Quest Diagnostics 2010 Annual Report Download - page 99

Download and view the complete annual report

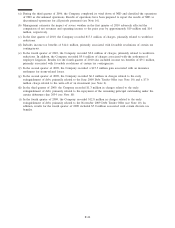

Please find page 99 of the 2010 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.kits. The complaint alleges that certain of NID’s test kits were defective and that defendants, among other things,

violated RICO and state consumer protection laws. The complaint alleges an unspecified amount of damages.

In August 2010, a shareholder derivative action was filed in the Superior Court of New Jersey, Morris

County, on behalf of the Company against the directors and certain present officers of the Company. The

complaint alleges that the defendants breached their fiduciary duties in connection with, among other things,

alleged overcharges by the Company to MediCal for testing services, and seeks unspecified compensatory

damages and equitable relief.

In November 2010, a putative class action was filed against the Company and certain present and former

officers of the Company in the Superior Court of New Jersey, Essex County, on behalf of the Company’s sales

people nationwide who were over forty years old and who either resigned or were terminated after being placed

on a performance improvement plan. The complaint alleges that the defendants’ conduct violates the New Jersey

Law Against Discrimination, and seeks, among other things, unspecified damages. The defendants removed the

complaint to the United States District Court for the District of New Jersey.

In addition, the Company and certain of its subsidiaries have received subpoenas from state agencies in five

states and from the Office of Inspector General of the U.S. Department of Health and Human Services which

seek documents relating to the Company’s billing practices. The Company is cooperating with the requests.

The federal or state governments may bring claims based on new theories as to the Company’s practices

which management believes to be in compliance with law. In addition, certain federal and state statutes, including

the qui tam provisions of the federal False Claims Act, allow private individuals to bring lawsuits against

healthcare companies on behalf of government or private payers. The Company is aware of certain pending

individual or class action lawsuits, and has received several subpoenas, related to billing practices filed under the

qui tam provisions of the Civil False Claims Act and/or other federal and state statutes, regulations or other laws.

The Company understands that there may be other pending qui tam claims brought by former employees or other

“whistleblowers” as to which the Company cannot determine the extent of any potential liability.

Several of these matters are in their early stages of development and involve responding to and cooperating

with various government investigations and related subpoenas. While the Company believes that at least a

reasonable possibility exists that losses may have been incurred, based on the nature and status of the

investigations, the losses are either currently not probable or a range of loss cannot be reasonably estimated.

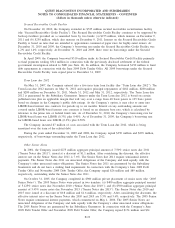

Management has established reserves in accordance with generally accepted accounting principles for the

matters discussed above. Such reserves totaled approximately $10 million as of December 31, 2010. Management

cannot predict the outcome of such matters. Although management does not anticipate that the ultimate outcome

of such matters will have a material adverse effect on the Company’s financial condition, the outcome may be

material to the Company’s results of operations or cash flows in the period in which the impact of such matters

is determined or paid.

As a general matter, providers of clinical testing services may be subject to lawsuits alleging negligence or

other similar legal claims. These suits could involve claims for substantial damages. Any professional liability

litigation could also have an adverse impact on the Company’s client base and reputation. The Company

maintains various liability insurance coverages for, among other things, claims that could result from providing,

or failing to provide, clinical testing services, including inaccurate testing results, and other exposures. The

Company’s insurance coverage limits its maximum exposure on individual claims; however, the Company is

essentially self-insured for a significant portion of these claims. Reserves for such matters, including those

associated with both asserted and incurred but not reported claims, are established by considering actuarially

determined losses based upon the Company’s historical and projected loss experience. Such reserves totaled

approximately $130 million and $135 million as of December 31, 2010 and 2009, respectively. Management

believes that established reserves and present insurance coverage are sufficient to cover currently estimated

exposures. Management cannot predict the outcome of any claims made against the Company. Although

management does not anticipate that the ultimate outcome of any such proceedings or claims will have a material

adverse effect on the Company’s financial condition, the outcome may be material to the Company’s results of

operations or cash flows in the period in which the impact of such claims is determined or paid.

F-33

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)