Quest Diagnostics 2010 Annual Report Download - page 96

Download and view the complete annual report

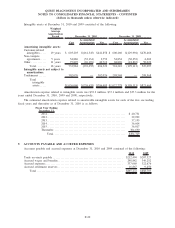

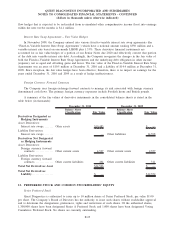

Please find page 96 of the 2010 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.defined contribution plans aggregated $79 million, $82 million and $78 million for 2010, 2009 and 2008,

respectively.

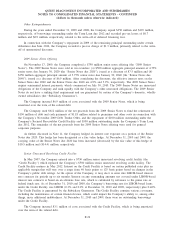

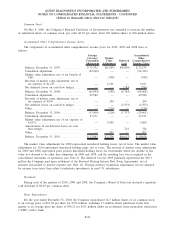

Supplemental Deferred Compensation Plans

The Company’s supplemental deferred compensation plan is an unfunded, non-qualified plan that provides

for certain management and highly compensated employees to defer up to 50% of their salary in excess of their

defined contribution plan limits and for certain eligible employees, up to 95% of their variable incentive

compensation. The Company matches employee contributions up to a maximum of 6%. The compensation

deferred under this plan, together with Company matching amounts, are credited with earnings or losses measured

by the mirrored rate of return on investments elected by plan participants. Each plan participant is fully vested in

all deferred compensation, Company match and earnings credited to their account. The amounts accrued under

this plan were $39 million and $34 million at December 31, 2010 and 2009, respectively. Although the Company

is currently contributing all participant deferrals and matching amounts to a trust, the funds in the trust, totaling

$39 million and $34 million at December 31, 2010 and 2009, respectively, are general assets of the Company

and are subject to any claims of the Company’s creditors.

The Company also offers certain employees the opportunity to participate in a non-qualified deferred

compensation program. Eligible participants are allowed to defer up to 20 thousand dollars of eligible

compensation per year. The Company matches employee contributions equal to 25%, up to a maximum of 5

thousand dollars per plan year. A participant’s deferrals, together with Company matching credits, are “invested”

at the direction of the employee in a hypothetical portfolio of investments which are tracked by an administrator.

Each participant is fully vested in their deferred compensation and vest in Company matching contributions over

a four-year period at 25% per year. The amounts accrued under this plan were $23 million and $20 million at

December 31, 2010 and 2009, respectively. The Company purchases life insurance policies, with the Company

named as beneficiary of the policies, for the purpose of funding the program’s liability. The cash surrender value

of such life insurance policies was $20 million and $16 million at December 31, 2010 and 2009, respectively.

For the years ended December 31, 2010, 2009 and 2008, the Company’s expense for matching contributions

to these plans was $1.6 million, $0.8 million and $1.0 million, respectively.

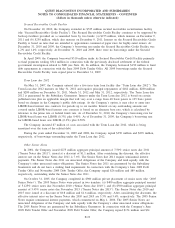

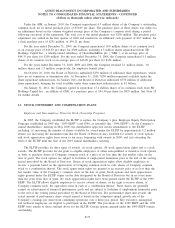

14. RELATED PARTY TRANSACTIONS

At December 31, 2010, GSK beneficially owned approximately 18% of the outstanding shares of Quest

Diagnostics common stock. On January 31, 2011, the Company agreed to repurchase from SB Holdings Capital

Inc., an affiliate of GSK, approximately one-half of GSK’s ownership interest in the Company, or 15.4 million

shares of the Company’s common stock. In a separate transaction on January 31, 2011, GSK agreed to sell in an

underwritten offering to the public, its remaining ownership interest in the Company, or 15.4 million shares of

the Company’s common stock. Subsequent to these transactions, GSK no longer beneficially owns any shares of

Quest Diagnostics common stock. See Note 18 for further details.

Quest Diagnostics is the primary provider of testing to support GSK’s clinical trials testing requirements

under a worldwide agreement (the “Clinical Trials Agreement”). Net revenues, primarily derived under the

Clinical Trials Agreement were $63 million, $72 million and $71 million for 2010, 2009 and 2008, respectively.

At December 31, 2010 and 2009, accounts receivable due from GSK were $15.7 million and $17.3 million,

respectively.

During 2009, the Company paid SmithKline Beecham approximately $10 million related to the realization of

certain pre-acquisition net loss carryforwards that were payable to SmithKline Beecham pursuant to a tax

indemnification arrangement. Amounts due to GSK at December 31, 2010 and 2009 were not material.

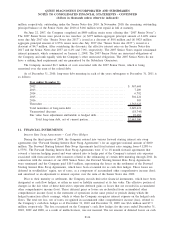

15. COMMITMENTS AND CONTINGENCIES

Letter of Credit Lines and Contractual Obligations

The Company has a line of credit with a financial institution totaling $85 million for the issuance of letters

of credit (the “Letter of Credit Line”). The Letter of Credit Line, which is renewed annually, matures on

November 19, 2011 and is guaranteed by the Subsidiary Guarantors.

F-30

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)