Quest Diagnostics 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dividends

During each of the quarters of 2010 and 2009, our Board of Directors declared a quarterly cash dividend of

$0.10 per common share. We expect to fund future dividend payments with cash flows from operations, and do

not expect the dividend to have a material impact on our ability to finance future growth.

Share Repurchases

For the year ended December 31, 2010, we repurchased 14.7 million shares of our common stock at an

average price of $51.04 per share for $750 million, including 4.5 million shares purchased in the first quarter at

an average price of $56.21 per share for $251 million under an accelerated share repurchase transaction with a

bank. For the year ended December 31, 2009, we repurchased 10 million shares of our common stock at an

average price of $49.83 per share for $500 million, including 4.5 million shares repurchased from SB Holdings

Capital Inc., a wholly-owned subsidiary of GlaxoSmithKline plc. (“GSK”), at an average price of $44.33 per

share for $200 million. For the years ended December 31, 2010 and 2009, we reissued 2.1 million shares and 3.0

million shares, respectively, for employee benefit plans. Since the inception of our share repurchase program in

May 2003, we have repurchased approximately 74 million shares of our common stock at an average price of

$47.13 for $3.5 billion. At December 31, 2010, $250 million of our share repurchase authorization remained

available. In January 2011, our Board of Directors authorized $750 million of additional share repurchases,

bringing the total available under share repurchase authorizations, which have no set expiration or termination

date, to $1 billion.

On January 31, 2011, we agreed to repurchase 15.4 million shares of our common stock from SB Holdings

Capital Inc., an affiliate of GSK, at a purchase price of $54.30 per share for $835 million (the “Repurchase”).

We funded the Repurchase, which closed on February 4, 2011, with $260 million of cash on-hand, $500 million

of borrowings under our secured receivables credit facility and $75 million of borrowings under our senior

unsecured revolving credit facility. Subsequent to the Repurchase, our remaining share repurchase authorization

totaled $165 million.

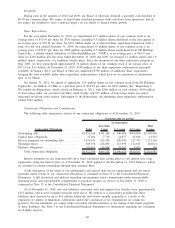

Contractual Obligations and Commitments

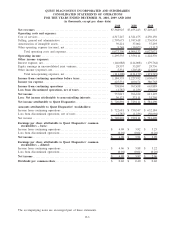

The following table summarizes certain of our contractual obligations as of December 31, 2010.

Contractual Obligations Total

Less than

1 year 1–3 years 3–5 years

After

5 years

(in thousands)

Payments due by period

Outstanding debt................................ $2,951,268 $341,268 $ 560,000 $500,000 $1,550,000

Capital lease obligations......................... 47,184 7,736 14,877 11,016 13,555

Interest payments on outstanding debt............ 1,676,941 126,786 220,046 217,743 1,112,366

Operating leases ................................ 645,358 174,094 217,939 112,651 140,674

Purchase obligations . . . ......................... 91,613 49,444 33,162 8,621 386

Total contractual obligations ................ $5,412,364 $699,328 $1,046,024 $850,031 $2,816,981

Interest payments on our long-term debt have been calculated after giving effect to our interest rate swap

agreements, using the interest rates as of December 31, 2010 applied to the December 31, 2010 balances, which

are assumed to remain outstanding through their maturity dates.

A full description of the terms of our indebtedness and related debt service requirements and our future

payments under certain of our contractual obligations is contained in Note 10 to the Consolidated Financial

Statements. A full discussion and analysis regarding our minimum rental commitments under noncancelable

operating leases and noncancelable commitments to purchase product or services at December 31, 2010 is

contained in Note 15 to the Consolidated Financial Statements.

As of December 31, 2010, our total liabilities associated with unrecognized tax benefits were approximately

$152 million, which were excluded from the table above. We believe it is reasonably possible that these

liabilities may decrease by up to $14 million within the next twelve months, primarily as a result of the

expiration of statutes of limitations, settlements and/or the conclusion of tax examinations on certain tax

positions. For the remainder, we cannot make reasonably reliable estimates of the timing of the future payments

of these liabilities. See Note 5 to the Consolidated Financial Statements for information regarding our contingent

tax liability reserves.

60