Quest Diagnostics 2010 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2010 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The maximum number of shares of Company common stock that may be optioned or granted under the

ELTIP is approximately 53 million shares. In addition, any remaining shares under the 1996 EEPP are available

for issuance under the ELTIP.

In 2005, the Company established the DLTIP, to replace the Company’s prior plan established in 1998. At

the Company’s annual shareholders’ meeting in May 2009, the shareholders approved certain amendments to the

DLTIP including: (i) increasing the number of shares available for award under the DLTIP by 0.4 million shares;

(ii) increasing the maximum term that the Board of Directors may establish for awards of stock options from

seven to ten years, beginning with awards in 2009; and (iii) extending the term of the DLTIP until the date of

the 2019 annual shareholders’ meeting.

The DLTIP provides for the grant to non-employee directors of non-qualified stock options to purchase

shares of Company common stock at a price of no less than the fair market value on the date of grant. The

DLTIP also permits awards of restricted stock and restricted stock units to non-employee directors. Stock options

granted under the DLTIP expire on the date designated by the Board of Directors but in no event more than ten

years from date of grant, and generally become exercisable in three equal annual installments beginning on the

first anniversary date of the grant of the option regardless of whether the optionee remains a director of the

Company. The maximum number of shares that may be issued under the DLTIP is 2.4 million shares. For each

of the years ended December 31, 2010, 2009 and 2008, grants under the DLTIP totaled 77 thousand shares.

In general, the Company’s practice has been to issue shares related to its stock-based compensation program

from shares of its common stock held in treasury. See Note 12 for further information regarding the Company’s

share repurchase program.

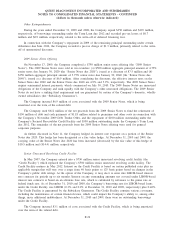

The fair value of each stock option award granted was estimated on the date of grant using a lattice-based

option-valuation model. The expected volatility under the lattice-based option-valuation model was based on the

current and the historical implied volatilities from traded options of the Company’s common stock. The dividend

yield was based on the approved annual dividend rate in effect and current market price of the underlying

common stock at the time of grant. The risk-free interest rate of each stock option granted was based on the U.S.

Treasury yield curve in effect at the time of grant for bonds with maturities ranging from one month to ten

years. The expected holding period of the options granted was estimated using the historical exercise behavior of

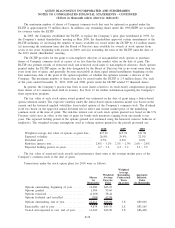

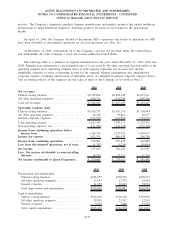

employees. The weighted average assumptions used in valuing options granted in the periods presented are:

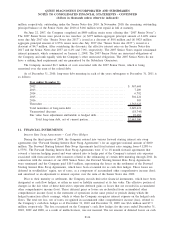

2010 2009 2008

Weighted average fair value of options at grant date . . . $17.60 $15.78 $11.58

Expected volatility . .................................. 26.8% 29.4% 22.5%

Dividend yield ....................................... 0.7% 0.8% 0.8%

Risk-free interest rate. ................................ 2.8% – 3.2% 2.1% – 2.3% 2.6% – 2.8%

Expected holding period, in years ..................... 6.7 – 7.6 6.2 – 7.2 5.2 – 5.9

The fair value of restricted stock awards and performance share units is the average market price of the

Company’s common stock at the date of grant.

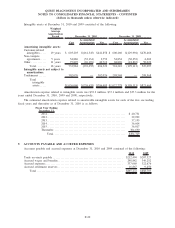

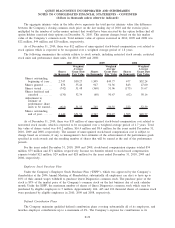

Transactions under the stock option plans for 2010 were as follows:

Shares

(in

thousands)

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Term

(in years)

Aggregate

Intrinsic

Value

(in thousands)

Options outstanding, beginning of year ......... 12,680 $45.19

Options granted ............................... 1,384 55.60

Options exercised ............................. (1,269) 38.44

Options forfeited and cancelled . . .............. (384) 47.98

Options outstanding, end of year . .............. 12,411 $46.96 3.8 $89,666

Exercisable, end of year ....................... 9,834 $45.55 2.8 $83,265

Vested and expected to vest, end of year . . ..... 11,260 $46.50 3.8 $86,468

F-28

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)