and ₩ 5,090,433 million has been accounted for as borrowings as of December 31, 2011 and 2010 (Note 13).

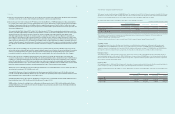

B) Movements on the provision for impairment of trade receivables are as follows :

(In millions of Korean Won)

2011 2011

Trade Non-Trade Trade Non-Trade

Balance on January 1 ₩ (185,758) ₩ (19,585) ₩ (129,078) ₩ (26,510)

Provision for receivables impairment (78,202) (11,478) (100,912) (10,561)

Receivables written off during the year as

uncollectible 7,345 224 10,909 10,668

Unused amounts reversed 56,539 11,561 32,062 7,776

Others (14,521) (18,555) 1,261 (958)

Balance on December 31 ₩ (214,597) ₩ (37,833) ₩ (185,758) ₩ (19,585)

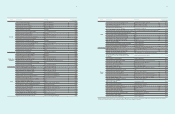

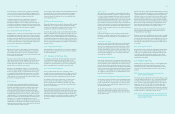

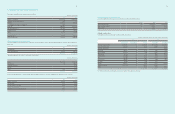

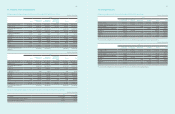

C) An aging analysis of trade and other receivables as of December 31, 2011 and 2010, is as follows :

(In millions of Korean Won)

December 31, 2011 December 31, 2010

Receivables not past due ₩22,467,108 ₩19,807,731

Receivables past due, not impaired¹ : Less than 31 days overdue 1,351,566 1,158,929

Bad debts² :

31 days to 90 days overdue 339,107 298,503

90 days overdue or more 287,956 253,477

24,445,737 21,518,640

¹ The company does not consider receivables that are overdue for less than or equal to 31 days as impaired.

² The balance of allowance for doubtful debts as of December 31, 2011 amounts to ₩ 252,430 million (2010 : ₩ 205,343 million).

D) The maximum exposure to credit risk at the reporting date is the carrying value of each class of receivable mentioned above. As of December

31, 2011, the Company has credit insurance with Korea Trade Insurance and overseas insurance companies against its export accounts

receivables from approved foreign customers.

