Quest Diagnostics 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

selling price for the asset or pay the lowest price to settle the liability, after considering transaction costs.

However, when using the most advantageous market, transaction costs are only considered to determine which

market is the most advantageous and these costs are then excluded when applying a fair value measurement. The

adoption of SFAS 157 did not have a material effect on the Company’s financial position, results of operations

or cash flows.

In February 2008, the FASB issued FASB Staff Position (“FSP”) FAS 157-1, “Application of FASB

Statement No. 157 to FASB Statement No. 13 and Other Accounting Pronouncements That Address Fair Value

Measurements for Purposes of Lease Classification or Measurement under Statement 13” (“FSP FAS 157-1”).

FSP FAS 157-1 amended SFAS 157 to exclude from its scope SFAS No. 13, “Accounting for Leases,” and its

related interpretive accounting pronouncements that address leasing transactions. However, this exclusion does not

apply to the Company’s impairment of long-lived assets under a capital lease pursuant to SFAS No. 144,

“Accounting for Impairment or Disposal of Long-Lived Assets,” the Company’s cost to terminate an operating

lease under SFAS No. 146, “Accounting for Costs Associated with Exit and Disposal Activities,” and the

measurement of acquired leases in a business combination pursuant to SFAS No. 141 or 141(R), “Business

Combinations.” Also in February 2008, the FASB issued FSP FAS 157-2, “Effective Date of FASB Statement

No. 157” (“FSP FAS 157-2”). FSP FAS 157-2 amended SFAS 157 to defer the effective date of SFAS 157 for

one year for non-financial assets and non-financial liabilities, except for items that are recognized or disclosed at

fair value in the financial statements on a recurring basis, at least annually. The impact of SFAS 157 on the

Company’s non-financial assets and non-financial liabilities measured at fair value on a nonrecurring basis is not

expected to have a material effect on the Company’s financial position, results of operations or cash flows.

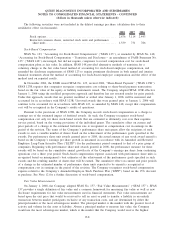

SFAS 157 creates a three-level hierarchy to prioritize the inputs used in the valuation techniques to derive

fair values. The basis for fair value measurements for each level within the hierarchy is described below with

Level 1 having the highest priority and Level 3 having the lowest.

Level 1: Quoted prices in active markets for identical assets or liabilities.

Level 2: Quoted prices for similar assets or liabilities in active markets; quoted prices for

identical or similar instruments in markets that are not active; and model-derived

valuations in which all significant inputs are observable in active markets.

Level 3: Valuations derived from valuation techniques in which one or more significant inputs

are unobservable.

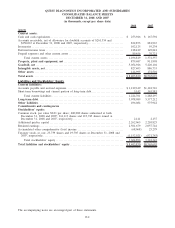

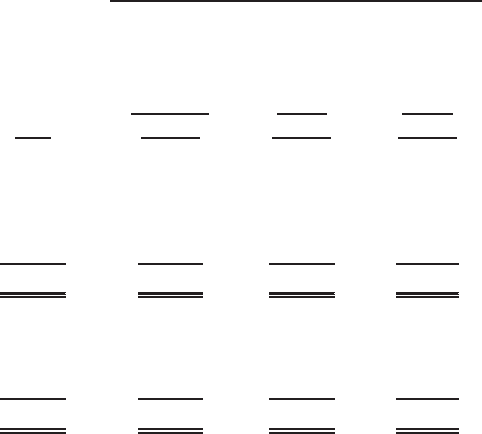

The following table provides a summary of the recognized assets and liabilities that are measured at fair

value on a recurring basis.

December 31,

2008 Level 1 Level 2 Level 3

Quoted Prices

in Active

Markets for

Identical

Assets/

Liabilities

Significant

Other

Observable

Inputs

Significant

Unobservable

Inputs

Basis of Fair Value Measurements

Assets:

Trading securities ................................ $25,383 $25,383 $ - $ -

Cash surrender value of life insurance policies ..... 11,767 - 11,767 -

Foreign currency forward contracts ................ 2,617 - 2,617 -

Available-for-sale securities ....................... 255 233 22 -

Total .......................................... $40,022 $25,616 $14,406 $ -

Liabilities:

Interest rate swaps................................ $ 5,888 $ - $ 5,888 $ -

Foreign currency forward contracts ................ 4,142 - 4,142 -

Deferred compensation liabilities . . ................ 39,304 - 39,304 -

Total .......................................... $49,334 $ - $49,334 $ -

F-9

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)