Quest Diagnostics 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

as discontinued operations in the accompanying consolidated statements of operations and related disclosures for

all periods presented.

During the third quarter of 2007, the government and the Company began settlement discussions with

respect to the government’s on going investigation involving NID and the Company, as discussed above (see

Note 14). In the course of those discussions, the government disclosed to the Company certain of the

government’s legal theories regarding the amount of damages allegedly incurred by the government. The

Company analyzed the government’s position and presented its own analysis which argued against many of the

government’s claims. In light of that analysis and based on the status of settlement discussions, the Company

established a reserve, in accordance with generally accepted accounting principles, reflected in discontinued

operations, of $241 million during 2007 in connection with these claims.

During the third quarter of 2008, the Company and NID reached an agreement in principle with the United

States Attorney’s Office to settle the federal government investigation involving NID and the Company regarding

NID test kits and tests performed using those test kits.

As a result of the agreement in principle in 2008, the Company recorded charges of $75 million in

discontinued operations to increase its reserve for the settlement and related matters. As of December 31, 2008,

the total reserve was $316 million. The Company has recorded deferred tax benefits of $58 million on the

reserve, reflecting the Company’s current estimate of the portion of the reserve expected to be deductible for tax

purposes. The reserve reflects the Company’s current estimate of the expected probable loss with respect to these

matters, assuming the settlement is finalized. If a settlement is not finalized, the eventual losses related to these

matters could be materially different than the amount reserved and could be material to the Company’s results of

operations, cash flows and financial condition in the period that such matters are determined or paid. See Note

14 for further details.

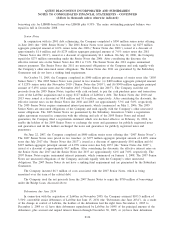

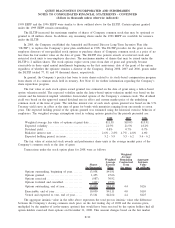

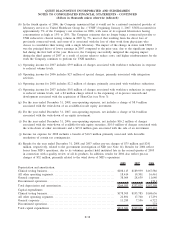

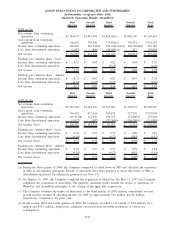

Summarized financial information for the discontinued operations of NID is set forth below:

2008 2007 2006

Net revenues .................................................... $ - $ - $ 3,610

Loss from discontinued operations before income taxes ............ (79,582) (250,278) (59,169)

Income tax benefit. . . ............................................ 28,888 36,389 19,898

Loss from discontinued operations, net of taxes . . ................. $(50,694) $(213,889) $(39,271)

Results for the year ended December 31, 2008 and 2007 reflect charges of $75 million and $241 million,

respectively, to reserve for the settlement and related matters in connection with various government claims (see

Note 14 for further details).

Results for 2006 reflect losses from NID’s operations, due to its voluntary product hold instituted late in the

second quarter of 2005 in connection with a quality review of all its products. In addition, results for 2006 also

reflect pre-tax charges of $32 million, primarily related to the wind down of NID’s operations. These charges

included: inventory write-offs of $7 million; asset impairment charges of $6 million; employee severance costs of

$6 million; contract termination costs of $6 million; facility closure costs of $2 million; and costs to support

activities to wind-down the business comprised primarily of employee costs and professional fees of $5 million.

The settlement reserve is included in “accounts payable and accrued expenses” in the consolidated balance

sheet at December 31, 2008 and 2007. The deferred tax asset recorded in connection with establishing the reserve

is included in “deferred income taxes” in the consolidated balance sheet at December 31, 2008 and 2007. The

remaining balance sheet information related to NID was not material at December 31, 2008 and 2007.

16. BUSINESS SEGMENT INFORMATION

Clinical testing is an essential element in the delivery of healthcare services. Physicians use clinical tests to

assist in the detection, diagnosis, evaluation, monitoring and treatment of diseases and other medical conditions.

Clinical testing is generally categorized as clinical laboratory testing and anatomic pathology services. Clinical

laboratory testing is performed on blood and body fluids, such as urine. Anatomic pathology services are

performed on tissues, such as biopsies, and other samples, such as human cells. Customers of the clinical testing

business include patients, physicians, hospitals, employers, governmental institutions and other commercial clinical

F-36

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)