Saks Fifth Avenue 2010 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SAKS INCORPORATED & SUBSIDIARIES

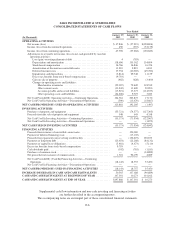

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

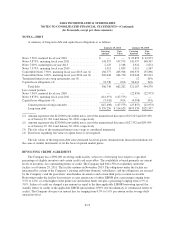

An impairment loss is recognized when the carrying amount of the assets is not recoverable and exceeds its

fair value. The Company uses an income-based approach to determine the fair value of its assets that involves

making assumptions regarding the estimated future cash flows, as described above, and the discount rate to

determine the present value of those future cash flows. The Company discounts its cash flows at a rate equal to

the average of its weighted average cost of capital and the weighted average cost of capital of its competitors as

an estimate of the rate that market participants would use in pricing the assets.

Long-lived asset impairment charges are included within Impairments and Dispositions in the Consolidated

Statements of Income.

IMPAIRMENTS AND DISPOSITIONS

Impairment and disposition costs include costs associated with store closures, including employee severance

and lease termination costs, asset impairment and disposal charges, and other store closure activities.

Additionally, Impairments and Dispositions include long-lived asset impairment charges related to assets held

and used and losses related to asset dispositions made during the normal course of business.

The Company continuously evaluates its real estate portfolio and closes underproductive stores in the

normal course of business as leases expire or as other circumstances dictate. During 2010, the Company closed

six SFA locations, as well as one OFF 5TH location and announced an agreement to close another SFA location

during the first quarter ending April 30, 2011. The Company incurred $12,045 of store closing-related costs

associated with these locations, including $10,110 of net lease termination costs, $4,171 of asset impairment and

disposal costs, $2,504 of severance costs, $3,833 of other store-closing related costs, all of which are offset by a

deferred rent benefit of $8,573.

Also included in impairment and disposition costs for 2010 are $785 of asset impairment charges related to

held and used assets and $255 of losses on the disposal of assets during the normal course of business. The fair

value of the assets impaired during 2010 was $0 and was classified as Level 3 within the fair value hierarchy.

During 2009, the Company incurred $28,176 of asset impairment charges related to held and used assets and

$1,172 of losses on the disposal of assets during the normal course of business. During 2008, the Company

incurred $9,711 of asset impairment charges related to held and used assets and $1,428 of losses on the disposal

of assets during the normal course of business.

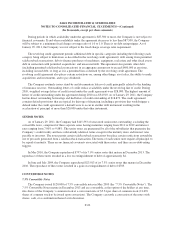

FAIR VALUE MEASUREMENTS

The FASB’s accounting guidance defines fair value as the price that would be received to sell an asset or

paid to transfer a liability in an orderly transaction between market participants at the measurement date (exit

price). The FASB guidance discusses valuation techniques, such as the market approach (comparable market

prices), the income approach (present value of future income or cash flow), and the cost approach (cost to replace

the service capacity of an asset or replacement cost). The standard utilizes a fair value hierarchy that prioritizes

the inputs to valuation techniques used to measure fair value into three broad levels. The FASB’s guidance

classifies the inputs used to measure fair value into the following hierarchy:

Level 1: Quoted market prices in active markets for identical assets or liabilities

Level 2: Observable market-based inputs or unobservable inputs that are corroborated by market data

Level 3: Unobservable inputs reflecting the reporting entity’s own assumptions

F-11