Samsung 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

55

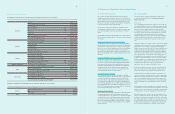

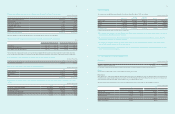

3. Critical Estimates and Judgments

The preparation of consolidated financial statements requires management

to exercise significant judgment and assumptions based on historical

experience and other factors, including expectations of future events that

are believed to be reasonable under the circumstances.

The Company makes estimates and assumptions concerning the future.

The resulting accounting estimates will, by definition, seldom equal

the related actual results. The estimates and assumptions that have a

significant risk of causing a material adjustment to the carrying amounts

of assets and liabilities within the next financial year are addressed below.

A) Revenue recognition

The Company uses the percentage-of-completion method in accounting

for its fixed-price contracts to deliver installation services. Use of the

percentage-of-completion method requires the company to estimate

the services performed to date as a proportion of the total services to

be performed. Revenues and earnings are subject to significant change,

effected by early steps in a long-term projects, change in scope of a

project, cost, period, and plans of the customers.

B) Provision for warranty

The Company recognizes provision for warranty at the point of recording

related revenue. The company accrues provision for warranty based

on the best estimate of amounts necessary to settle future and existing

claims on products sold as of each balance sheet date. Continuous

release of products, that are more technologically complex and changes

in local regulations and customs could result in additional allowances

being required in future periods.

C) Fair value of derivatives and other financial instruments

The fair value of financial instruments that are not traded in an active

market is determined by using valuation techniques. The Company uses

its judgement to select a variety of methods and make assumptions

that are mainly based on market conditions existing at the end of each

reporting period.

D) Pension benefits

The present value of the pension obligations depends on a number of

factors that are determined on an actuarial basis using a number of

assumptions. The assumptions used in determining the net cost (income)

for pensions include the discount rate. Any changes in these assumptions

will impact the carrying amount of pension obligations. The Company

determines the appropriate discount rate at the end of each year. This

is the interest rate that should be used to determine the present value

of estimated future cash outflows expected to be required to settle the

pension obligations. In determining the appropriate discount rate, the

Company considers the interest rates of high-quality corporate bonds that

are denominated in the currency in which the benefits will be paid and

that have terms to maturity approximating the terms of the related pension

obligation.

E) Estimated impairment of goodwill

The Company tests at the end of each reporting period whether goodwill

has suffered any impairment in accordance with the accounting policy

described in Note 2.11. The recoverable amounts of cash generating

units have been determined based on value-in-use calculations. These

calculations require the use of estimates.

F) Legal contingencies

Legal proceedings covering a wide range of matters are pending or

threatened in various jurisdictions against the Company. Provisions are

recorded for pending litigation when it is determined that an unfavorable

outcome is probable and the amount of loss can be reasonably estimated.

Due to the inherent uncertain nature of litigation, the ultimate outcome or

actual cost of settlement may materially vary from estimates.

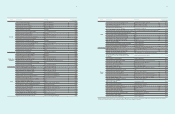

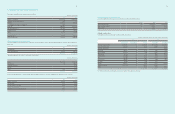

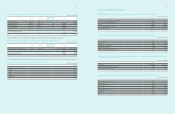

4. Cash and Cash Equivalents

Cash and cash equivalents include cash on hand, deposits held at call

with banks, and other short-term highly liquid investments (MMDA and

etc.) with original maturities of less than three months.

Cash and cash equivalents as of December 31, 2011 and 2010, consist of

the following :

(In millions of Korean won)

2011 2010

Cash on hand ₩16,042 ₩5,897

Bank deposits, etc. 14,675,719 9,785,522

Total ₩14,691,761 ₩9,791,419

5. Financial Assets Subject to

Withdrawal Restrictions

Financial instruments subject to withdrawal restrictions as of December

31, 2011 and 2010, consist of the following :

(In millions of Korean won)

2011 2010

Short-term financial instruments ₩39,770 ₩46,371

Other non-current assets

- long-term financial instruments 16 26

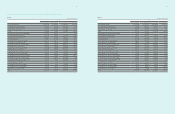

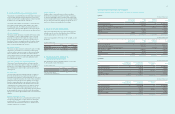

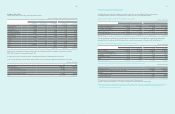

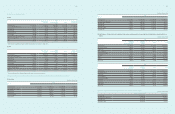

6. Financial Instruments by Category

A) Financial instruments by category as of December 31, 2011 and 2010, consist of the following :

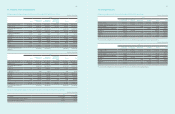

(1) Assets

(In millions of Korean won)

2011

Assets at fair

value through

the profit and loss

Loans

and

receivables

Available-

for-sale

financial assets

Total

Cash and cash equivalents ₩-₩14,691,761 ₩-₩14,691,761

Short-term financial instruments - 11,529,905 -11,529,905

Long and short-term available-for-sale financial assets - - 3,879,567 3,879,567

Trade and other receivables - 24,153,028 -24,153,028

Deposits -791,863 -791,863

Other financial assets 130,057 1,289,447 -1,419,504

Total ₩ 130,057 ₩ 52,456,004 ₩ 3,879,567 ₩ 56,465,628

(In millions of Korean won)

2010

Assets at fair

value through

the profit and loss

Loans

and

receivables

Available-

for-sale

financial assets

Total

Cash and cash equivalents ₩-₩9,791,419 ₩-₩9,791,419

Short-term financial instruments - 11,529,392 -11,529,392

Long and short-term available-for-sale financial assets - - 4,199,358 4,199,358

Trade and other receivables - 21,308,834 -21,308,834

Deposits -655,662 -655,662

Other financial assets 34,458 1,013,771 -1,048,229

Total ₩ 34,458 ₩ 44,299,078 ₩ 4,199,358 ₩ 48,532,894

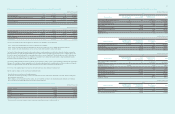

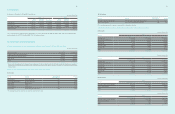

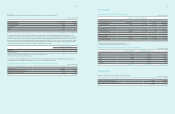

(2) Liabilities

(In millions of Korean won)

2011

Liabilities at

fair value through

profit and loss

Financial liabilities

measured at

amortized cost

Other financial

liabilities Total

Trade and other payables ₩-₩18,509,490 ₩-₩18,509,490

Long-term other payables - 1,024,804 -1,024,804

Long and short-term borrowings - 8,482,567 4,878,383 13,360,950

Debentures -1,285,661 -1,285,661

Other financial liabilities 40,932 7,788,449 -7,829,381

Total ₩ 40,932 ₩ 37,09 0,971 ₩ 4,878,383 ₩ 42,010,286

(In millions of Korean won)

2010

Liabilities at

fair value through

profit and loss

Financial liabilities

measured at

amortized cost

Other financial

liabilities Total

Trade and other payables ₩-₩ 16,049,800 ₩-₩16,049,800

Long-term other payables - 1,072,661 -1,072,661

Long and short-term borrowings - 4,992,14 4 5,090,433 10,082,577

Debentures -692,797 -692,797

Other financial liabilities 24,638 7,78 9, 567 -7,814,205

Total ₩ 24,638 ₩ 30,596,969 ₩ 5,090,433 ₩ 35,712,040