Saks Fifth Avenue 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

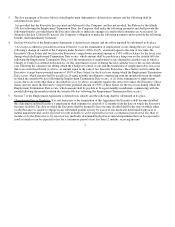

will, to the extent necessary, delay making the payment or providing the benefit until the earliest date on which the

Company in good faith determines that the payment can be paid or the benefit can be provided without causing the

payment or the benefit to be subject to additional taxes imposed by Section 409A of the Code. Notwithstanding any other

provision of this Agreement to the contrary, to the extent the Executive is considered a “key employee” (as defined in Code

Section 416(i) without regard to Section 416(i)(5)) of a company that is publicly traded on an established securities market

or otherwise, distributions will be delayed six months after the separation from service in accordance with Code

Section 409A(a)(2)(B)(i), but not later than the Executive’s death.

(iii) The Agreement is intended to comply with the requirements of Section 409A or an exemption or exclusion therefrom and,

with respect to amounts that are subject to Section 409A, shall in all respects be administered in accordance with

Section 409A. Any payments that qualify for the “short-term deferral” exception or another exception under Section 409A

shall be paid under the applicable exception. Each payment of compensation under this Agreement shall be treated as a

separate payment of compensation for purposes of Section 409A. All payments to be made upon a termination of

employment under this Agreement may only be made upon a “separation from service” under Section 409A. In no event

may the Executive, directly or indirectly, designate the calendar year of any payment under this Agreement. Any tax gross-

up payment made pursuant to this Agreement shall be made no later than the end of Executive’s taxable year next

followin

g

Executive’s taxable

y

ear in which Executive remits the related taxes.

(iv) Notwithstanding anything to the contrary in this Agreement, all reimbursements and in-kind benefits provided under this

Agreement shall be made or provided in accordance with the requirements of Section 409A, including, where applicable,

the requirement that (a) any reimbursement is for expenses incurred during the Executive’s lifetime (or during a shorter

period of time specified in this Agreement); (b) the amount of expenses eligible for reimbursement, or in-kind benefits

provided, during a calendar year may not affect the expenses eligible for reimbursement, or in-kind benefits to be provided,

in any other calendar year, except, if such benefits consist of the reimbursement of expenses referred to in Section 105(b)

of the Code, a maximum, if provided under the terms of the plan providing such medical benefit, may be imposed on the

amount of such reimbursements over some or all of the period in which such benefit is to be provided to the Executive as

described in Treasury Regulation Section 1.409A-3(i)(1)(iv)(B); (c) the reimbursement of an eligible expense will be made

no later than the last day of the calendar year following the year in which the expense is incurred, provided that the

Executive shall have submitted an invoice for such fees and expenses at least ten (10) days before the end of the calendar

year next following the calendar year in which such fees and expenses were incurred; and (d) the right to reimbursement or

in-kind benefits is not sub

j

ect to li

q

uidation or exchan

g

e for another benefit.

(v) Notwithstanding anything to the contrary in this Agreement, payment of any amounts, including, but not limited to, salary

and bonuses, will be subject to, and payable in accordance with, any prior deferral elections made with respect to such

amounts under the Com

p

an

y

’s Deferred Com

p

ensation Plan (as amended and restated effective Januar

y

1, 2009).”