Saks Fifth Avenue 2010 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

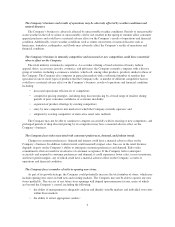

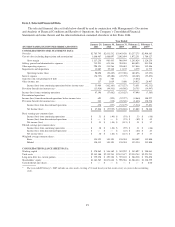

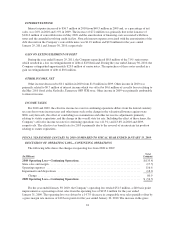

Item 6. Selected Financial Data.

The selected financial data set forth below should be read in conjunction with Management’s Discussion

and Analysis of Financial Condition and Results of Operations, the Company’s Consolidated Financial

Statements and notes thereto and the other information contained elsewhere in this Form 10-K.

Year Ended

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

January 29,

2011

January 30,

2010

January 31,

2009

February 2,

2008

February 3,

2007*

CONSOLIDATED INCOME STATEMENT DATA:

Net sales ................................................... $2,785,745 $2,631,532 $3,043,438 $3,237,275 $2,900,383

Cost of sales (excluding depreciation and amortization) .............. 1,668,487 1,668,097 2,062,494 1,972,251 1,780,127

Gross margin ........................................... 1,117,258 963,435 980,944 1,265,024 1,120,256

Selling, general and administrative expenses ...................... 715,951 674,306 784,510 840,823 811,248

Other operating expenses ...................................... 298,124 314,266 320,683 317,046 312,486

Impairments and dispositions .................................. 13,085 29,348 11,139 4,279 11,775

Operating income (loss) ................................... 90,098 (54,485) (135,388) 102,876 (15,253)

Interest expense ............................................. (56,725) (49,480) (45,739) (48,303) (55,693)

Gain (loss) on extinguishment of debt ............................ (4) 783 — (5,634) 7

Other income, net ............................................ 117 1,019 5,600 24,912 28,407

Income (loss) from continuing operations before income taxes .... 33,486 (102,163) (175,527) 73,851 (42,532)

Provision (benefit) for income taxes ............................. (13,910) (44,501) (48,902) 26,755 (34,947)

Income (loss) from continuing operations ......................... 47,396 (57,662) (126,625) 47,096 (7,585)

Discontinued operations:

Income (loss) from discontinued operations before income taxes ....... 693 (395) (52,727) (4,860) 188,227

Provision (benefit) for income taxes ............................. 243 (138) (20,548) (1,646) 130,536

Income (loss) from discontinued operations ................... 450 (257) (32,179) (3,214) 57,691

Net Income (loss) ........................................ $ 47,846 $ (57,919) $ (158,804) $ 43,882 $ 50,106

Basic earnings per common share:

Income (loss) from continuing operations ..................... $ .31 $ (.40) $ (.93) $ .33 $ (.06)

Income (loss) from discontinued operations ................... $ — $ — $ (.23) $ (.02) $ .43

Net income (loss) ........................................ $ .31 $ (.40) $ (1.15) $ .31 $ .37

Diluted earnings per common share:

Income (loss) from continuing operations ..................... $ .30 $ (.40) $ (.92) $ .31 $ (.06)

Income (loss) from discontinued operations ................... $ — $ — $ (.23) $ (.02) $ .43

Net income (loss) ........................................ $ .30 $ (.40) $ (1.15) $ .29 $ .37

Weighted average common shares:

Basic .................................................. 154,325 143,194 138,384 140,402 135,880

Diluted ................................................ 158,413 143,194 138,384 153,530 135,880

CONSOLIDATED BALANCE SHEET DATA:

Working capital ............................................. $ 578,862 $ 546,169 $ 503,952 $ 345,097 $ 388,061

Total assets ................................................. $2,143,100 $2,135,701 $2,147,677 $2,350,744 $2,521,211

Long-term debt, less current portion ............................. $ 359,250 $ 493,330 $ 593,103 $ 204,238 $ 394,498

Shareholders’ equity ......................................... $1,163,565 $1,071,610 $ 990,586 $1,204,434 $1,128,559

Cash dividends (per share) ..................................... $ — $ — $ — $ — $ 8.00

* The year ended February 3, 2007 includes an extra week, creating a 53-week fiscal year that occurs every six years in the accounting

cycle.

19