Quest Diagnostics 2008 Annual Report Download - page 87

Download and view the complete annual report

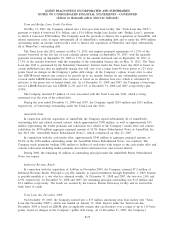

Please find page 87 of the 2008 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In December 2007, the FASB issued SFAS No. 141(R) “Business Combinations” (“SFAS 141(R)”). SFAS

141(R) changes several underlying principles in applying the purchase method of accounting. Among the

significant changes, SFAS 141(R) requires a redefining of the measurement date of a business combination,

expensing direct transaction costs as incurred, capitalizing in-process research and development costs as an

intangible asset and recording a liability for contingent consideration at the measurement date with subsequent re-

measurements recorded in the results of operations. SFAS 141(R) also requires that costs for business

restructuring and exit activities related to the acquired company will be included in the post-combination financial

results of operations and also provides new guidance for the recognition and measurement of contingent assets

and liabilities in a business combination. In addition, adjustments to acquisition-related tax contingencies and

deferred tax valuation allowances for both past and prospective business combinations will no longer be an

adjustment to goodwill, but rather reflected in earnings in the period of adjustment. SFAS 141(R) requires several

new disclosures, including the reasons for the business combination, the factors that contribute to the recognition

of goodwill, the amount of acquisition related third-party expenses incurred, the nature and amount of contingent

consideration, and a discussion of pre-existing relationships between the parties. SFAS 141(R) is effective for the

Company as of January 1, 2009. The Company expects that the adoption of SFAS 141(R) is likely to have a

significant impact on how the Company allocates the purchase price of an acquired business, including the

expensing of direct transaction costs and costs to integrate the acquired business. Transaction costs for potential

business combinations that had not closed by December 31, 2008 were written off on January 1, 2009 and were

not material.

In December 2007, the FASB issued SFAS No. 160 “Noncontrolling Interests in Consolidated Financial

Statements, an Amendment of ARB No. 51,” (“SFAS 160”). SFAS 160 establishes accounting and reporting

standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary. SFAS 160

requires noncontrolling interests in subsidiaries initially to be measured at fair value and classified as a separate

component of equity. SFAS 160 also requires a new presentation on the face of the consolidated financial

statements to separately report the amounts attributable to controlling and non-controlling interests. SFAS 160 is

effective for the Company as of January 1, 2009. The adoption of SFAS 160 is not expected to have a material

impact on the Company’s consolidated financial statements.

In March 2008, the FASB issued SFAS No. 161 “Disclosures About Derivative Instruments and Hedging

Activities – an amendment of FASB Statement No. 133” (“SFAS 161”). SFAS 161 amends SFAS No. 133,

“Accounting for Derivative Instruments and Hedging Activities,” by requiring expanded disclosures about an

entity’s derivative instruments and hedging activities. SFAS 161 requires qualitative disclosures about objectives

and strategies for using derivatives, quantitative disclosures about fair value amounts of and gains and losses on

derivative instruments, and disclosures about credit-risk-related contingent features in derivative instruments.

SFAS 161 is effective for the Company as of January 1, 2009. The adoption of SFAS 161 is not expected to

have a material impact on the Company’s consolidated financial statements.

In May 2008, the FASB issued SFAS No. 162 “The Hierarchy of Generally Accepted Accounting

Principles” (“SFAS 162”). SFAS 162 identifies the sources of accounting principles and the framework for

selecting the principles used in the preparation of financial statements of nongovernmental entities that are

presented in conformity with generally accepted accounting principles (the GAAP hierarchy). SFAS 162 will

become effective 60 days following the SEC’s approval of the Public Company Accounting Oversight Board

amendments to AICPA Professional Standards AU Section 411, “The Meaning of Present Fairly in Conformity

With Generally Accepted Accounting Principles.” The adoption of SFAS 162 is not expected to have a material

impact on the Company’s consolidated financial statements.

In June 2008, the FASB issued FSP EITF 03-6-1, “Determining Whether Instruments Granted in Share-

Based Payment Transactions Are Participating Securities” (“FSP EITF 03-6-1”). FSP EITF 03-6-1 addresses

whether instruments granted in share-based payment transactions are participating securities prior to vesting and,

therefore, need to be included in computing earnings per share under the two-class method described in SFAS

No. 128, “Earnings Per Share.” FSP EITF 03-6-1 is effective for the Company as of January 1, 2009 and in

accordance with its requirements it will be applied retrospectively. The Company does not expect the adoption of

FSP EITF 03-6-1 to have a material impact on its consolidated financial statements.

In October 2008, the FASB issued FSP No. FAS 157-3, “Determining the Fair Value of a Financial Asset

When the Market for That Asset Is Not Active” (“FSP FAS 157-3”). FSP FAS 157-3 clarifies the application of

F-15

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)