Saks Fifth Avenue 2010 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

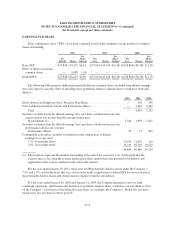

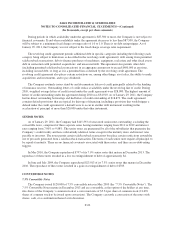

NOTE 6—DEBT

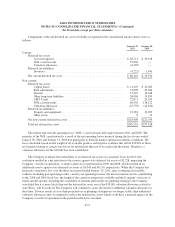

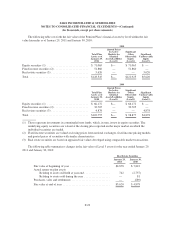

A summary of long-term debt and capital lease obligations is as follows:

January 29, 2011 January 30, 2010

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Notes 7.50%, matured fiscal year 2010 .................... $ — $ — $ 22,859 $ 22,973

Notes 9.875%, maturing fiscal year 2011 .................. 141,557 147,573 141,557 148,547

Notes 7.00%, maturing fiscal year 2013 ................... 2,125 2,168 2,922 2,674

Notes 7.375%, maturing fiscal year 2019 .................. 1,911 1,835 1,911 1,567

Convertible Notes 7.50%, maturing fiscal year 2013, net (1) . . . 104,777 265,906 100,570 175,896

Convertible Notes 2.00%, maturing fiscal year 2024, net (2) . . . 202,648 244,720 194,946 192,913

Terminated interest rate swap agreements, net (3) ............ — — 12 N/A

Capital lease obligations (4) ............................. 53,730 N/A 56,410 N/A

Total debt ....................................... 506,748 662,202 521,187 544,570

Less current portion:

Notes 7.50%, matured fiscal year 2010 .................... — — (22,859) (22,973)

Notes 9.875%, maturing fiscal year 2011 .................. (141,557) (147,573) — —

Capital lease obligations (4) ............................. (5,941) N/A (4,998) N/A

Current portion of long-term debt .................... (147,498) (147,573) (27,857) (22,973)

Long-term debt ................................... $359,250 $ 514,629 $493,330 $521,597

(1) Amount represents the $120,000 convertible notes, net of the unamortized discount of $15,223 and $19,430

as of January 29, 2011 and January 30, 2010, respectively.

(2) Amount represents the $230,000 convertible notes, net of the unamortized discount of $27,352 and $35,054

as of January 29, 2011 and January 30, 2010, respectively.

(3) The fair value of the terminated interest rate swaps is considered immaterial.

(4) Disclosure regarding fair value of capital leases is not required.

The fair values of the long-term debt were estimated based on quotes obtained from financial institutions for

the same or similar instruments or on the basis of quoted market prices.

REVOLVING CREDIT AGREEMENT

The Company has a $500,000 revolving credit facility, subject to a borrowing base equal to a specified

percentage of eligible inventory and certain credit card receivables. The availability is based primarily on current

levels of inventory, less outstanding letters of credit. The Company had $412,378 of availability under the

facility as of January 29, 2011. The facility matures in November 2013. The obligations under the facility are

guaranteed by certain of the Company’s existing and future domestic subsidiaries, and the obligations are secured

by the Company’s and the guarantors’ merchandise inventories and certain third party accounts receivable.

Borrowings under the facility bear interest at a per annum rate of either LIBOR plus a percentage ranging from

3.5% to 4.0%, or at the higher of the prime rate and federal funds rate plus a percentage ranging from 2.5% to

3.0%. Letters of credit are charged a per annum fee equal to the then applicable LIBOR borrowing spread (for

standby letters of credit) or the applicable LIBOR spread minus 0.50% (for documentary or commercial letters of

credit). The Company also pays an unused line fee ranging from 0.5% to 1.0% per annum on the average daily

unused revolver.

F-19