Quest Diagnostics 2008 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2008 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Term and Bridge Loan Credit Facilities

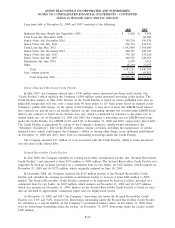

On May 31, 2007, the Company entered into a five-year term loan facility (the “Term Loan due 2012”),

pursuant to which it borrowed $1.6 billion, and a $1.0 billion bridge loan facility (the “Bridge Loan”), pursuant

to which it borrowed $780 million. The Company used the proceeds to finance the acquisition of AmeriPath, and

related transaction costs, to repay substantially all of AmeriPath’s outstanding debt and to repay the $450 million

outstanding under an interim credit facility used to finance the acquisition of HemoCue and repay substantially

all of HemoCue’s outstanding debt.

The Term Loan due 2012 matures on May 31, 2012 and requires principal repayments of 1.25% of the

amount borrowed on the last day of each calendar quarter starting on September 30, 2007, with the quarterly

payments increasing on September 30, 2009 to 2.5% of the amount borrowed and on September 30, 2011 to

17.5% of the amount borrowed, with the remainder of the outstanding balance due on May 31, 2012. The Term

Loan due 2012 is guaranteed by the Subsidiary Guarantors. Interest under the Term Loan due 2012 is based on

certain published rates plus an applicable margin that will vary over a range from 40 basis points to 125 basis

points based on changes in the Company’s public debt ratings. At the Company’s option, it may elect to enter

into LIBOR-based interest rate contracts for periods up to six months. Interest on any outstanding amounts not

covered under LIBOR-based interest rate contracts is based on an alternate base rate, which is calculated by

reference to the prime rate or federal funds rate. As of December 31, 2008 and 2007, the Company’s borrowing

rate for LIBOR-based loans was LIBOR (2.2% and 5.1% at December 31, 2008 and 2007, respectively) plus

0.50%.

The Company incurred $7 million of costs associated with the Term Loan due 2012, which is being

amortized over the term of the related debt.

During the year ended December 31, 2008 and 2007, the Company repaid $293 million and $215 million,

respectively, of borrowings outstanding under the Term Loan due 2012.

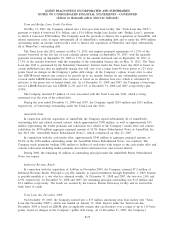

AmeriPath Debt

In connection with the acquisition of AmeriPath, the Company repaid substantially all of AmeriPath’s

outstanding debt and related accrued interest, which approximated $780 million, as well as approximately $31

million representing the tender premium and solicitation fees related to the Company’s tender offer and consent

solicitation for $350 million aggregate principal amount of 10.5% Senior Subordinated Notes of AmeriPath, Inc.

due 2013 (the “AmeriPath Senior Subordinated Notes”), which commenced on May 21, 2007.

In conjunction with the cash tender offer, approximately $348 million in aggregate principal amount, or

99.4% of the $350 million outstanding under the AmeriPath Senior Subordinated Notes, was tendered. The

Company made payments totaling $386 million to holders of such notes with respect to the cash tender offer and

consent solicitation including tender premium and related solicitation fees and accrued interest.

During 2008, the remaining $2 million of outstanding principal under the AmeriPath Senior Subordinated

Notes was repaid.

Industrial Revenue Bonds

In connection with the acquisition of LabOne in November 2005, the Company assumed $7.2 million of

Industrial Revenue Bonds. Principal is payable annually in equal installments through September 1, 2009. Interest

is payable monthly at a rate which is adjusted weekly. At December 31, 2008 and 2007, the rate was 2.0% and

4.9%, respectively. At December 31, 2008 and 2007, the remaining principal outstanding was $1.8 million and

$3.6 million, respectively. The bonds are secured by the Lenexa, Kansas laboratory facility and an irrevocable

bank letter of credit.

Term Loan due December 2008

On December 19, 2003, the Company entered into a $75 million amortizing term loan facility (the “Term

Loan due December 2008”), which was funded on January 12, 2004. Interest under the Term Loan due

December 2008 is based on LIBOR plus an applicable margin that can fluctuate over a range of up to 119 basis

points, based on changes in the Company’s public debt rating. As of December 31, 2007, the Company’s

F-25

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)