Saks Fifth Avenue 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

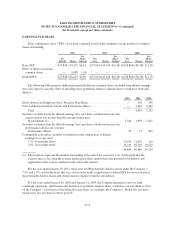

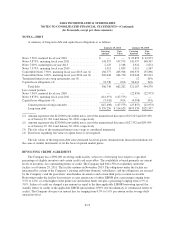

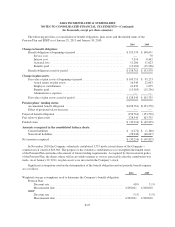

MATURITIES

At January 29, 2011, maturities of long-term debt and capital lease obligations for the next five years and

thereafter are as follows:

Year Maturities

2011 ............................................................ $147,498

2012 ............................................................ 6,016

2013 ............................................................ 128,694

2014 ............................................................ 6,354

2015 ............................................................ 5,751

Thereafter ........................................................ 255,010

Subtotal .......................................................... 549,323

Unamortized discount as of January 29, 2011 ............................ (42,575)

Total ............................................................ $506,748

The Company made interest payments of $35,286, $36,388, and $31,741, of which $721, $758, and $1,308

was capitalized into property and equipment during 2010, 2009, and 2008, respectively.

NOTE 7—COMMITMENTS AND CONTINGENCIES

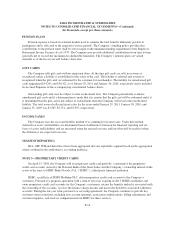

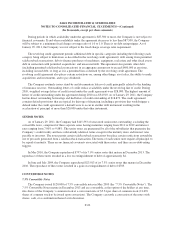

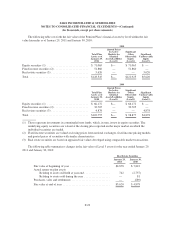

OPERATING LEASES AND OTHER PURCHASE COMMITMENTS

The Company leases certain property and equipment under various non-cancelable capital and operating

leases. The leases provide for monthly fixed amount rentals or contingent rentals based upon sales in excess of

stated amounts and normally require the Company to pay real estate taxes, insurance, common area maintenance

costs and other occupancy costs. Generally, the leases have primary terms ranging from 20 to 30 years and

include renewal options ranging from 5 to 20 years.

At January 29, 2011, future minimum rental commitments under capital leases and non-cancelable operating

leases consisted of the following:

Operating

Leases

Capital

Leases

2011 .................................................. $ 60,811 $ 11,997

2012 .................................................. 55,693 11,547

2013 .................................................. 49,855 11,521

2014 .................................................. 41,770 10,673

2015 .................................................. 38,467 9,369

Thereafter .............................................. 151,080 35,059

$397,676 90,166

Amounts representing interest .............................. (36,436)

Capital lease obligations .................................. $53,730

Total rental expense for operating leases was $98,501, $101,756, and $101,063 during 2010, 2009, and

2008, respectively, including contingent rent of $14,284, $13,301, and $17,381, respectively, and common area

maintenance costs of $11,611, $12,299, and $12,702, respectively.

F-23