Quest Diagnostics 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

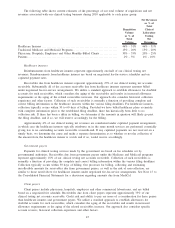

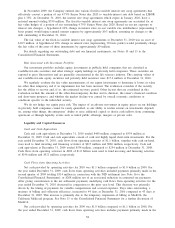

Operating Costs and Expenses

$

% Net

Revenues $

% Net

Revenues $

% Net

Revenues

2009 2008

Change

Increase

(decrease)

(dollars in millions)

Cost of services................................ $4,321.5 58.0% $4,256.2 58.7% $65.3 (0.7)%

Selling, general and administrative expenses

(SG&A) . . ................................... 1,747.6 23.4% 1,736.9 24.0% 10.7 (0.6)%

Amortization of intangible assets................ 37.0 0.5% 37.3 0.5% (0.3) —

Other operating expense (income), net. . . ........ (10.0) (0.1)% (3.3) (0.1)% (6.7) —

Total operating costs and expenses .............. $6,096.1 81.8% $6,027.1 83.1% $69.0 (1.3)%

Bad debt expense (included in SG&A) . . ........ $ 321.0 4.3% $ 326.2 4.5% $ (5.2) (0.2)%

Total Operating Costs and Expenses

Total operating costs and expenses for the year ended December 31, 2009 increased from the prior year and

decreased as a percentage of net revenues due to actions we have taken to improve our operating efficiency and

reduce the size of our workforce, along with discrete cost containment actions taken during 2009 which have

enabled us to realize modest cost increases on increased net revenues. These efforts, coupled with higher revenue

per requisition, served to reduce operating costs and expenses as a percentage of net revenues. In addition, results

for the year ended December 31, 2009 include a $15.5 million second quarter gain related to an insurance

settlement for storm-related losses while results for the year ended December 31, 2008 include fourth quarter

charges of $16.2 million, primarily associated with workforce reductions ($7.7 million included in cost of services

and $8.5 million included in selling, general and administrative).

Also, year-over-year comparisons were adversely impacted by approximately $18 million associated with

gains and losses on investments in our supplemental deferred compensation plans. The impact can fluctuate

significantly from year to year based on investment performance. Under our supplemental deferred compensation

plans, employee compensation deferrals, together with Company matching contributions, are invested in a variety

of participant-directed investments held in trusts. Gains and losses associated with the investments are recorded in

earnings within other income (expense), net. A corresponding and offsetting adjustment is also recorded to the

deferred compensation obligation to reflect investment gains and losses earned by employees. Such adjustments to

the deferred compensation obligation are recorded in earnings, principally within selling, general and

administrative expenses, and offset the amount of investment gains and losses recorded in other income

(expense), net. Results for 2009 included an increase in operating costs of $8.4 million, representing an increase

in the deferred compensation obligation to reflect investment gains earned by employees participating in our

deferred compensation plans. Results for 2008 included a reduction in operating costs of $9.9 million,

representing a decrease in the deferred compensation obligation to reflect investment losses incurred by

employees participating in our deferred compensation plans.

Cost of Services

Cost of services decreased as a percentage of net revenues for the year ended December 31, 2009 compared

to the prior year due to actions taken to reduce our cost structure and higher revenue per requisition.

Selling, General and Administrative Expenses

Selling, general and administrative expenses decreased as a percentage of net revenues for the year ended

December 31, 2009 compared to prior year primarily due to actions taken to reduce our cost structure and higher

revenue per requisition. In addition, year-over-year comparisons of selling, general and administrative expenses as

a percentage of net revenues, were adversely impacted by 0.2% associated with investment gains and losses

earned by employees on assets held in trust under our supplemental deferred compensation plans discussed

earlier. Days sales outstanding decreased to 43 days at December 31, 2009 compared to 44 days at December 31,

2008. Continued progress in our billing and collection processes has resulted in stable bad debt and

improvements in days sales outstanding and the cost of our billing operations.

55