Quest Diagnostics 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

million, respectively, outstanding under the Senior Notes due 2010. In November 2010, the remaining outstanding

principal balance of the Senior Notes due 2010 of $166 million were repaid in full at maturity.

On June 22, 2007, the Company completed an $800 million senior notes offering (the “2007 Senior Notes”).

The 2007 Senior Notes were priced in two tranches: (a) $375 million aggregate principal amount of 6.40% senior

notes due July 2017 (the “Senior Notes due 2017”), issued at a discount of $0.8 million and (b) $425 million

aggregate principal amount of 6.95% senior notes due July 2037 (the “Senior Notes due 2037”), issued at a

discount of $4.7 million. After considering the discounts, the effective interest rates on the Senior Notes due

2017 and the Senior Notes due 2037 are 6.4% and 7.0%, respectively. The 2007 Senior Notes require semiannual

interest payments, which commenced on January 1, 2008. The 2007 Senior Notes are unsecured obligations of

the Company and rank equally with the Company’s other unsecured obligations. The 2007 Senior Notes do not

have a sinking fund requirement and are guaranteed by the Subsidiary Guarantors.

The Company incurred $6.3 million of costs associated with the 2007 Senior Notes, which is being

amortized over the term of the related debt.

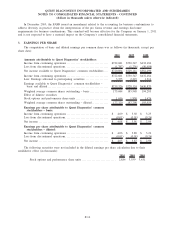

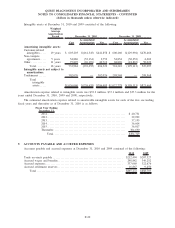

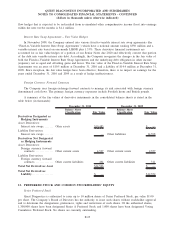

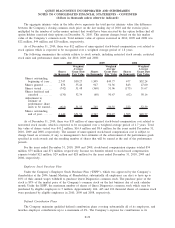

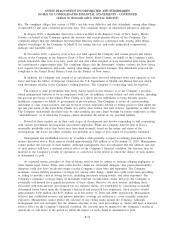

As of December 31, 2010, long-term debt maturing in each of the years subsequent to December 31, 2011 is

as follows:

Year ending December 31,

2012 ...................................................................... $ 567,668

2013 ...................................................................... 7,209

2014 ...................................................................... 6,792

2015 ...................................................................... 504,224

2016 ...................................................................... 505

Thereafter . . . .............................................................. 1,563,023

Total maturities of long-term debt .......................................... 2,649,421

Unamortized discount . ..................................................... (18,744)

Fair value basis adjustment attributable to hedged debt....................... 10,483

Total long-term debt, net of current portion............................. $2,641,160

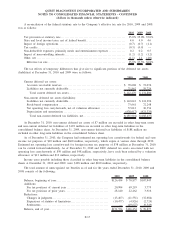

11. FINANCIAL INSTRUMENTS

Interest Rate Swap Agreements – Cash Flow Hedges

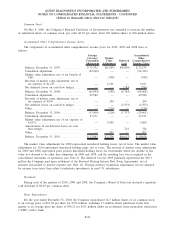

During the third quarter of 2009, the Company entered into various forward starting interest rate swap

agreements (the “Forward Starting Interest Rate Swap Agreements”) for an aggregate notional amount of $400

million. The Forward Starting Interest Rate Swap Agreements had fixed interest rates ranging from 4.120% to

4.575%. The Forward Starting Interest Rate Swap Agreements were 17 to 18 month forward agreements that

covered a ten-year hedging period and were entered into to hedge part of the Company’s interest rate exposure

associated with forecasted new debt issuances related to the refinancing of certain debt maturing through 2011. In

connection with the issuance of our 2009 Senior Notes, the Forward Starting Interest Rate Swap Agreements

were terminated and the Company paid $10.5 million, representing the losses on the settlement of the Forward

Starting Interest Rate Swap Agreements, which have been accounted for as cash flow hedges. These losses are

deferred in stockholders’ equity, net of taxes, as a component of accumulated other comprehensive income (loss),

and amortized as an adjustment to interest expense over the term of the Senior Notes due 2020.

Prior to their maturity or settlement, the Company records derivative financial instruments, which have been

designated as cash flow hedges, as either an asset or liability measured at its fair value. The effective portion of

changes in the fair value of these derivatives represent deferred gains or losses that are recorded in accumulated

other comprehensive income (loss). These deferred gains or losses are reclassified from accumulated other

comprehensive income (loss) to the statement of operations in the same period or periods during which the

hedged transaction affects earnings, which is when the Company recognizes interest expense on the hedged cash

flows. The total net loss, net of taxes, recognized in accumulated other comprehensive income (loss), related to

the Company’s cash flow hedges as of December 31, 2010 and December 31, 2009 was $6.6 million and $7.3

million, respectively. The loss recognized on the Company’s cash flow hedges for the years ended December 31,

2010, 2009 and 2008, as a result of ineffectiveness, was not material. The net amount of deferred losses on cash

F-24

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)