Quest Diagnostics 2010 Annual Report Download - page 75

Download and view the complete annual report

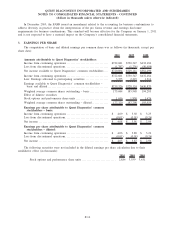

Please find page 75 of the 2010 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.related healthcare programs are funded by federal and state governments, and payment is primarily dependent on

submitting appropriate documentation. As of December 31, 2010 and 2009, receivables due from government

payers under the Medicare and Medicaid programs represent approximately 16% and 12%, respectively, of the

Company’s consolidated net accounts receivable. See Note 15 for a discussion regarding certain amounts due

from MediCal, the California Medicaid program. The portion of the Company’s accounts receivable due from

patients comprises the largest portion of credit risk. At both December 31, 2010 and 2009, receivables due from

patients represent approximately 19% of the Company’s consolidated net accounts receivable. The Company

applies assumptions and judgments including historical collection experience for assessing collectibility and

determining allowances for doubtful accounts for accounts receivable from patients.

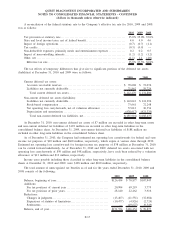

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are reported at realizable value, net of allowances for doubtful accounts, which is

estimated and recorded in the period the related revenue is recorded. The Company has a standardized approach

to estimate and review the collectibility of its receivables based on a number of factors, including the period they

have been outstanding. Historical collection and payer reimbursement experience is an integral part of the

estimation process related to allowances for doubtful accounts. In addition, the Company regularly assesses the

state of its billing operations in order to identify issues which may impact the collectibility of these receivables

or reserve estimates. Revisions to the allowances for doubtful accounts estimates are recorded as an adjustment to

bad debt expense within selling, general and administrative expenses. Receivables deemed to be uncollectible are

charged against the allowance for doubtful accounts at the time such receivables are written-off. Recoveries of

receivables previously written-off are recorded as credits to the allowance for doubtful accounts.

Inventories

Inventories, which consist principally of testing supplies and reagents, are valued at the lower of cost (first

in, first out method) or market.

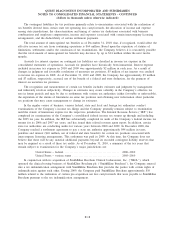

Property, Plant and Equipment

Property, plant and equipment is recorded at cost. Major renewals and improvements are capitalized, while

maintenance and repairs are expensed as incurred. Costs incurred for computer software developed or obtained

for internal use are capitalized for application development activities and expensed as incurred for preliminary

project activities and post-implementation activities. Capitalized costs include external direct costs of materials

and services consumed in developing or obtaining internal-use software, payroll and payroll-related costs for

employees who are directly associated with and who devote time to the internal-use software project, and interest

costs incurred, when material, while developing internal-use software. Capitalization of such costs ceases when

the project is substantially complete and ready for its intended purpose. Certain costs, such as maintenance and

training, are expensed as incurred. The Company capitalizes interest on borrowings during the active construction

period of major capital projects. Capitalized interest is added to the cost of the underlying assets and is amortized

over the expected useful lives of the assets. Depreciation and amortization are provided on the straight-line

method over expected useful asset lives as follows: buildings and improvements, ranging from ten to thirty years;

laboratory equipment and furniture and fixtures, ranging from three to seven years; leasehold improvements, the

lesser of the useful life of the improvement or the remaining life of the building or lease, as applicable; and

computer software developed or obtained for internal use, ranging from three to seven years.

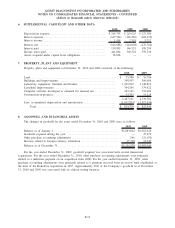

Goodwill

Goodwill arising from acquisitions completed prior to January 1, 2009 represents the cost of acquired

businesses in excess of the fair value of assets acquired, including separately recognized intangible assets, less the

fair value of liabilities assumed in a business combination. On January 1, 2009, the Company adopted a new

accounting standard related to business combinations using the acquisition method. Goodwill arising from

acquisitions completed on or after January 1, 2009 represents the excess of the fair value of the acquiree

(including the fair value of non-controlling interests) over the recognized bases of the net identifiable assets

F-9

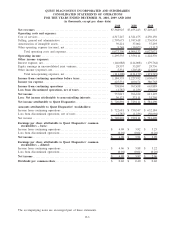

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)