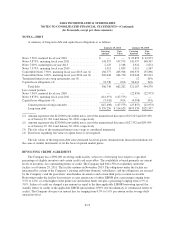

Saks Fifth Avenue 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

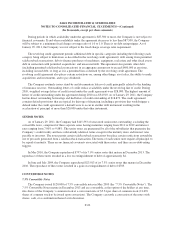

Authoritative accounting literature requires the allocation of convertible debt proceeds between the liability

component and the embedded conversion option (i.e., the equity component). The liability component of the debt

instrument is accreted to par value using the effective interest method over the remaining life of the debt. The

accretion is reported as a component of interest expense. The equity component is not subsequently revalued as

long as it continues to qualify for equity treatment. Upon issuance, the Company estimated the fair value of the

liability component of the 7.5% Convertible Notes, assuming a 13% non-convertible borrowing rate, to be

$97,994. The difference between the fair value and the principal amount of the 7.5% Convertible Notes was

$22,006. This amount was recorded as a debt discount and as an increase to additional paid-in capital as of the

issuance date. The discount is being accreted to interest expense over the 4.5 year period to the maturity date of

the notes in December 2013 resulting in an increase in non-cash interest expense in future periods.

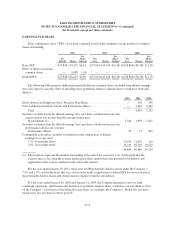

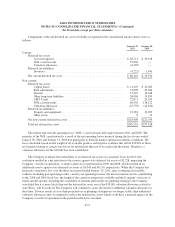

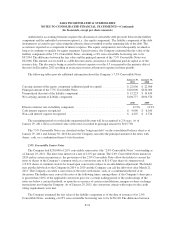

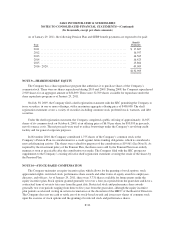

The following tables provide additional information about the Company’s 7.5% Convertible Notes.

January 29,

2011

January 30,

2010

Carrying amount of the equity component (additional paid-in capital) ............... $ 22,006 $ 22,006

Principal amount of the 7.5% Convertible Notes ................................ $120,000 $120,000

Unamortized discount of the liability component ................................ $ 15,223 $ 19,430

Net carrying amount of liability component .................................... $104,777 $100,570

2010 2009

Effective interest rate on liability component ................................... 12.9% 12.9%

Cash interest expense recognized ............................................ $ 9,000 $ 6,100

Non-cash interest expense recognized ........................................ $ 4,207 $ 2,576

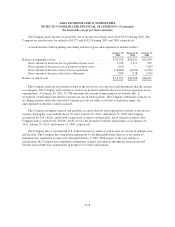

The remaining period over which the unamortized discount will be recognized is 2.8 years. As of

January 29, 2011, the if-converted value of the notes exceeded its principal amount by $125,738.

The 7.5% Convertible Notes are classified within “long-term debt” on the consolidated balance sheet as of

January 29, 2011 and January 30, 2010 because the Company can settle the principal amount of the notes with

shares, cash, or a combination thereof at its discretion.

2.0% Convertible Senior Notes

The Company had $230,000 of 2.0% convertible senior notes (the “2.0% Convertible Notes”) outstanding as

of January 29, 2011. The notes bear interest at a rate of 2.0% per annum. The 2.0% Convertible Notes mature in

2024 and in certain circumstances, the provisions of the 2.0% Convertible Notes allow the holder to convert the

notes to shares of the Company’s common stock at a conversion rate of $11.97 per share of common stock

(19,219 shares of common stock to be issued upon conversion) subject to an anti-dilution adjustment. The holder

may put the debt back to the Company in 2014 or 2019 and the Company can call the debt on or after March 21,

2011. The Company can settle a conversion of the notes with shares, cash, or a combination thereof at its

discretion. The holders may convert the notes at the following times, among others: if the Company’s share price

is greater than 120% of the applicable conversion price for a certain trading period; if the credit ratings of the

notes are below a certain threshold; or upon the occurrence of certain consolidations, mergers or share exchange

transactions involving the Company. As of January 29, 2011, the conversion criteria with respect to the credit

rating requirements were met.

The Company estimated the fair value of the liability component as of the date of issuance of its 2.0%

Convertible Notes, assuming a 6.25% non-convertible borrowing rate, to be $158,148. The difference between

F-21