Quest Diagnostics 2008 Annual Report Download - page 101

Download and view the complete annual report

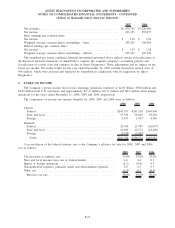

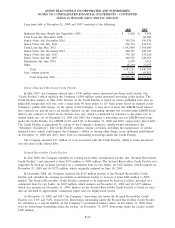

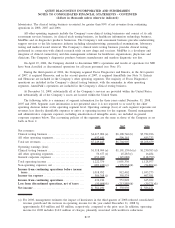

Please find page 101 of the 2008 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.holding losses for investments where the decline in fair value was deemed to be other than temporary in 2008,

2007 and 2006, and the resulting loss was recognized in the consolidated statements of operations (see Note 2).

The deferred loss for 2008 primarily represented deferred losses on the Company’s interest rate swap agreements,

net of amounts reclassified to interest expense. The deferred loss for 2007 represented the $3.5 million the

Company paid upon the settlement of its Treasury Forward Agreements, net of amounts reclassified as an

increase to interest expense, and $2.7 million in deferred losses on its Interest Rate Swap Agreements (see Note

10). Foreign currency translation adjustments are not adjusted for income taxes since they relate to indefinite

investments in non-U.S. subsidiaries.

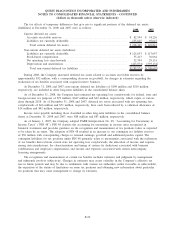

Dividend Program

During each of the quarters of 2008, 2007 and 2006, the Company’s Board of Directors has declared a

quarterly cash dividend of $0.10 per common share.

Share Repurchase Plan

During the fourth quarter of 2008, the Board of Directors expanded the Company’s common stock share

repurchase authorization by an additional $150 million.

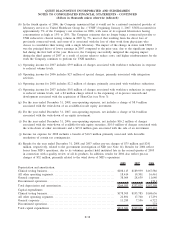

For the year ended December 31, 2008, the Company repurchased 5.5 million shares of its common stock at

an average price of $46.09 per share for $254 million, and reissued 1.5 million shares in connection with

employee benefit plans. For the year ended December 31, 2007, the Company repurchased 2.8 million shares of

its common stock at an average price of $52.14 per share for $146 million, and reissued 2.9 million shares in

connection with employee benefit plans. For the year ended December 31, 2006, the Company repurchased 8.9

million shares of its common stock at an average price of $53.23 per share for $472 million, and reissued 4.2

million shares in connection with employee benefit plans.

At December 31, 2008, the share repurchase authorization was essentially fully utilized. In January 2009, the

Company’s Board of Directors authorized the Company to repurchase an additional $500 million of the

Company’s common stock. The share repurchase authorization has no set expiration or termination date.

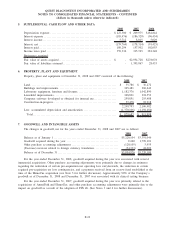

12. STOCK OWNERSHIP AND COMPENSATION PLANS

Employee and Non-employee Directors Stock Ownership Programs

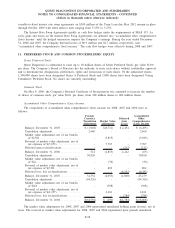

In 2005, the Company established the ELTIP to replace the Company’s prior Employee Equity Participation

Programs established in 1999 (the “1999 EEPP”) and 1996, as amended (the “1996 EEPP”). The ELTIP provides

for three types of awards: (a) stock options, (b) stock appreciation rights and (c) stock awards. The ELTIP

provides for the grant to eligible employees of either non-qualified or incentive stock options, or both, to

purchase shares of Company common stock at a price of no less than the fair market value on the date of grant.

The stock options are subject to forfeiture if employment terminates prior to the end of the vesting period

prescribed by the Board of Directors. Grants of stock appreciation rights allow eligible employees to receive a

payment based on the appreciation of Company common stock in cash, shares of Company common stock or a

combination thereof. The stock appreciation rights are granted at an exercise price at no less than the fair market

value of the Company’s common stock on the date of grant. Stock options and stock appreciation rights granted

under the ELTIP expire on the date designated by the Board of Directors but in no event more than seven years

from date of grant. No stock appreciation rights have been granted under the ELTIP or the 1999 EEPP. The

ELTIP allows eligible employees to receive awards of shares, or the right to receive shares, of Company

common stock, the equivalent value in cash or a combination thereof. These shares are generally earned on

achievement of financial performance goals and are subject to forfeiture if employment terminates prior to the

end of the vesting period prescribed by the Board of Directors. For performance share unit awards granted prior

to 2008, the actual amount of performance share awards earned is based on the Company’s earnings per share

growth for the performance period compared to that of a peer group of companies. Beginning with performance

share unit awards granted in 2008, the performance measure for these awards is based on the cumulative annual

growth rate of the Company’s earnings per share from continuing operations over a three year period. Key

executive, managerial and technical employees are eligible to participate in the ELTIP. The provisions of the

F-29

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)