Quest Diagnostics 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other Extinguishments

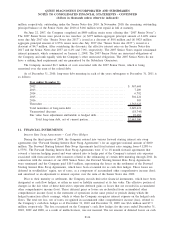

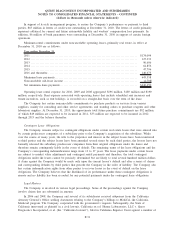

During the years ended December 31, 2009 and 2008, the Company repaid $350 million and $293 million,

respectively, of borrowings outstanding under the Term Loan due 2012 and recorded pre-tax losses of $0.7

million and $0.9 million, respectively, related to the write-off of deferred financing fees.

In connection with the Company’s repayment in 2009 of the remaining principal outstanding under certain

debentures due June 2034, the Company recorded a pre-tax charge of $1.3 million, primarily related to the write-

off of unamortized discounts.

2009 Senior Notes Offering

On November 17, 2009, the Company completed a $750 million senior notes offering (the “2009 Senior

Notes”). The 2009 Senior Notes were sold in two tranches: (a) $500 million aggregate principal amount of 4.75%

senior notes due January 30, 2020 (the “Senior Notes due 2020”), issued at a discount of $7.5 million and (b)

$250 million aggregate principal amount of 5.75% senior notes due January 30, 2040 (the “Senior Notes due

2040”), issued at a discount of $6.9 million. After considering the discounts, the effective interest rates on the

Senior Notes due 2020 and the Senior Notes due 2040 are 4.9% and 5.9%, respectively. The 2009 Senior Notes

require semiannual interest payments, which commenced on July 30, 2010. The 2009 Senior Notes are unsecured

obligations of the Company and rank equally with the Company’s other unsecured obligations. The 2009 Senior

Notes do not have a sinking fund requirement and are guaranteed by certain of the Company’s domestic, wholly-

owned subsidiaries (the “Subsidiary Guarantors”).

The Company incurred $6.9 million of costs associated with the 2009 Senior Notes, which is being

amortized over the term of the related debt.

The Company used $612 million of the net proceeds from the 2009 Senior Notes to fund the retirement of

$150 million of debt and cash payments of $11.8 million related to premiums and other costs in connection with

the Company’s November 2009 Debt Tender Offer, and the repayment of $100 million outstanding under the

Company’s Secured Receivables Credit Facility and $350 million outstanding under the Company’s Term Loan

due 2012. The remainder of the net proceeds from the 2009 Senior Notes offering were used for general

corporate purposes.

As further discussed in Note 11, the Company hedged its interest rate exposure on a portion of the Senior

Notes due 2020. This hedge has been designated as a fair value hedge. At December 31, 2010 and 2009, the

carrying value of the Senior Notes due 2020 has been increased (decreased) by the fair value of this hedge of

$10.5 million and ($14.4) million, respectively.

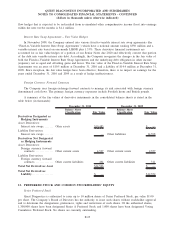

Senior Unsecured Revolving Credit Facility

In May 2007, the Company entered into a $750 million senior unsecured revolving credit facility (the

“Credit Facility”) which replaced the Company’s $500 million senior unsecured revolving credit facility. The

Credit Facility matures in May 2012. Interest on the Credit Facility is based on certain published rates plus an

applicable margin that will vary over a range from 40 basis points to 125 basis points based on changes in the

Company’s public debt ratings. At the option of the Company, it may elect to enter into LIBOR-based interest

rate contracts for periods up to six months. Interest on any outstanding amounts not covered under LIBOR-based

interest rate contracts is based on an alternate base rate, which is calculated by reference to the prime rate or

federal funds rate. As of December 31, 2010 and 2009, the Company’s borrowing rate for LIBOR-based loans

under the Credit Facility was LIBOR (0.3% and 0.2% at December 31, 2010 and 2009, respectively) plus 0.40%.

The Credit Facility is guaranteed by the Subsidiary Guarantors. The Credit Facility contains various covenants,

including the maintenance of certain financial ratios, which could impact the Company’s ability to, among other

things, incur additional indebtedness. At December 31, 2010 and 2009, there were no outstanding borrowings

under the Credit Facility.

The Company incurred $3.1 million of costs associated with the Credit Facility, which is being amortized

over the term of the related debt.

F-22

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)