Quest Diagnostics 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

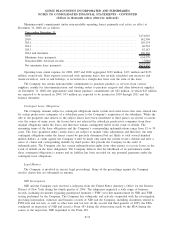

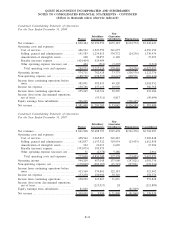

(b) In the fourth quarter of 2006, the Company announced that it would not be a national contracted provider of

laboratory services to United Healthcare Group Inc. (“UNH”) beginning January 1, 2007. UNH accounted for

approximately 7% of the Company’s net revenues in 2006, with some of its regional laboratories having

concentrations as high as 15% to 20%. The Company estimates that no longer being a contracted provider to

UNH reduced its clinical testing volume in 2007 by 7%, most of that resulting from the direct loss of

previously contracted work, and some of it associated with the loss of other work from physicians who

choose to consolidate their testing with a single laboratory. The impact of the change in status with UNH

was the principal driver of lower earnings in 2007 compared to the prior year, due to the significant impact it

had during the first half of the year. However, the Company successfully mitigated the ongoing impact

during the third quarter of 2007 as a result of actions taken to reduce costs, and higher reimbursement for the

work the Company continues to perform for UNH members.

(c) Operating income for 2007 includes $9.9 million of charges associated with workforce reductions in response

to reduced volume levels.

(d) Operating income for 2006 includes $27 million of special charges, primarily associated with integration

activities.

(e) Operating income for 2008 includes $2.2 million of charges, primarily associated with workforce reductions.

(f) Operating income for 2007 includes $0.8 million of charges associated with workforce reductions in response

to reduced volume levels, and a $4 million charge related to the expensing of in-process research and

development associated with the acquisition of HemoCue (see Note 3).

(g) For the year ended December 31, 2008, non-operating expenses, net includes a charge of $8.9 million

associated with the write-down of an available-for-sale equity investment.

(h) For the year ended December 31, 2007, non-operating expenses, net includes a charge of $4.0 million

associated with the write-down of an equity investment.

(i) For the year ended December 31, 2006, non-operating expenses, net includes $16.2 million of charges

associated with the write-down of available-for-sale equity securities, $10.0 million of charges associated with

the write-down of other investments and a $15.8 million gain associated with the sale of an investment.

(j) Income tax expense for 2008 includes a benefit of $16.5 million primarily associated with favorable

resolutions of certain tax contingencies.

(k) Results for the year ended December 31, 2008 and 2007 reflect pre-tax charges of $75 million and $241

million, respectively, related to the government investigation of NID (see Note 14). Results for 2006 reflect

losses from NID’s operations, due to its voluntary product hold instituted late in the second quarter of 2005

in connection with a quality review of all its products. In addition, results for 2006 also reflect pre-tax

charges of $32 million, primarily related to the wind down of NID’s operations.

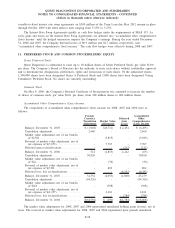

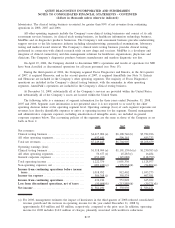

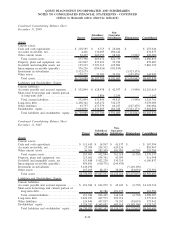

2008 2007 2006

Depreciation and amortization:

Clinical testing business. . ................................................... $208,115 $189,939 $167,586

All other operating segments ................................................ 18,414 19,301 16,461

General corporate........................................................... 38,064 28,639 11,640

Discontinued operations . . ................................................... - - 1,711

Total depreciation and amortization .......................................... $264,593 $237,879 $197,398

Capital expenditures:

Clinical testing business. . ................................................... $178,505 $193,785 $168,636

All other operating segments ................................................ 22,891 17,760 17,291

General corporate........................................................... 11,285 7,556 6,722

Discontinued operations . . ................................................... - - 773

Total capital expenditures ................................................... $212,681 $219,101 $193,422

F-38

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)