Quest Diagnostics 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Derivative Financial Instruments

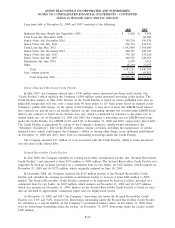

The Company uses derivative financial instruments to manage its market risks. This includes the use of

interest rate swap agreements to manage its exposure to movements in interest rates and foreign currency forward

contracts to manage its exposure to foreign exchange rates. The Company has established policies and procedures

for risk assessment and the approval, reporting and monitoring of derivative financial instrument activities. These

policies prohibit holding or issuing derivative financial instruments for speculative purposes.

Interest rate swaps involve the periodic exchange of payments without the exchange of underlying principal

or notional amounts. Net payments are recognized as an adjustment to interest expense. When the swaps are

terminated, unrealized gains or losses are deferred in stockholders’ equity, as a component of “accumulated other

comprehensive (loss) income,” and are amortized as an adjustment to interest expense over the shorter of the

remaining original term of the hedging instrument or the remaining life of the underlying debt instrument.

The Company formally documents its hedge relationships, including identifying the hedging instruments and

the hedged items, as well as its risk management objectives and strategies for undertaking the hedge transaction.

On the date the derivative is entered into, the Company designates the type of derivative as a fair value hedge or

cash flow hedge, and accounts for the derivative in accordance with its designation as prescribed by SFAS No.

133, “Accounting for Derivative Instruments and Hedging Activities” (“SFAS 133”), as amended. The Company

currently holds only cash flow hedges, designated as a hedge of the variability of cash outflows related to the

Company’s long-term debt due to changes in interest rates. Both at inception and at least quarterly thereafter, the

Company also formally assesses whether the derivatives that are used in hedging transactions are highly effective

in offsetting changes in the cash flows of the hedged item. All components of each derivative financial

instrument’s gain or loss are included in the assessment of hedge effectiveness.

The Company accounts for derivatives in conformity with SFAS No. 133, as amended, and records

derivatives as either an asset or liability measured at its fair value. The fair value is based upon quoted market

prices obtained from third-party institutions. For derivatives that have been formally designated as a cash flow

hedge (interest rate swap agreements), the effective portion of changes in the fair value of the derivatives is

recorded in “accumulated other comprehensive (loss) income.” Changes in the fair value of derivatives are

recorded each period in current earnings or other comprehensive income, depending on whether a derivative is

designated as part of a hedge transaction and, if it is, the type of hedge transaction based on the specific

qualifying conditions in SFAS 133. Amounts in “accumulated other comprehensive (loss) income” are reclassified

into earnings in “interest expense, net” during the same period in which the hedged item affects earnings. If it is

determined that a derivative ceases to be a highly effective hedge, the Company discontinues hedge accounting,

and any deferred gains or losses are recorded in the consolidated statement of operations.

Comprehensive Income (Loss)

Comprehensive income (loss) encompasses all changes in stockholders’ equity (except those arising from

transactions with stockholders) and includes net income, net unrealized capital gains or losses on available-for-

sale securities, foreign currency translation adjustments and deferred gains related to the settlement of certain

treasury lock agreements (see Note 10).

New Accounting Standards

In September 2007, the FASB ratified Emerging Issues Task Force Issue No. 07-1 “Accounting for

Collaborative Agreements,” (“EITF 07-1”). EITF 07-1 defines collaborative agreements as contractual

arrangements that involve a joint operating activity. These arrangements involve two (or more) parties that are

both active participants in the activity and are exposed to significant risks and rewards dependent on the

commercial success of the activity. EITF 07-1 provides guidance that revenues generated and costs incurred by

participants from transactions with parties outside the collaborative agreement should be reported either on a

gross basis or a net basis depending on whether the participant is a principal or agent to the transaction. EITF

07-1 also provides that a company should report the effects of adoption as a change in accounting principle

through retrospective application to all periods and requires additional disclosures about a company’s

collaborative arrangements. EITF 07-1 is effective for the Company as of January 1, 2009. The adoption of EITF

07-1 is not expected to have a material impact on the Company’s consolidated financial statements.

F-14

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)