Saks Fifth Avenue 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

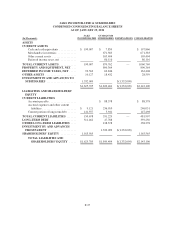

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

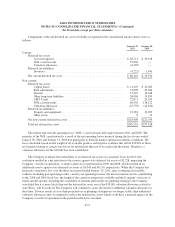

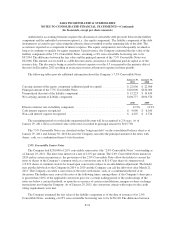

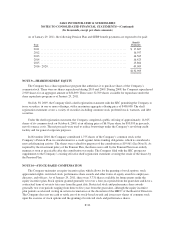

The following provides a reconciliation of benefit obligations, plan assets and the funded status of the

Pension Plan and SERP as of January 29, 2011 and January 30, 2010:

2010 2009

Change in benefit obligation:

Benefit obligation at beginning of period .................................. $153,570 $ 148,671

Service cost ..................................................... — 70

Interest cost ..................................................... 7,314 8,442

Actuarial loss ................................................... 11,260 11,623

Benefits paid .................................................... (13,383) (15,236)

Benefit obligation at end of period ....................................... $158,761 $ 153,570

Change in plan assets:

Fair value of plan assets at beginning of period ............................. $103,755 $ 95,273

Actual return on plan assets ........................................ 16,340 22,643

Employer contributions ........................................... 21,833 1,075

Benefits paid .................................................... (13,383) (15,236)

Administrative expenses ........................................... — —

Fair value of plan assets at end of period .................................. $128,545 $ 103,755

Pension plans’ funding status:

Accumulated benefit obligation ......................................... $(158,761) $(153,570)

Effect of projected salary increases ...................................... — —

Projected benefit obligation ................................................ (158,761) (153,570)

Fair value of plan assets ................................................... 128,545 103,755

Funded status ........................................................... $ (30,216) $ (49,815)

Amounts recognized in the consolidated balance sheets:

Current liabilities .................................................... $ (1,272) $ (1,168)

Noncurrent liabilities ................................................. (28,944) (48,647)

Net amount recognized .................................................... $ (30,216) $ (49,815)

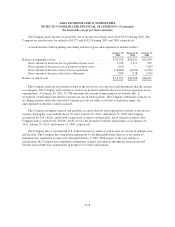

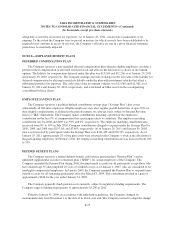

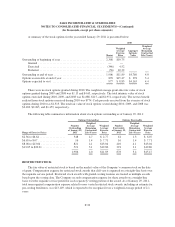

In November 2010 the Company voluntarily contributed 1,755 newly issued shares of the Company’s

common stock valued at $19,961. The purpose of the voluntary contribution was to strengthen the funded status

of the Pension Plan and reduce the amount of future funding requirements. As required by the investment policy

of the Pension Plan, the shares where sold in an orderly manner as soon as practicable after the contribution was

made. As of January 29, 2011, no plan assets were invested in the Company’s stock.

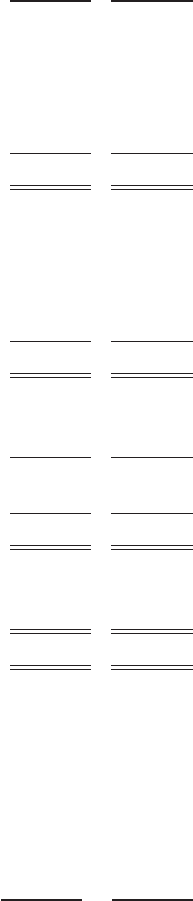

Significant assumptions used in the determination of the benefit obligation and net periodic benefit expense

are as follows:

2010 2009

Weighted-average assumptions used to determine the Company’s benefit obligation:

Pension Plan:

Discount rate ................................................... 4.8% 5.1%

Measurement date ............................................... 1/29/2011 1/30/2010

SERP

Discount rate ................................................... 5.1% 5.5%

Measurement date ............................................... 1/29/2011 1/30/2010

F-27