Saks Fifth Avenue 2010 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INTEREST EXPENSE

Interest expense increased to $56.7 million in 2010 from $49.5 million in 2009 and, as a percentage of net

sales, was 2.0% in 2010 and 1.9% in 2009. The increase of $7.2 million was primarily due to the issuance of

$120.0 million of convertible notes in May 2009 and the amortization of financing costs associated with these

notes and the amended revolving credit facility. Noncash interest expense associated with the amortization of the

debt discount on the Company’s convertible notes was $11.9 million and $9.8 million for the years ended

January 29, 2011 and January 30, 2010, respectively.

GAIN ON EXTINGUISHMENT OF DEBT

During the year ended January 29, 2011, the Company repurchased $0.8 million of the 7.0% senior notes

which resulted in a loss on extinguishment of debt of $4.0 thousand. During the year ended January 30, 2010, the

Company extinguished approximately $23.0 million of senior notes. The repurchase of these notes resulted in a

gain on extinguishment of debt of $0.8 million.

OTHER INCOME, NET

Other income decreased to $0.1 million in 2010 from $1.0 million in 2009. Other income in 2010 was

primarily related to $0.7 million of interest income which was offset by $0.6 million of casualty losses relating to

the May 2010 flood at the Nashville, Tennessee OFF 5TH store. Other income in 2009 was primarily attributable

to interest income.

INCOME TAXES

For 2010 and 2009, the effective income tax rate for continuing operations differs from the federal statutory

tax rate due to state income taxes and other items such as the change in the valuation allowance against state

NOL carryforwards, the effect of concluding tax examinations and other tax reserve adjustments primarily

relating to statute expirations, and the change in the overall state tax rate. Including the effect of these items, the

Company’s effective income tax rate for continuing operations was (41.5%) and 43.6% in 2010 and 2009,

respectively. The effective tax benefit rate for 2010 is primarily due to the reversal of an uncertain tax position

relating to statute expirations.

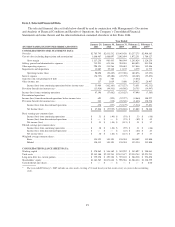

FISCAL YEAR ENDED JANUARY 30, 2010 COMPARED TO FISCAL YEAR ENDED JANUARY 31, 2009

DISCUSSION OF OPERATING LOSS—CONTINUING OPERATIONS

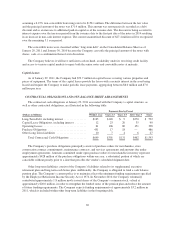

The following table shows the changes in operating loss from 2008 to 2009:

(In Millions)

Total

Company

2008 Operating Loss—Continuing Operations ........................................... $(135.4)

Store sales and margin ................................................................ (17.5)

Operating expenses .................................................................. 116.6

Impairments and dispositions .......................................................... (18.2)

Change ........................................................................ 80.9

2009 Operating Loss—Continuing Operations ........................................... $ (54.5)

For the year ended January 30, 2010, the Company’s operating loss totaled $54.5 million, a 240 basis point

improvement as a percentage of net sales from the operating loss of $135.4 million for the year ended

January 31, 2009. The operating loss was driven by a 14.7% decrease in comparable store sales partially offset by

a gross margin rate increase of 440 basis points for the year ended January 30, 2010. The increase in the gross

24