Saks Fifth Avenue 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133

|

|

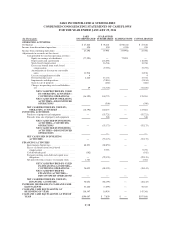

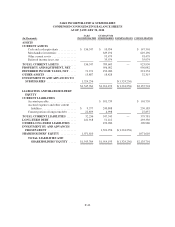

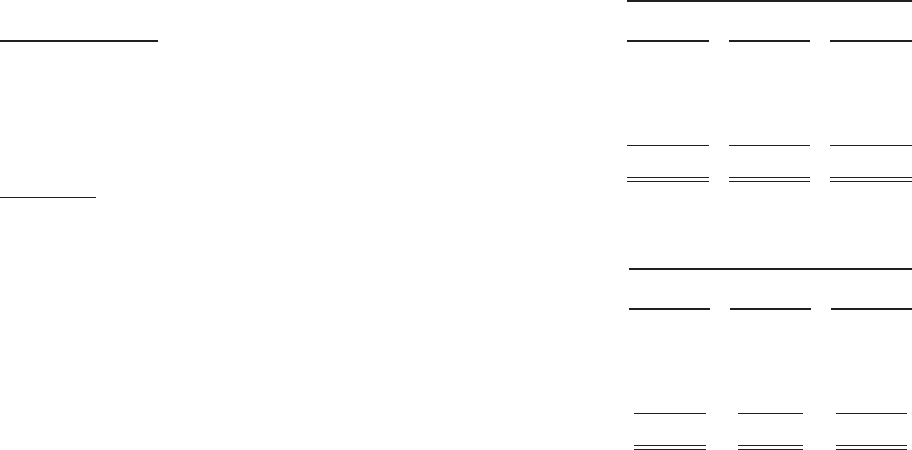

SAKS INCORPORATED & SUBSIDIARIES

SCHEDULE II—VALUATION AND QUALIFYING ACCOUNTS

Year Ended

(Dollars In Thousands)

January 29,

2011

January 30,

2010

January 31,

2009

Allowance for sales returns, net:

Balance at Beginning of Year ................................ $ 3,905 $ 4,238 $ 7,255

Charged to Costs and Expenses ............................... 775,092 765,534 946,230

Deductions (A) ............................................ (774,895) (765,867) (949,247)

Balance at End of Year .......................................... $ 4,102 $ 3,905 $ 4,238

(A) Deductions consist of actual returns net of related costs and commissions

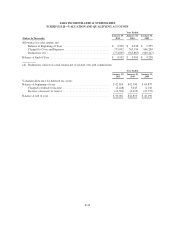

Year Ended

January 29,

2011

January 30,

2010

January 31,

2009

Valuation allowance for deferred tax assets:

Balance at beginning of year ..................................... $42,810 $42,190 $ 63,837

Charged (credited) to income ................................. (2,228) 3,045 6,110

Increase (decrease) to reserve ................................. (10,501) (2,425) (27,757)

Balance at end of year ........................................... $30,081 $42,810 $ 42,190

F-44