Saks Fifth Avenue 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

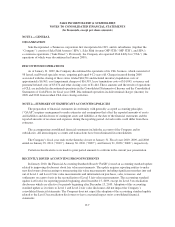

ADOPTION OF NEW ACCOUNTING PRONOUNCEMENTS

On January 31, 2010, the Company adopted a new standard that changed the accounting for transfers of

financial assets. This new standard eliminates the concept of a qualified special-purpose entity, removes the

scope exception from applying the accounting standards that address the consolidation of variable interest entities

to qualifying special-purpose entities, changes the standard for de-recognizing financial assets, and requires

enhanced disclosure. The adoption of this new standard did not impact the Company’s consolidated financial

statements.

On January 31, 2010, the Company adopted a new standard for determining whether to consolidate a

variable interest entity. This new standard eliminated a mandatory quantitative approach to determine whether a

variable interest gives the entity a controlling financial interest in a variable interest entity in favor of a

qualitatively focused analysis and required an ongoing reassessment of whether an entity is the primary

beneficiary. The adoption of this new standard did not impact the Company’s consolidated financial statements.

On February 1, 2009, the Company retrospectively adopted a new standard related to accounting for

convertible debt instruments that may be settled in cash upon conversion (including partial cash settlement). The

standard specifies that issuers of such instruments should separately account for the liability and equity

components in a manner that will reflect the entity’s nonconvertible debt borrowing rate when interest cost is

recognized in subsequent periods. The effect of the adoption is disclosed in Note 6.

In May 2009, the FASB issued guidance regarding subsequent events, which was subsequently updated in

February 2010. This guidance established general standards of accounting for and disclosure of events that occur

after the balance sheet date but before financial statements are issued or are available to be issued. In particular,

this guidance sets forth the period after the balance sheet date during which management of a reporting entity

should evaluate events or transactions that may occur for potential recognition or disclosure in the financial

statements, the circumstances under which an entity should recognize events or transactions occurring after the

balance sheet date in its financial statements, and the disclosures that an entity should make about events or

transactions that occurred after the balance sheet date. This guidance was effective for financial statements issued

for fiscal years and interim periods ending after June 15, 2009, and was therefore adopted by the Company for

the second quarter 2009 reporting. The adoption did not have a significant impact on the subsequent events that

the Company reports, either through recognition or disclosure, in the consolidated financial statements. In

February 2010, the FASB amended its guidance on subsequent events to remove the requirement to disclose the

date through which an entity has evaluated subsequent events, alleviating conflicts with current Securities and

Exchange Commission (“SEC”) guidance.

In December 2008, the FASB issued additional guidance on employers’ disclosures about the plan assets of

defined benefit pension or other postretirement plans. The new disclosure requirements include a description of

how investment allocation decisions are made, major categories of plan assets, valuation techniques used to

measure the fair value of plan assets, the impact of measurement using significant unobservable inputs and

concentrations of risk within plan assets. The new disclosure requirements are effective for fiscal years ending

after December 15, 2009. See Note 8 for the disclosures required in accordance with this accounting standard.

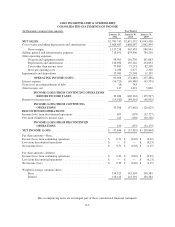

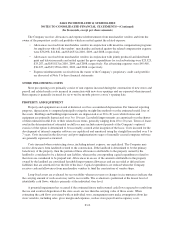

NET SALES

Net sales include sales of merchandise (net of returns and exclusive of sales taxes), commissions from

leased departments, shipping and handling revenues related to merchandise sold and breakage income from

unredeemed gift cards. Net sales are recognized at the time customers provide a satisfactory form of payment and

take ownership of the merchandise or direct its shipment. Revenue associated with gift cards is recognized upon

redemption of the card.

F-8