Saks Fifth Avenue 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

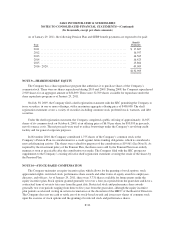

EMPLOYEE STOCK PURCHASE PLAN

The Employee Stock Purchase Plan (“ESPP”) provides for an aggregate of 1,450 shares of the Company’s

common stock to be purchased by eligible employees through payroll deductions at a 15% discount to market

value. As of January 29, 2011, the plan had 148 shares available for future issuances. In 2009, the HRCC of the

Board of Directors suspended the employee stock purchase plan indefinitely. During 2008, 250 shares of the

Company’s common stock were purchased by employees.

NOTE 11—CLUB LIBBY LU CLOSURE

During the fourth quarter of 2008, the Company discontinued the operations of its CLL specialty store

business which consisted of 98 leased, mall-based stores. Along with the previous disposition of the Saks

Department Store Group businesses, CLL was no longer determined to be a strategic fit for the Company. CLL

generated revenues of approximately $52,231 for 2008 and was not profitable. The Company incurred charges of

$44,521 in 2008 associated with the CLL store closings which are included in discontinued operations in the

Consolidated Statements of Income.

The Company made payments of $500 related to lease termination costs during the year ended January 29,

2011. As of January 29, 2011, there were no amounts payable remaining for the CLL store closings.

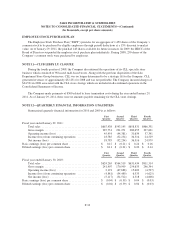

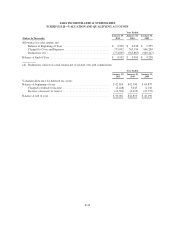

NOTE 12—QUARTERLY FINANCIAL INFORMATION (UNAUDITED)

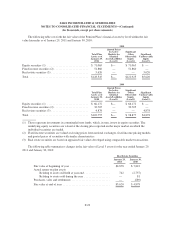

Summarized quarterly financial information for 2010 and 2009 is as follows:

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Fiscal year ended January 29, 2011:

Total sales ........................................ $667,438 $593,145 $658,831 $866,331

Gross margin ...................................... 287,731 221,271 280,655 327,601

Operating income (loss) ............................. 45,454 (44,381) 31,634 57,391

Income (loss) from continuing operations ............... 18,785 (32,234) 36,316 24,529

Net income (loss) .................................. 18,785 (32,234) 36,316 24,979

Basic earnings (loss) per common share ..................... $ 0.12 $ (0.21) $ 0.24 $ 0.16

Diluted earnings (loss) per common share ................... $ 0.11 $ (0.21) $ 0.20 $ 0.14

First

Quarter

Second

Quarter

Third

Quarter

Fourth

Quarter

Fiscal year ended January 30, 2010:

Total sales ........................................ $624,265 $564,519 $631,434 $811,314

Gross margin ...................................... 241,407 170,999 254,635 296,394

Operating income (loss) ............................. 2,191 (67,688) 15,609 (4,597)

Income (loss) from continuing operations ............... (4,881) (54,489) 6,333 (4,625)

Net income (loss) .................................. (5,117) (54,512) 6,318 (4,608)

Basic earnings (loss) per common share ..................... $ (0.04) $ (0.39) $ 0.04 $ (0.03)

Diluted earnings (loss) per common share ................... $ (0.04) $ (0.39) $ 0.04 $ (0.03)

F-34