Saks Fifth Avenue 2010 Annual Report Download - page 21

Download and view the complete annual report

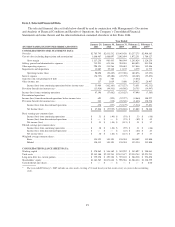

Please find page 21 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Management’s Discussion and Analysis (“MD&A”) is intended to provide an analytical view of the

business from management’s perspective of operating the business and is considered to have these major

components:

• Overview

• Results of Operations

• Liquidity and Capital Resources

• Critical Accounting Policies and Estimates

MD&A should be read in conjunction with the consolidated financial statements and related notes thereto

contained elsewhere in this Form 10-K.

OVERVIEW

GENERAL

The operations of Saks Incorporated, a Tennessee corporation first incorporated in 1919, and its subsidiaries

(together the “Company”) consist of Saks Fifth Avenue (“SFA”), Saks Fifth Avenue OFF 5TH (“OFF 5TH”),

and SFA’s e-commerce operations (“Saks Direct”). Previously, the Company also operated Club Libby Lu

(“CLL”), the operations of which were discontinued in January 2009. The operations of CLL are presented as

discontinued operations in the Consolidated Statements of Income and the Consolidated Statements of Cash

Flows for the current and prior year periods and are discussed below in “Discontinued Operations.”

The Company is primarily a fashion retail organization offering a wide assortment of distinctive luxury

fashion apparel, shoes, accessories, jewelry, cosmetics, and gifts. SFA stores are principally free-standing stores

in exclusive shopping destinations or anchor stores in upscale regional malls. Customers may also purchase SFA

products by catalog or online at Saks Direct. OFF 5TH is intended to be the premier luxury off-price retailer in

the United States. OFF 5TH stores are primarily located in upscale mixed-use and off-price centers and offer

luxury apparel, shoes, and accessories, targeting the value-conscious customer. As of January 29, 2011, the

Company operated 47 SFA stores with a total of approximately 5.5 million square feet and 57 OFF 5TH stores

with a total of approximately 1.6 million square feet.

The Company is primarily focused on the luxury retail sector. All of the goods that the Company sells are

discretionary items. Consequently, a downturn in the economy or difficult economic conditions may result in

fewer customers shopping in the Company’s stores or online. In response, the Company may have to increase the

duration and/or frequency of promotional events and offer larger discounts in order to attract customers, which

would reduce gross margin and adversely affect results of operations.

The Company continues to make targeted investments in key areas to improve customer service and

enhance merchandise assortment and allocation effectiveness. In addition, strategic investments are being made

to remodel existing selling space with a heightened focus on return on investment. The Company believes that its

long-term strategic plans can deliver additional operating margin expansion in future years.

The Company seeks to create value for its shareholders by improving returns on its invested capital. The

Company attempts to generate improved operating margins by generating sales increases while improving

merchandising margins and controlling expenses. The Company uses operating cash flows to reinvest in the

business and to repurchase debt or equity. The Company actively manages its real estate portfolio by routinely

evaluating opportunities to improve or close underproductive stores and open new stores.

20