Quest Diagnostics 2008 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2008 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

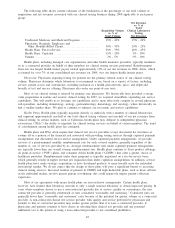

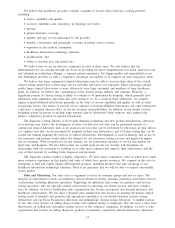

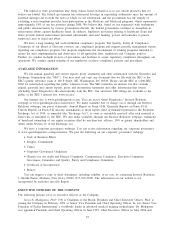

The following table shows current estimates of the breakdown of the percentage of our total volume of

requisitions and net revenues associated with our clinical testing business during 2008 applicable to each payer

group:

Requisition Volume

as % of

Total Volume

Net Revenues

as % of

Total

Clinical Laboratory

Testing

Net Revenues

Traditional Medicare and Medicaid Programs .............. 15% - 20% 15% - 20%

Physicians, Hospitals, Employers and

Other Monthly-Billed Clients. ........................... 30% - 35% 20% - 25%

Health Plans: Fee-for-Service.............................. 30% - 35% 40% - 45%

Health Plans: Capitated . . . ................................ 15% - 20% 5% - 10%

Patients .................................................. 2% - 5% 5% - 10%

Health plans, including managed care organizations and other health insurance providers, typically reimburse

us as a contracted provider on behalf of their members for clinical testing services performed. Reimbursement

from our two largest health insurer payers totaled approximately 13% of our net revenues in 2008. Aetna, which

accounted for over 7% of our consolidated net revenues for 2008, was our largest health insurer payer.

Physicians. Physicians requiring testing for patients are the primary referral source of our clinical testing

volume. Physicians determine which laboratory to recommend or use, based on a variety of factors, including:

service; patient access and convenience, including inclusion in a health plan network; price; and depth and

breadth of test and service offering. Physicians also order our point-of-care tests.

Most of our clinical testing is referred by primary care physicians. We historically have provided a strong

value proposition in routine and esoteric clinical testing. In 2007, we acquired AmeriPath, expanding our service

capabilities. This will enable us to leverage our capabilities and to more effectively compete in several physician

sub-specialties, including dermatology, urology, gastroenterology, hematology and oncology, where historically we

had a smaller market share. We plan to continue to enhance our test menu and service capabilities.

Health Plans. Health plans typically negotiate directly or indirectly with a number of clinical laboratories,

and represent approximately one-half of our total clinical testing volumes and one-half of our net revenues from

clinical testing. In certain markets, such as California, health plans may delegate to independent physician

associations (“IPAs”) the ability to negotiate for clinical testing services on behalf of certain members. The trend

of consolidation among health plans has continued.

Health plans and IPAs often require that clinical test service providers accept discounted fee structures or

assume all or a portion of the financial risk associated with providing testing services through capitated payment

arrangements and discounted fee-for-service arrangements. Under capitated payment arrangements, we provide

services at a predetermined monthly reimbursement rate for each covered member, generally regardless of the

number or cost of services provided by us. Average reimbursement rates under capitated payment arrangements

are typically lower than our overall average reimbursement rate. Health plans continue to focus product offerings

on point-of-service (“POS”) plans, and consumer driven health plans (“CDHPs”) that offer a greater choice of

healthcare providers. Reimbursement under these programs is typically negotiated on a fee-for-service basis,

which generally results in higher revenue per requisition than under capitation arrangements. In addition, several

health plans have made strategic acquisitions or have developed products to more broadly serve the individual

(non-group) market. We do not expect that the design of these plans will pose a significant barrier to accessing

clinical testing services. Increased number of patients in CDHPs and high deductible plans, such as those offered

in the individual market, involve greater patient cost-sharing; this could negatively impact patient collection

experience.

Most of our agreements with major health plans are non-exclusive arrangements. Certain health plans,

however, have limited their laboratory network to only a single national laboratory to obtain improved pricing. In

cases where members choose to use a non-contracted provider due to service, quality or convenience, the non-

contracted provider is generally reimbursed at rates considered “reasonable and customary.” Contracted rates are

generally lower than “reasonable and customary” rates because of the potential for greater volume as a contracted

provider. A non-contracted clinical test service provider with quality and service preferred by physicians and

patients to that of contracted providers may realize greater profits than if it were a contracted provider, if

physicians and patients continue to have choice in selecting their clinical test provider and any potential

additional cost to the patient of using a non-contracted provider is not considered prohibitive.

10