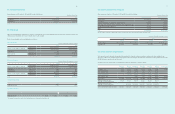

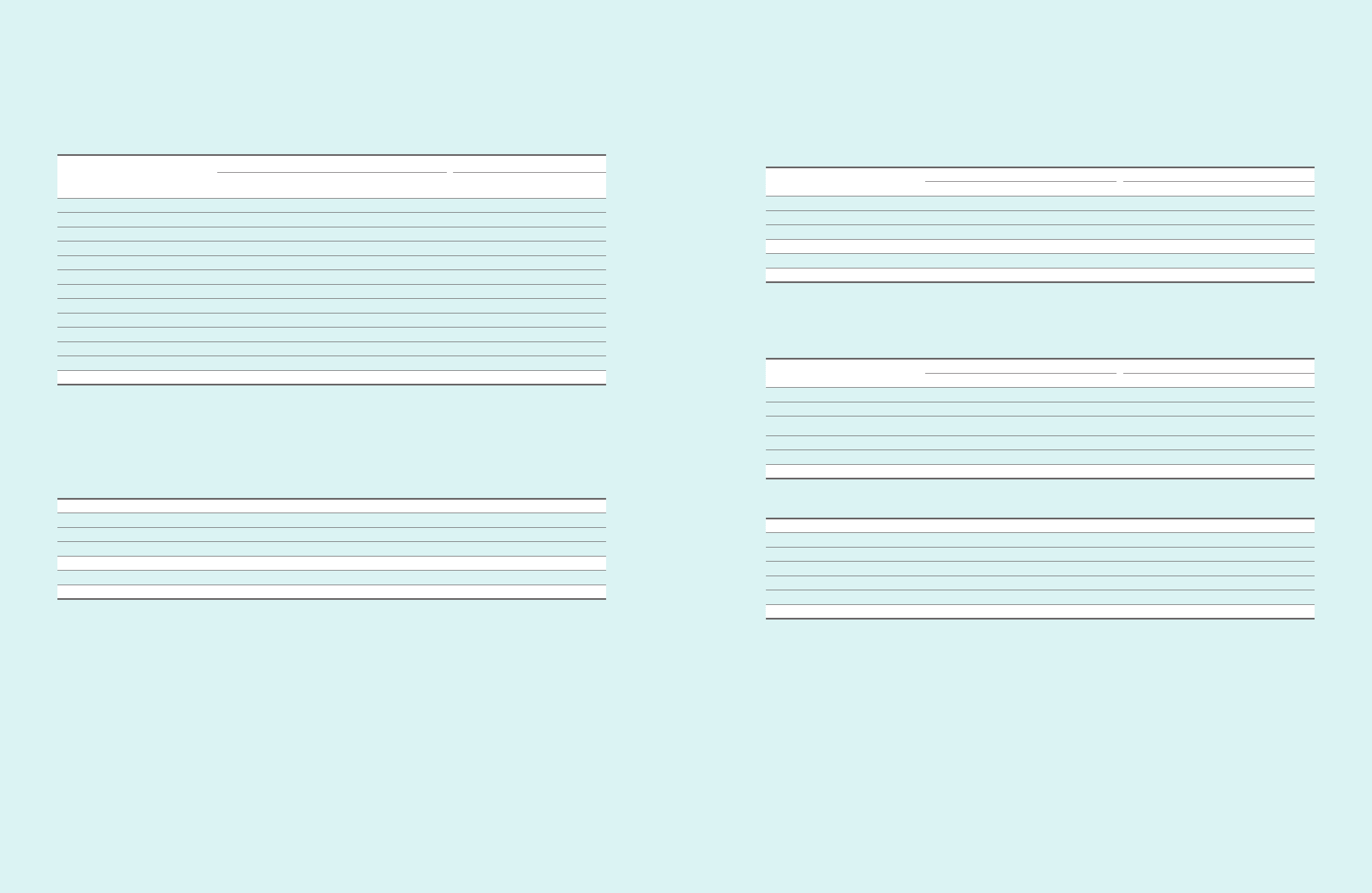

(2) Equity securities-Unlisted

Unlisted equity securities as of December 31, 2011 and 2010, are as follows :

(In millions of Korean Won, except for the number of shares and percentage)

2011 2010

Number of

Shares Owned

Percentage of

Ownership (%)

Acquisition

Cost

Recorded

Book Value

Recorded

Book Value

Kihyup Technology 1,000,000 17.2 ₩5,000 ₩5,000 ₩5,000

Pusan Newport 1,135,307 1.0 5,677 5,677 5,677

Samsung Venture 980,000 16.3 4,900 5,835 5,223

Samsung Petrochemical 514,172 13.0 8,040 91,489 58,940

Samsung General Chemicals 1,914,251 3.9 19,143 71,365 65,322

icube Investment 40 16.2 4,000 4,000 4,000

Yong Pyong Resort 400,000 1.1 1,869 1,869 1,869

KT Skylife - - - - 3,000

SK Telink 14,609 1.1 4,357 4,357 4,357

CSOT - 15.0 278,130 278,130 -

Nanosys 13,100,436 12.5 17,861 17,861 17,861

Others - - 144,557 138,156 155,110

- - ₩ 493,534 ₩ 623,739 ₩ 326,359

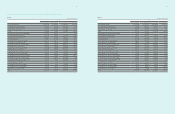

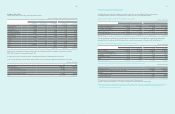

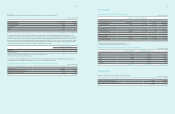

Impairment losses on unlisted equity securities resulting from the decline in realizable value below the acquisition cost amounted to ₩ 39 million

(2010 :₩10,719 million) for the year ended December 31, 2011.

As of December 31, 2011, the Company’s investments in Pusan Newport are pledged as collateral against the investee’s debt.

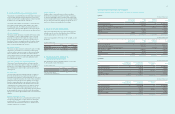

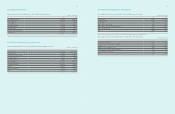

For the years ended December 31, 2011 and 2010, changes in valuation gain (loss) on long-term available-for-sale financial assets are as follows :

(In millions of Korean Won)

2011 2010

Balance at January 1 ₩2,058,189 ₩874,036

Fair value gains (losses) (565,800) 1,184,153

Net gains (losses) transfer from equity (125,058) -

Balance at December 31 1,367,331 2,058,189

Deferred income tax and minority interest (331,008) (457,085)

Total ₩ 1,036,323 ₩ 1,601,104