Quest Diagnostics 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

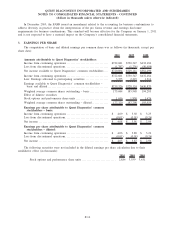

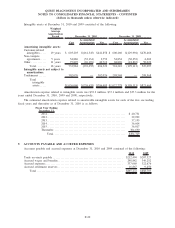

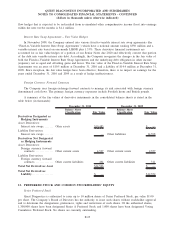

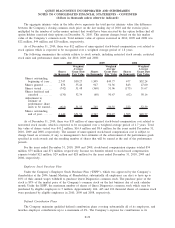

6. SUPPLEMENTAL CASH FLOW AND OTHER DATA

2010 2009 2008

Depreciation expense ............................................ $ 214,743 $ 219,625 $ 227,300

Interest expense ................................................. (147,502) (146,586) (185,476)

Interest income. ................................................. 1,414 2,518 5,712

Interest, net ..................................................... (146,088) (144,068) (179,764)

Interest paid . . . ................................................. 139,802 146,352 189,294

Income taxes paid ............................................... 421,864 362,524 359,336

Assets acquired under capital lease obligations .................... 18,818 — —

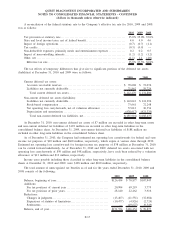

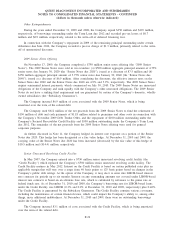

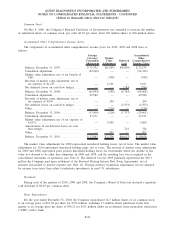

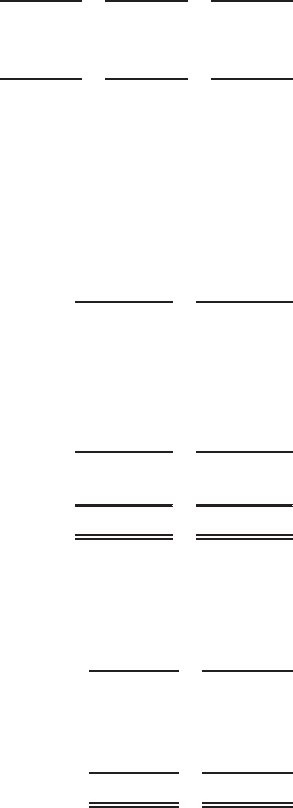

7. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment at December 31, 2010 and 2009 consisted of the following:

2010 2009

Land . . .................................................................. $ 35,786 $ 35,786

Buildings and improvements.............................................. 369,507 360,684

Laboratory equipment, furniture and fixtures .............................. 1,207,049 1,140,862

Leasehold improvements . ................................................ 394,296 374,922

Computer software developed or obtained for internal use.................. 427,161 376,004

Construction-in-progress . . ................................................ 53,392 51,124

2,487,191 2,339,382

Less: accumulated depreciation and amortization........................... (1,652,815) (1,513,436)

Total ............................................................... $ 834,376 $ 825,946

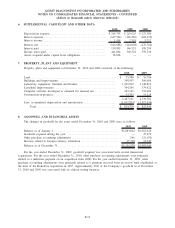

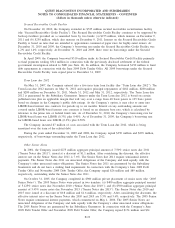

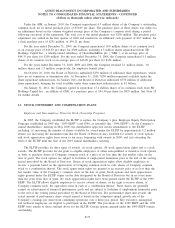

8. GOODWILL AND INTANGIBLE ASSETS

The changes in goodwill for the years ended December 31, 2010 and 2009 were as follows:

2010 2009

Balance as of January 1 . . ................................................. $5,083,944 $5,054,926

Goodwill acquired during the year . ........................................ — 25,973

Other purchase accounting adjustments ..................................... 246 (21,195)

Increase related to foreign currency translation .............................. 17,748 24,240

Balance as of December 31 ................................................ $5,101,938 $5,083,944

For the year ended December 31, 2009, goodwill acquired was associated with several immaterial

acquisitions. For the year ended December 31, 2010, other purchase accounting adjustments were primarily

related to a milestone payment on an acquisition from 2008. For the year ended December 31, 2009, other

purchase accounting adjustments were primarily related to a payment received from an escrow fund established at

the time of the HemoCue acquisition in 2007. Approximately 90% of the Company’s goodwill as of December

31, 2010 and 2009 was associated with its clinical testing business.

F-19

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)