Saks Fifth Avenue 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

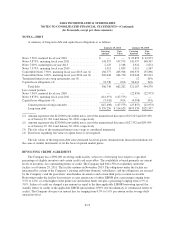

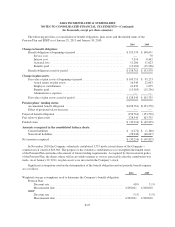

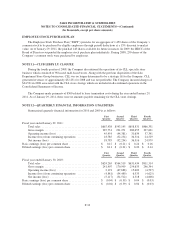

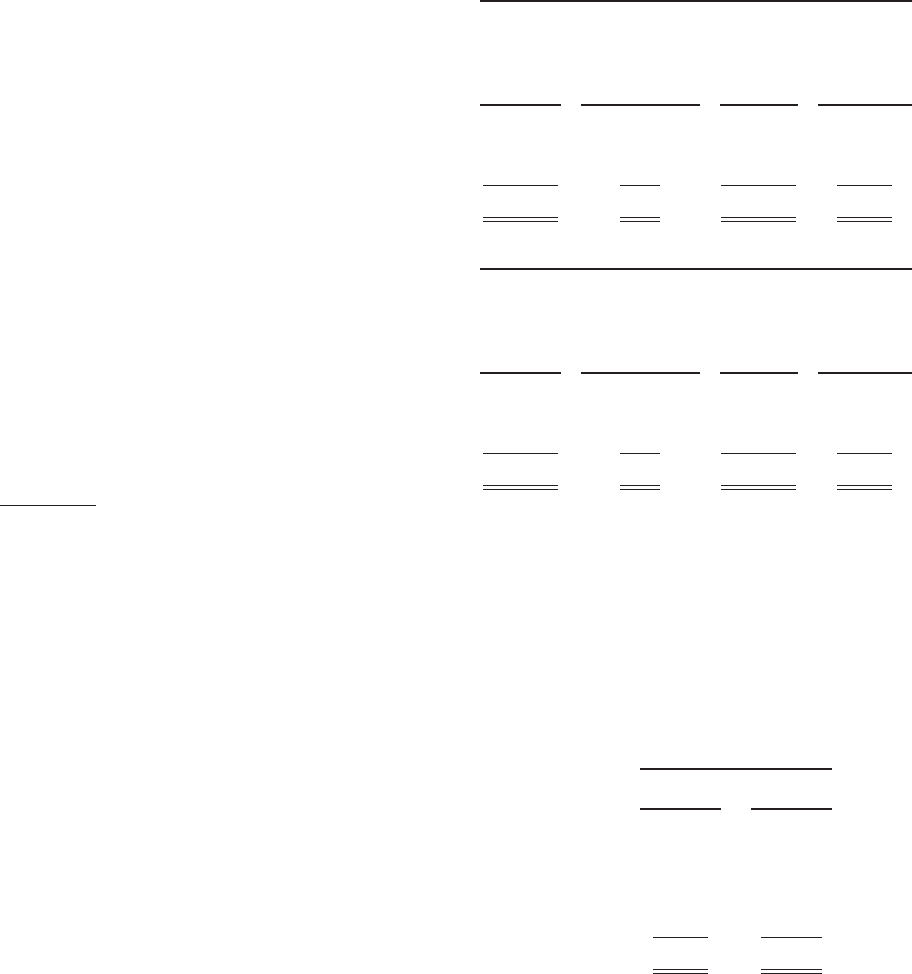

The following table sets forth the fair value of the Pension Plan’s financial assets by level within the fair

value hierarchy as of January 29, 2011 and January 30, 2010:

2010

Total Plan

Assets as of

January 29,

2011

Quoted Prices

In Active

Markets for

Identical

Assets/Liabilities

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Equity securities (1) ............................. $ 71,065 $— $ 71,065 $ —

Fixed income securities (2) ........................ 51,860 — 51,860 —

Real estate securities (3) .......................... 5,620 — — 5,620

Total ......................................... $128,545 $— $122,925 $5,620

2009

Total Plan

Assets as of

January 30,

2010

Quoted Prices

In Active

Markets for

Identical

Assets/Liabilities

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Equity securities (1) ............................. $ 66,172 $— $ 66,172 $ —

Fixed income securities (2) ........................ 32,705 — 32,705 —

Real estate securities (3) .......................... 4,878 — — 4,878

Total ......................................... $103,755 $— $ 98,877 $4,878

(1) These represent investments in commingled trust funds, which, in turn, invest in equity securities. The

underlying equity securities are valued at the closing price reported on the major market on which the

individual securities are traded.

(2) Fixed income securities are valued at closing prices from national exchanges, fixed income pricing models,

and quoted prices of securities with similar characteristics.

(3) Real estate securities are based on appraised fair values developed using comparable market transactions.

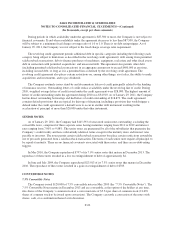

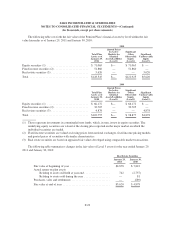

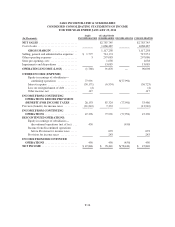

The following table summarizes changes in the fair value of Level 3 assets for the year ended January 29,

2011 and January 30, 2010:

Real Estate Securities

January 29,

2011

January 30,

2010

Fair value at beginning of year ............................ $4,878 $ 7,843

Actual return on plan assets:

Relating to assets still held at year-end .................. 742 (2,757)

Relating to assets sold during the year .................. — 81

Purchases, sales and settlements ........................... — (289)

Fair value at end of year ................................. $5,620 $ 4,878

F-29