Saks Fifth Avenue 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DISCONTINUED OPERATIONS

As of January 31, 2009, the Company discontinued the operations of its CLL business, which consisted of

98 leased, mall-based specialty stores, targeting girls aged 4-12 years old. Charges incurred during 2008

associated with the closing of these stores totaled approximately $44.5 million and included inventory liquidation

costs of approximately $7.0 million, asset impairment charges of $17.0 million, lease termination costs of $14.0

million, severance and personnel related costs of $5.1 million, and other closing costs of $1.4 million. These

amounts are included in discontinued operations in the Consolidated Statement of Income and the Consolidated

Statement of Cash Flows for fiscal year 2008. Discontinued operations include nominal charges (income) for

2009 and 2010 from residual CLL store closing activities.

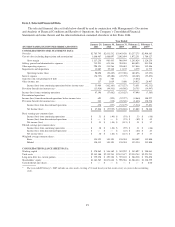

FINANCIAL PERFORMANCE SUMMARY

On a consolidated basis, total net sales and comparable store sales for the year ended January 29, 2011

increased 5.9% and 6.4%, respectively. The Company recorded income from continuing operations of $47.4

million, or $0.30 per share compared to a loss from continuing operations of $57.7 million, or $0.40 per share,

for the years ended January 29, 2011 and January 30, 2010, respectively. After recognition of the Company’s

after-tax gain from discontinued operations of $0.4 million, net income totaled $47.8 million, or $0.30 per share

for the year ended January 29, 2011. After recognition of the Company’s after-tax loss from discontinued

operations of $0.3 million, net loss totaled $57.9 million, or $0.40 per share for the year ended January 30, 2010.

The year ended January 29, 2011 included a net after-tax gain totaling $17.2 million or $0.11 per share,

primarily related to a $26.7 million or $0.17 per share gain related to the reversal of certain estimated income tax

reserves deemed no longer necessary due to the expiration of the statute of limitations. This gain was partially

offset by a net after-tax charge of $7.5 million or $0.05 per share, primarily related to store closings and asset

impairments and a $2.0 million or $0.01 per share non-cash pension charge related to excess lump sum

distributions during 2010.

The year ended January 30, 2010 included net after tax charges totaling $10.4 million or $0.07 per share,

primarily related to $17.3 million or $0.12 per share of asset impairment charges incurred in the normal course of

business and a $3.1 million or $0.02 per share non-cash pension charge related to excess lump sum distributions

during 2009 primarily resulting from the Company’s 2009 reductions-in-force. The year ended January 30, 2010

also included a net gain of $10.0 million or $0.07 per share, related to federal and state tax adjustments. The net

gain included income resulting from an increase in the state deferred tax rate, release of tax reserves due to the

expiration of the statute of limitations and reversal of a portion of the valuation allowance against deferred tax

assets.

The year ended January 31, 2009 included net after-tax charges totaling $26.2 million or $0.19 per share,

primarily related to $7.0 million or $0.05 per share of asset impairment charges incurred in the normal course of

business and approximately $6.7 million or $0.05 per share of severance costs related to the Company’s 2008

downsizing initiative and the Ft. Lauderdale store closing. The year ended January 31, 2009 also included a

write-off and adjustment of $14.6 million or $0.11 per share of certain deferred tax assets primarily associated

with federal net operating loss (“NOL”) tax credits that expired at the end of fiscal 2008. These expenses were

partially offset by a net gain of $2.1 million or $0.02 per share related to the sale of three unutilized properties.

The Company believes that an understanding of its reported financial condition and results of operations is

not complete without considering the effect of all other components of MD&A included herein.

21