Quest Diagnostics 2010 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2010 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

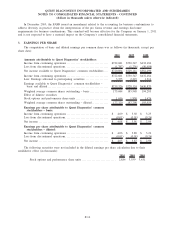

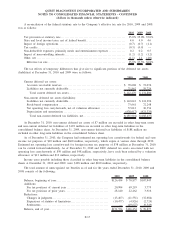

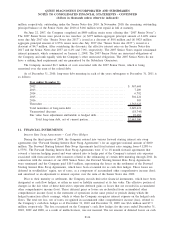

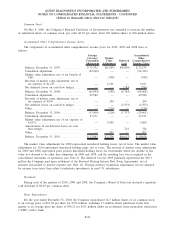

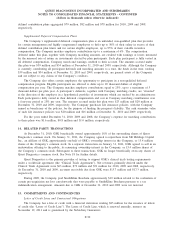

Intangible assets at December 31, 2010 and 2009 consisted of the following:

Cost

Accumulated

Amortization Net Cost

Accumulated

Amortization Net

Weighted

Average

Amortization

Period December 31, 2010 December 31, 2009

Amortizing intangible assets:

Customer-related

intangibles . .... 19 years $ 603,203 $(161,345) $441,858 $ 600,460 $(129,994) $470,466

Non-compete

agreements. .... 5 years 54,886 (52,134) 2,752 54,854 (50,252) 4,602

Other ............ 11 years 75,895 (26,176) 49,719 68,896 (18,867) 50,029

Total ........ 18 years 733,984 (239,655) 494,329 724,210 (199,113) 525,097

Intangible assets not subject to

amortization:

Tradenames . . .... 302,076 — 302,076 298,568 — 298,568

Total

intangible

assets . .... $1,036,060 $(239,655) $796,405 $1,022,778 $(199,113) $823,665

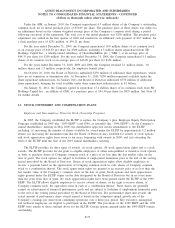

Amortization expense related to intangible assets was $39.2 million, $37.1 million and $37.3 million for the

years ended December 31, 2010, 2009 and 2008, respectively.

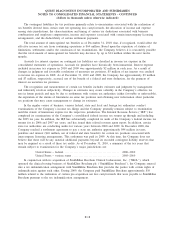

The estimated amortization expense related to amortizable intangible assets for each of the five succeeding

fiscal years and thereafter as of December 31, 2010 is as follows:

Fiscal Year Ending

December 31,

2011.............................................................. $ 40,731

2012.............................................................. 39,092

2013.............................................................. 37,195

2014.............................................................. 36,604

2015.............................................................. 36,017

Thereafter. . . ...................................................... 304,690

Total. . . ...................................................... $494,329

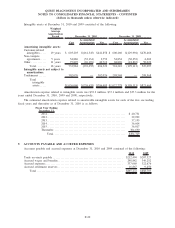

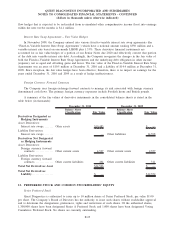

9. ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts payable and accrued expenses at December 31, 2010 and 2009 consisted of the following:

2010 2009

Trade accounts payable ....................................................... $212,494 $207,327

Accrued wages and benefits ................................................... 298,842 349,252

Accrued expenses ............................................................. 337,069 322,676

Accrued settlement reserves ................................................... 16,867 9,450

Total .................................................................... $865,272 $888,705

F-20

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)