Quest Diagnostics 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Comprehensive Income (Loss)

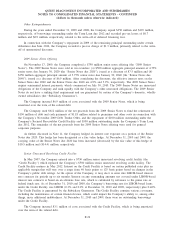

Comprehensive income (loss) encompasses all changes in stockholders’ equity (except those arising from

transactions with stockholders) and includes net income, net unrealized capital gains or losses on available-for-

sale securities, foreign currency translation adjustments and deferred gains and losses related to certain derivative

financial instruments (see Note 11). Total comprehensive income, including the amount attributable to

noncontrolling interests, was $789 million, $813 million and $520 million for the years ended December 31,

2010, 2009 and 2008, respectively.

New Accounting Standards

In October 2009, the Financial Accounting Standards Board (“FASB”) issued an amendment to the

accounting standards related to the accounting for revenue in arrangements with multiple deliverables including

how the arrangement consideration is allocated among delivered and undelivered items of the arrangement. This

standard will become effective for the Company on January 1, 2011 and is not expected to have a material

impact on the Company’s consolidated financial statements.

In October 2009, the FASB issued an amendment to the accounting standards related to certain revenue

arrangements that include software elements. This standard clarifies the existing accounting guidance such that

tangible products that contain both software and non-software components that function together to deliver the

product’s essential functionality, shall be excluded from the scope of the software revenue recognition accounting

standards. This standard will become effective for the Company on January 1, 2011 and is not expected to have

a material impact on the Company’s consolidated financial statements.

In January 2010, the FASB issued an amendment to the accounting standards related to the disclosures about

an entity’s use of fair value measurements. Among these amendments, entities are required to provide separate

disclosures about purchases, sales, issuances and settlements relating to the tabular reconciliation of beginning and

ending balances of the Level 3 (fair value determined based on significant unobservable inputs) classification and

provide greater disaggregation for each class of assets and liabilities that use fair value measurements. The

requirement to provide the enhanced disclosures for Level 3 fair value measurements is effective for the

Company for interim and annual reporting periods beginning after December 31, 2010. The Company does not

expect that the adoption of these new disclosure requirements will have a material impact on its consolidated

financial statements.

In August 2010, the FASB issued an amendment to the accounting standards related to the accounting for

insurance recoveries. This standard clarifies that a healthcare entity may not net insurance recoveries against

related professional claim liabilities in its balance sheet. In addition, this standard also requires that claim

liabilities be determined without consideration of insurance recoveries. This standard will become effective for the

Company on January 1, 2011 and is not expected to have a material impact on the Company’s consolidated

financial statements.

In August 2010, the FASB issued an amendment to the accounting standards related to the financial

statement disclosure of the amount of charity care provided by a healthcare entity. This standard requires that the

cost of performing services be used as the measurement basis for charity care disclosures. This standard will

become effective for the Company on January 1, 2011 and is not expected to have a material impact on the

Company’s consolidated financial statements.

In December 2010, the FASB issued an amendment to the accounting standards related to goodwill which

(1) modifies step one of the goodwill impairment test by requiring entities with reporting units that have a zero

or negative carrying value to assess, whether it is more likely than not that a goodwill impairment exists and (2)

does not prescribe a specific method of calculating the carrying value of a reporting unit in the performance of

step one of the goodwill impairment test. Under the requirements of this standard, if the entity concludes that it

is more likely than not that a goodwill impairment exists, the entity must perform step two of the goodwill

impairment test. In determining whether it is more likely than not that a goodwill impairment exists, an entity

should consider whether there are any adverse qualitative factors indicating that an impairment exists. This

standard will become effective for the Company on January 1, 2011 and is not expected to have a material

impact on the Company’s consolidated financial statements.

F-13

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)