Saks Fifth Avenue 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

assuming a 6.25% non-convertible borrowing rate to be $158.1 million. The difference between the fair value

and the principal amount of the notes was $71.9 million. This amount was retrospectively recorded as a debt

discount and as an increase to additional paid-in capital as of the issuance date. The discount is being accreted to

interest expense over the ten-year period from the issuance date to the first put date of the notes in 2014 resulting

in an increase in non-cash interest expense. The current unamortized discount of $27.4 million will be recognized

over the remaining 3.1 year period.

The convertible notes were classified within “long-term debt” on the Consolidated Balance Sheet as of

January 29, 2011 and January 30, 2010 because the Company can settle the principal amount of the notes with

shares, cash, or a combination thereof at its discretion.

The Company believes it will have sufficient cash on hand, availability under its revolving credit facility

and access to various capital markets to repay both the senior notes and convertible notes at maturity.

Capital Leases

As of January 29, 2011, the Company had $53.7 million in capital leases covering various properties and

pieces of equipment. The terms of the capital leases provide the lessor with a security interest in the asset being

leased and require the Company to make periodic lease payments, aggregating between $6.0 million and $7.0

million per year.

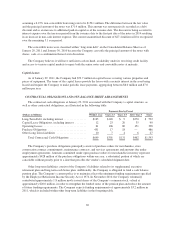

CONTRACTUAL OBLIGATIONS AND OFF-BALANCE SHEET ARRANGEMENTS

The contractual cash obligations at January 29, 2011 associated with the Company’s capital structure, as

well as other contractual obligations, are illustrated in the following table:

Payments Due by Period

(Dollars in Millions) Within 1 year Years 2-3 Years 4-5 After Year 5 Total

Long-Term Debt, including interest ................ $165 $148 $ 9 $270 $ 592

Capital Lease Obligations, including interest ........ 12 23 20 35 90

Operating Leases .............................. 61 106 80 151 398

Purchase Obligations ........................... 451 17 18 — 486

Other Long-Term Liabilities ..................... 10 7 4 6 27

Total Contractual Cash Obligations ............ $699 $301 $131 $462 $1,593

The Company’s purchase obligations principally consist of purchase orders for merchandise, store

construction contract commitments, maintenance contracts, and services agreements and amounts due under

employment agreements. Amounts committed under open purchase orders for merchandise inventory represent

approximately $428 million of the purchase obligations within one year, a substantial portion of which are

cancelable without penalty prior to a date that precedes the vendor’s scheduled shipment date.

Other long-term liabilities consist of the Company’s liabilities related to its supplemental executive

retirement plan and long-term cash bonus plan. Additionally, the Company is obligated to fund a cash balance

pension plan. The Company’s current policy is to maintain at least the minimum funding requirements specified

by the Employee Retirement Income Security Act of 1974. In November 2010, the Company voluntarily

contributed approximately 1.8 million newly issued shares of the Company’s common stock, valued at

approximately $20.0 million, in order to strengthen the funded status of the pension plan and reduce the amount

of future funding requirements. The Company expects funding requirements of approximately $3.2 million in

2011, which is included within other long-term liabilities in the foregoing table.

30