Quest Diagnostics 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

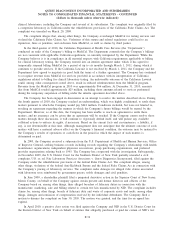

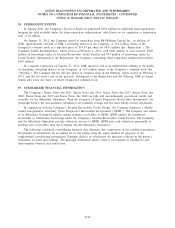

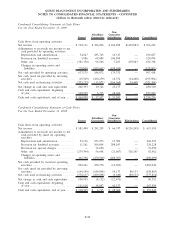

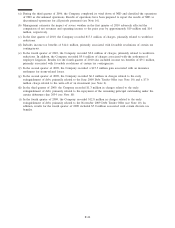

(a) During the third quarter of 2006, the Company completed its wind down of NID and classified the operations

of NID as discontinued operations. Results of operations have been prepared to report the results of NID as

discontinued operations for all periods presented (see Note 16).

(b) Management estimates the impact of severe weather in the first quarter of 2010 adversely affected the

comparison of net revenues and operating income to the prior year by approximately $19 million and $14

million, respectively.

(c) In the first quarter of 2010, the Company recorded $17.3 million of charges, primarily related to workforce

reductions.

(d) Includes income tax benefits of $14.4 million, primarily associated with favorable resolutions of certain tax

contingencies.

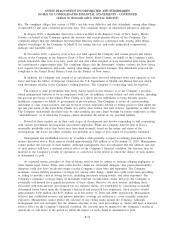

(e) In the fourth quarter of 2010, the Company recorded $9.6 million of charges, primarily related to workforce

reductions. In additon, the Company recorded $9.6 million of charges associated with the settlement of

employee litigation. Results for the fourth quarter of 2010 also included income tax benefits of $9.1 million,

primarily associated with favorable resolutions of certain tax contingencies.

(f) In the second quarter of 2009, the Company recorded a $15.5 million gain associated with an insurance

settlement for storm-related losses.

(g) In the second quarter of 2009, the Company recorded $6.3 million in charges related to the early

extinguishment of debt, primarily related to the June 2009 Debt Tender Offer (see Note 10) and a $7.0

million charge related to the write-off of an investment (see Note 2).

(h) In the third quarter of 2009, the Company recorded $1.3 million in charges related to the early

extinguishment of debt, primarily related to the repayment of the remaining principal outstanding under the

certain debentures due 2034 (see Note 10).

(i) In the fourth quarter of 2009, the Company recorded $12.8 million in charges related to the early

extinguishment of debt, primarily related to the November 2009 Debt Tender Offer (see Note 10). In

addition, results for the fourth quarter of 2009 included $7.0 million associated with certain discrete tax

benefits.

F-42