Saks Fifth Avenue 2010 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2010 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAKS INCORPORATED & SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(In thousands, except per share amounts)

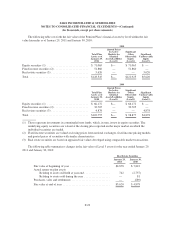

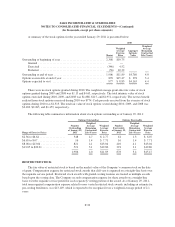

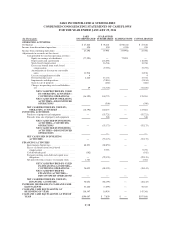

A summary of restricted stock awards for the year ended January 29, 2011 is presented below:

2010

Shares

Weighted

Average

Grant

Price

Outstanding at beginning of year ............................... 4,792 $ 8.68

Granted ............................................... 1,096 7.65

Vested ................................................ (313) 19.62

Forfeited .............................................. (198) 7.65

Outstanding at end of year .................................... 5,377 $ 7.87

The Company granted restricted stock awards of 1,096, 2,351, and 2,184 shares to certain employees in

2010, 2009, and 2008, respectively. The weighted-average grant-date fair value of restricted stock awards

granted in 2010, 2009, and 2008 was $7.65, $2.99, and $12.79, respectively. The total fair value of restricted

stock that vested in 2010, 2009, and 2008 was $6,134, $3,940, and $2,059.

PERFORMANCE SHARES

Under the equity incentive plan, the Company may grant performance share awards that vest based on the

outcome of certain performance criteria that are established and approved by the HRCC of the Board of

Directors. The actual number of performance shares earned is based on the level of performance achieved over

the performance period, typically one year from the grant date, relative to established financial and operating

goals, none of which are considered market conditions. The amount of shares that can be earned ranges from 0%

to 100% of the number of performance share awards granted. In addition to the performance criteria,

performance shares do not vest unless employees remain employed by the Company during the requisite service

period, which is typically three years from the grant date. The fair value of the performance share awards is

based on the market value of the Company’s common stock on the date of grant. Compensation expense for the

performance shares that cliff vest is expensed on a straight-line basis over the requisite service period. As of

January 29, 2011, total unrecognized compensation expense related to non-vested performance share awards,

including an estimate for pre-vesting forfeitures, was $3,199, which is expected to be recognized over a

weighted-average period of 2.0 years.

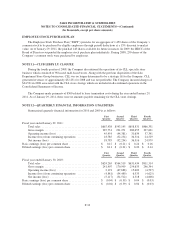

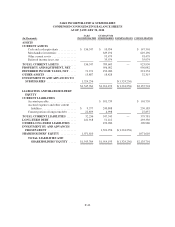

A summary of performance share awards for the year ended January 29, 2011 is presented below:

2010

Shares

Weighted

Average

Grant

Price

Outstanding at beginning of year ............................... 1,649 $ 7.66

Granted ............................................... 503 7.20

Vested ................................................ (462) 19.87

Forfeited .............................................. (33) 8.86

Outstanding at end of year .................................... 1,657 $ 4.08

The Company granted performance share awards of 503, 1,112, and 816 to certain employees in 2010, 2009,

and 2008, respectively. The weighted-average grant-date fair value of performance share awards granted in 2010,

2009, and 2008 was $7.20, $2.36, and $13.04, respectively. The total fair value of performance share awards that

vested in 2010, 2009, and 2008 was $9,186, $134, and $2,631, respectively.

F-33