Saks Fifth Avenue 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

in measurement date using the alternative transition method. In accordance with the alternative transition method,

the actuarial valuation provided a 15-month projection of net periodic benefit cost to January 31, 2009 that

resulted in a $344 decrease to 2008 ending retained earnings.

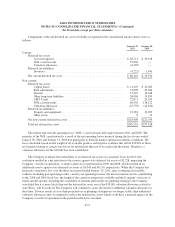

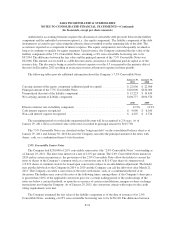

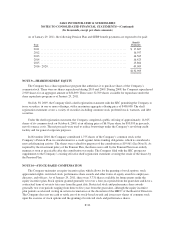

The components of pre-tax net periodic pension expense (benefit) and other amounts recognized in other

comprehensive loss related to the Pension Plan and SERP for the years ended January 29, 2011, January 30,

2010, and January 31, 2009 were as follows:

2010 2009 2008

Net periodic pension expense (benefit):

Service cost .................................................. $ — $ 70 $ 846

Interest cost .................................................. 7,315 8,442 10,613

Expected return on plan assets .................................... (6,920) (6,330) (15,184)

Recognized actuarial loss ........................................ 2,626 2,707 1,005

Settlement loss recognized (1) .................................... 3,654 5,121 —

Amortization of prior service costs ................................ — — (87)

Total pension expense (benefit) ....................................... $6,675 $ 10,010 $ (2,807)

Other changes recognized in other comprehensive loss:

Prior service credit recognized due to curtailment ..................... $ — $ — $ 616

Net loss (gain) ................................................ 1,840 (4,690) 68,200

Amortization of prior service credit ................................ — — 88

Amortization of loss ............................................ (6,281) (7,828) (1,005)

Total recognized in other comprehensive loss ............................ $(4,441) $(12,518) $ 67,899

Total recognized in net periodic pension expense (benefit) and other

comprehensive loss .............................................. $2,234 $ (2,508) $ 65,092

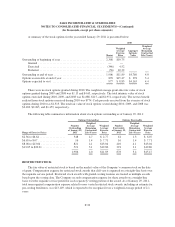

(1) In accordance with authoritative accounting guidance, the Company recorded a non-cash settlement charge

of $3,654 and $5,121 in 2010 and 2009, respectively, as the Company’s lump sum distributions exceeded its

interest and service cost.

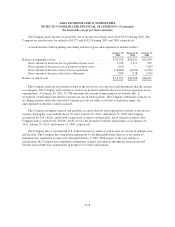

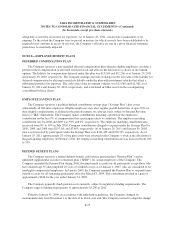

For the years ended January 29, 2011 and January 30, 2010, amounts recognized in accumulated other

comprehensive loss that have not yet been recognized as a component of net periodic pension expense consist of

a pre-tax net loss of $75,560 and $80,001, respectively. The estimated pre-tax net loss that is expected to be

amortized from accumulated other comprehensive loss into net periodic benefit expense during 2011 is $2,316.

F-26