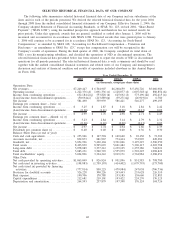

Quest Diagnostics 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

Overview

The Clinical Testing Industry

Clinical testing is an essential element in the delivery of healthcare services. Physicians use laboratory tests

to assist in the detection, diagnosis, evaluation, monitoring and treatment of diseases and other medical

conditions.

Most laboratory tests are performed by one of three types of laboratories: commercial clinical laboratories;

hospital-affiliated laboratories; and physician-office laboratories. In 2008, we estimate that hospital-affiliated

laboratories accounted for approximately 60% of the market, commercial clinical laboratories approximately one-

third and physician-office laboratories the balance.

Orders for laboratory testing are generated from physician offices, hospitals and employers and can be

affected by a number of factors. For example, changes in the United States economy can affect the number of

unemployed and uninsured, and design changes in healthcare plans can affect the number of physician office and

hospital visits, and can impact the utilization of laboratory testing.

While the recent economic slow down in the United States may temporarily reduce industry growth rates,

we believe the clinical testing industry will continue to grow over the long term because clinical testing is an

essential healthcare service and because of the following key trends:

•the growing and aging population;

•continuing research and development in the area of genomics (the study of DNA, genes and

chromosomes) and proteomics (the analysis of individual proteins and collections of proteins), which is

expected to yield new, more sophisticated and specialized diagnostic tests;

•increasing recognition by consumers and payers of the value of laboratory testing as a means to improve

health and reduce the overall cost of healthcare through early detection and prevention;

•increasing affordability of, and access to, tests due to advances in technology and cost efficiencies; and

•the growing demand for healthcare services in emerging markets and global demographic changes.

The diagnostic testing industry is subject to seasonal fluctuations in operating results and cash flows.

Typically, testing volume declines during the summer months, year-end holiday periods and other major holidays,

reducing net revenues and operating cash flows below annual averages. Testing volume is also subject to declines

due to severe weather or other events, which can deter patients from having testing performed and which can

vary in duration and severity from year to year.

Reimbursement for Services

Payments for clinical testing services are made by physicians, hospitals, employers, healthcare plans, patients

and the government. Physicians, hospitals and employers are typically billed on a fee-for-service basis based on

negotiated fee schedules. Fees billed to healthcare plans and patients are based on the laboratory’s patient fee

schedule, subject to any limitations on fees negotiated with the healthcare plans or with physicians on behalf of

their patients. Medicare and Medicaid reimbursements are based on fee schedules set by governmental authorities.

Government payers, such as Medicare and Medicaid, as well as healthcare plans and larger employers, have

taken steps and may continue to take steps to control the cost, utilization and delivery of healthcare services,

including clinical testing services. Despite the added cost and complexity of participating in the Medicare and

Medicaid programs, we continue to participate in such programs because we believe that our other business may

depend, in part, on continued participation in these programs, since certain customers may want a single

laboratory capable of performing all of their clinical testing services, regardless of who pays for such services.

Healthcare plans, which typically negotiate directly or indirectly on behalf of their members, represent

approximately one-half of our clinical testing volumes and one-half of our net revenues from our clinical testing

business. Larger healthcare plans typically prefer to use large commercial clinical laboratories because they can

provide services to their members on a national or regional basis. In addition, larger clinical laboratories are

better able to achieve the low-cost structures necessary to profitably service the members of large healthcare

plans and can provide test utilization data across various products in a consistent format. In certain markets, such

42