Quest Diagnostics 2008 Annual Report Download - page 88

Download and view the complete annual report

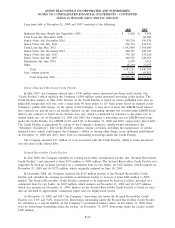

Please find page 88 of the 2008 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SFAS 157 in a market that is not active and illustrates how an entity would determine fair value when the

market for a financial asset is not active. FSP FAS 157-3 provides guidance on how an entity’s own assumptions

about cash flows and discount rates should be considered when measuring fair value when relevant market data

does not exist, how observable market information in an inactive or dislocated market affects fair value

measurements and how the use of broker and pricing service quotes should be considered when applying fair

value measurements. FSP FAS 157-3 was effective immediately as of September 30, 2008 and for all interim and

annual periods thereafter. The adoption of FSP FAS 157-3 did not have a material impact on the Company’s

consolidated financial statements.

In November 2008, the FASB ratified the consensus reached under EITF Issue No. 08-7, “Accounting for

Defensive Intangible Assets” (“EITF 08-7”). EITF 08-7 requires that certain intangible assets acquired in a

business combination that will be held for defensive purposes shall be measured at their fair value when they are

obtained. The useful life of a defensive intangible asset will be based on the period in which the asset is

expected to directly or indirectly contribute to future cash flows up through the date it is effectively abandoned.

EITF 08-7 is effective for the Company as of January 1, 2009. The purchase price allocations in prospective

business combinations will require the Company to ascribe a fair value to intangible assets it intends to hold for

defensive purposes and to amortize such assets over their estimated useful lives.

In December 2008, the FASB issued FSP No. FAS 140-4 and FIN 46(R)-8, “Disclosures by Public Entities

(Enterprises) about Transfers of Financial Assets and Interests in Variable Interest Entities” (“FSP FAS 140-4 and

FIN 46(R)-8”). FSP FAS 140-4 and FIN 46(R)-8 changes the accounting and reporting for transfers and

securitizations of financial assets and the use of qualified special purpose entities (QSPEs) and other variable

interest entities (VIEs) by modifying the rules for de-recognition of transferred financial assets, eliminating the

concept QSPEs and modifying the consolidation model for VIEs to require a continual reassessment of

consolidation conclusions. The consolidation model will include a two-step approach that will consider qualitative

attributes of the relationship with a VIE as well as a quantitative approach that analyzes the expected losses and

expected residual returns of the VIE. FSP FAS 140-4 and FIN 46(R)-8 is effective for the Company as of

December 31, 2008. The Company currently does not securitize any of its financial assets through QSPEs and its

relationship with VIEs has not been material.

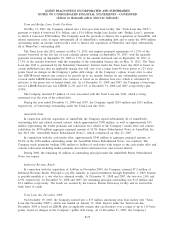

3. BUSINESS ACQUISITIONS

2007 Acquisitions

Acquisition of HemoCue

On January 31, 2007, the Company completed its acquisition of POCT Holding AB (“HemoCue”), a

Sweden-based company specializing in point-of-care testing, in an all-cash transaction valued at approximately

$450 million, including $113 million of assumed debt. HemoCue is the leading international provider in point-of-

care for hemoglobin, with a growing share in professional glucose and microalbumin testing.

In conjunction with the acquisition of HemoCue, the Company repaid approximately $113 million of debt,

representing substantially all of HemoCue’s existing outstanding debt as of January 31, 2007.

The Company financed the aggregate purchase price of $344 million, which includes transaction costs of

approximately $7 million, of which $2 million was paid in 2006, and the repayment of substantially all of

HemoCue’s outstanding debt with the proceeds from a $450 million term loan and cash on-hand. On May 31,

2007, the Company refinanced this term loan. In January 2008, the Company received a payment of

approximately $23 million from an escrow fund established at the time of the acquisition which reduced the

aggregate purchase price to $321 million.

The acquisition of HemoCue was accounted for under the purchase method of accounting. As such, the cost

to acquire HemoCue was allocated to the respective assets and liabilities acquired based on their estimated fair

values as of the closing date. The consolidated financial statements include the results of operations of HemoCue

subsequent to the closing of the acquisition.

Of the aggregate purchase price of $321 million, $298 million was allocated to goodwill, $38 million was

allocated to customer relationships that are being amortized over 20 years and $39 million was allocated to

technology that is being amortized over 14 years.

F-16

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)