Saks Fifth Avenue 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

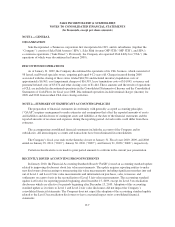

At the end of the ten-year term expiring in 2013, the agreement can be renewed for two two-year terms. At the

end of the agreement, the Company has the right to repurchase, at fair value, substantially all of the accounts and

outstanding accounts receivable, negotiate a new agreement with HSBC or begin issuing private label credit cards itself

or through others. The agreement allows the Company to terminate the agreement early following the occurrence of

certain events, the most significant of which would be HSBC’s failure to pay owed amounts, bankruptcy, a change in

control or a material adverse change in HSBC’s ability to perform under the agreement. The agreement also allows for

HSBC to terminate the agreement if the Company fails to pay owed amounts or enters bankruptcy. Should either the

Company or HSBC choose to terminate the agreement early, the Company has the right, but not the requirement, to

repurchase substantially all credit card accounts and associated accounts receivable from HSBC at their fair value. The

Company is contingently liable to pay monies to HSBC in the event of an early termination or a significant disposition

of stores. The contingent payment is based upon a declining portion of an amount established at the beginning of the

ten-year agreement and on a prorated portion of significant store closings. The maximum contingent payment had the

agreement been terminated early on January 29, 2011 would have been approximately $10,894. Management believes

the risk of incurring a contingent payment is remote.

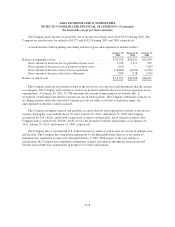

The Company and HSBC have entered into several amendments to the program agreement since 2003. In

October 2009, the Company and HSBC entered into a fifth amendment to the program agreement in response to

macroeconomic conditions and portfolio performance, which provided for certain changes to the allocation of

risk and revenue sharing between the parties. The fifth amendment, which became effective February 1, 2010,

provides for HSBC to share with the Company certain credit losses of the card portfolio and also provides

increased revenue sharing to the Company.

In September 2006, the Company entered into agreements with HSBC and MasterCard International

Incorporated to issue a co-branded MasterCard card to new and existing proprietary credit card customers. Under

this program, qualifying customers are issued a SFA and MasterCard branded credit card that functions as a

traditional proprietary credit card when used at any SFA or OFF 5TH store and at Saks Direct or as a MasterCard

card when used at any unaffiliated location that accepts MasterCard cards. HSBC establishes and owns the

co-brand accounts, retains the benefits and sales associated with the ownership of the accounts, receives the

finance charge and other income from the accounts, and incurs the bad-debts associated with the accounts.

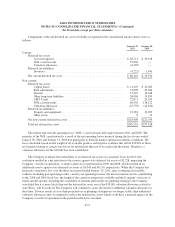

With the exception of depreciation expense, all components of the credit card operations are included in

SG&A in the Consolidated Statements of Income. The credit contribution comprises program compensation and

servicing compensation. For 2010, 2009, and 2008, the components of the credit contribution included in SG&A

were $24,204, $29,425, and $29,899, respectively.

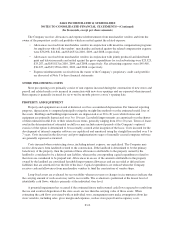

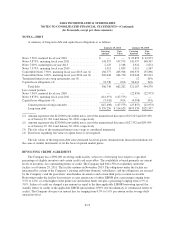

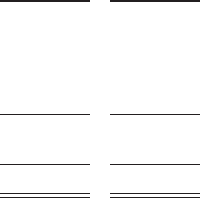

NOTE 4—PROPERTY AND EQUIPMENT

A summary of property and equipment is as follows:

January 29,

2011

January 30,

2010

Land and land improvements ............................................. $ 174,283 $ 174,551

Buildings ............................................................. 589,998 585,860

Leasehold improvements ................................................. 317,394 321,092

Fixtures and equipment .................................................. 751,655 734,847

Construction in progress ................................................. 15,906 10,921

1,849,236 1,827,271

Accumulated depreciation ................................................ (958,872) (871,189)

$ 890,364 $ 956,082

F-15